Asked by Cooper Lumsden on May 09, 2024

Verified

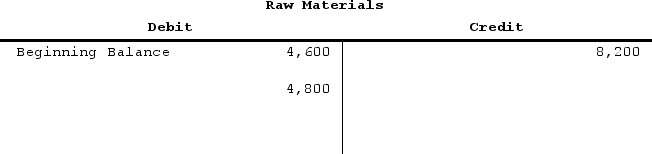

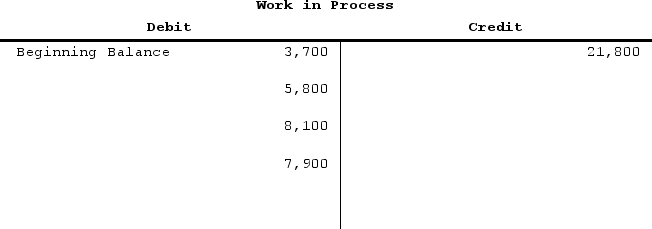

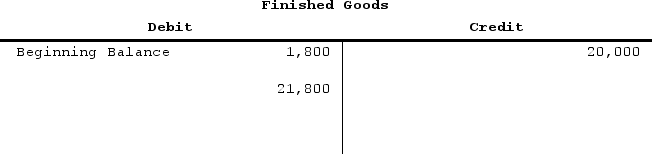

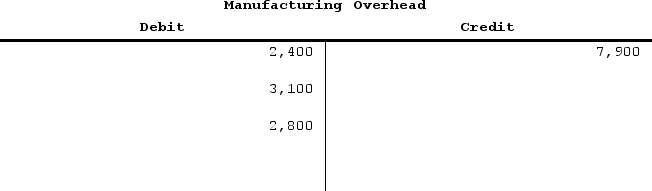

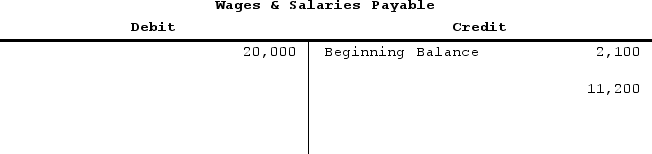

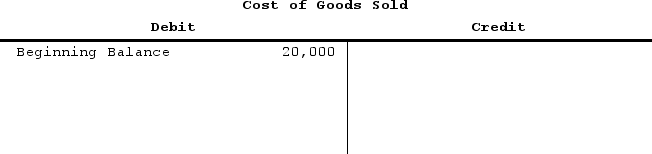

The following partially completed T-accounts summarize transactions for Faaberg Corporation during the year:

The manufacturing overhead was:

The manufacturing overhead was:

A) $400 overapplied

B) $2,800 overapplied

C) $400 underapplied

D) $2,800 underapplied

Manufacturing Overhead

Covers all indirect costs associated with manufacturing a product, including expenses such as rent for the manufacturing space, utilities, and salaries for employees not directly producing goods.

T-Accounts

A visual representation of accounts used in double-entry bookkeeping, showing debits on the left and credits on the right.

- Ascertain the real manufacturing overhead and contrast it against the applied overhead to identify if there is an instance of underapplied or overapplied overhead.

Verified Answer

Learning Objectives

- Ascertain the real manufacturing overhead and contrast it against the applied overhead to identify if there is an instance of underapplied or overapplied overhead.

Related questions

Baka Corporation Applies Manufacturing Overhead on the Basis of Direct ...

Matthias Corporation Has Provided Data Concerning the Corporation's Manufacturing Overhead ...

Matthias Corporation Has Provided Data Concerning the Corporation's Manufacturing Overhead ...

Sagon Corporation Has Provided Data Concerning the Corporation's Manufacturing Overhead ...

Sagon Corporation Has Provided Data Concerning the Corporation's Manufacturing Overhead ...