Asked by Jeremiah Starre on Jun 10, 2024

Verified

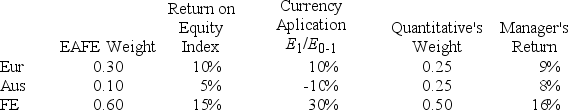

The manager of Quantitative International Fund uses EAFE as a benchmark. Last year's performance for the fund and the benchmark were as follows:

Calculate Quantitative's currency selection return contribution.

A) +20%

B) −5%

C) +15%

D) +5%

E) −10%

Currency Selection Return

The return attributed to the choice of currency in which investments are denominated.

EAFE

An abbreviation for Europe, Australasia, and Far East, representing a stock market index that gauges the equity market performance of developed markets outside of the U.S. and Canada.

Benchmark

A standard or reference by which others can be measured or judged, often used in finance to compare the performance of investments.

- Acknowledge the role and importance of international benchmarks and indexes in the appraisal of investment achievements.

Verified Answer

SG

Shenelle GabrielJun 11, 2024

Final Answer :

B

Explanation :

EAFE: (.30)(10%) + (.10)(−10%) + (.60)(30%) = 20% appreciation; Diversified: (.25)(10%) + (.25)(−10%) + (.50)(30%) = 15% appreciation; Loss of 5% relative to EAFE.

Learning Objectives

- Acknowledge the role and importance of international benchmarks and indexes in the appraisal of investment achievements.