Asked by morgan lewallen on May 05, 2024

Verified

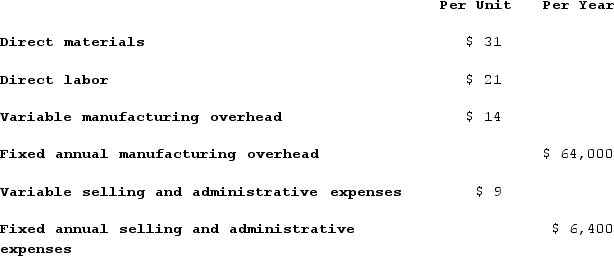

The management of Landstrom Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:

Management plans to produce and sell 4,000 units of the new product annually. The new product would require an investment of $560,000 and has a required return on investment of 10%.Required:a. Determine the unit product cost for the new product.b. Determine the markup percentage on absorption cost for the new product.c. Determine the selling price for the new product using the absorption costing approach. (Round your intermediate and final answer to 2 decimal places.)

Management plans to produce and sell 4,000 units of the new product annually. The new product would require an investment of $560,000 and has a required return on investment of 10%.Required:a. Determine the unit product cost for the new product.b. Determine the markup percentage on absorption cost for the new product.c. Determine the selling price for the new product using the absorption costing approach. (Round your intermediate and final answer to 2 decimal places.)

Absorption Costing

An accounting method that includes all production costs (direct materials, direct labor, and both variable and fixed overhead) in the cost of a product.

Markup Percentage

The percentage added to the cost of goods to cover overhead and profit, calculated as markup divided by the cost of the goods.

Selling Price

The amount of money for which a product is sold to the customer; it may include costs such as manufacturing, distribution, and markup.

- Comprehend the fundamental principles of calculating product costs, encompassing expenses for direct materials, direct labor, and overhead.

- Comprehend the fundamentals of cost-plus pricing and the method of calculating selling prices through this strategy.

Verified Answer

![a. The unit product cost is: b. Selling and administrative expenses = (${{[a(5)]:#,##0.00}} × {{[a(7)]:#,###}}) + ${{[a(6)]:#,###}} = ${{[a(13)]:#,###}}Markup percentage on absorption cost = [(Required return on investment (ROI) × Investment) + Selling and administrative expenses] ÷ [Unit product cost × Units sales]= [({{[a(9)]:#,###}}% × ${{[a(8)]:#,###}}) + (${{[a(13)]:#,###}})] ÷ [${{[a(11)]:#,###}} × {{[a(7)]:#,###}}]= [${{[a(12)]:#,###}} + ${{[a(13)]:#,###}}] ÷ [${{[a(14)]:#,###}}]= ${{[a(18)]:#,###}} ÷ ${{[a(14)]:#,###}}= {{[a(15)]:#,###}}% c. The selling price is determined as follows:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_62fc_017b_bf83_994e7b0d5906_TB8314_00.jpg) b. Selling and administrative expenses = (${{[a(5)]:#,##0.00}} × {{[a(7)]:#,###}}) + ${{[a(6)]:#,###}} = ${{[a(13)]:#,###}}Markup percentage on absorption cost = [(Required return on investment (ROI) × Investment) + Selling and administrative expenses] ÷ [Unit product cost × Units sales]= [({{[a(9)]:#,###}}% × ${{[a(8)]:#,###}}) + (${{[a(13)]:#,###}})] ÷ [${{[a(11)]:#,###}} × {{[a(7)]:#,###}}]= [${{[a(12)]:#,###}} + ${{[a(13)]:#,###}}] ÷ [${{[a(14)]:#,###}}]= ${{[a(18)]:#,###}} ÷ ${{[a(14)]:#,###}}= {{[a(15)]:#,###}}%

b. Selling and administrative expenses = (${{[a(5)]:#,##0.00}} × {{[a(7)]:#,###}}) + ${{[a(6)]:#,###}} = ${{[a(13)]:#,###}}Markup percentage on absorption cost = [(Required return on investment (ROI) × Investment) + Selling and administrative expenses] ÷ [Unit product cost × Units sales]= [({{[a(9)]:#,###}}% × ${{[a(8)]:#,###}}) + (${{[a(13)]:#,###}})] ÷ [${{[a(11)]:#,###}} × {{[a(7)]:#,###}}]= [${{[a(12)]:#,###}} + ${{[a(13)]:#,###}}] ÷ [${{[a(14)]:#,###}}]= ${{[a(18)]:#,###}} ÷ ${{[a(14)]:#,###}}= {{[a(15)]:#,###}}%c. The selling price is determined as follows:

![a. The unit product cost is: b. Selling and administrative expenses = (${{[a(5)]:#,##0.00}} × {{[a(7)]:#,###}}) + ${{[a(6)]:#,###}} = ${{[a(13)]:#,###}}Markup percentage on absorption cost = [(Required return on investment (ROI) × Investment) + Selling and administrative expenses] ÷ [Unit product cost × Units sales]= [({{[a(9)]:#,###}}% × ${{[a(8)]:#,###}}) + (${{[a(13)]:#,###}})] ÷ [${{[a(11)]:#,###}} × {{[a(7)]:#,###}}]= [${{[a(12)]:#,###}} + ${{[a(13)]:#,###}}] ÷ [${{[a(14)]:#,###}}]= ${{[a(18)]:#,###}} ÷ ${{[a(14)]:#,###}}= {{[a(15)]:#,###}}% c. The selling price is determined as follows:](https://d2lvgg3v3hfg70.cloudfront.net/TB8314/11eb6b8f_62fc_017c_bf83_77965db3b8ae_TB8314_00.jpg)

Learning Objectives

- Comprehend the fundamental principles of calculating product costs, encompassing expenses for direct materials, direct labor, and overhead.

- Comprehend the fundamentals of cost-plus pricing and the method of calculating selling prices through this strategy.

Related questions

The Management of Landstrom Corporation Would Like to Set the ...

The Constraint at Dreyfus Incorporated Is an Expensive Milling Machine ...

Prosner Corporation Manufactures Three Products from a Common Input in ...

Glover Company Makes Three Products in a Single Facility ...

Which Statement Below Is the Most Correct About the Cost-Plus ...