Asked by Alberto Perez on May 05, 2024

Verified

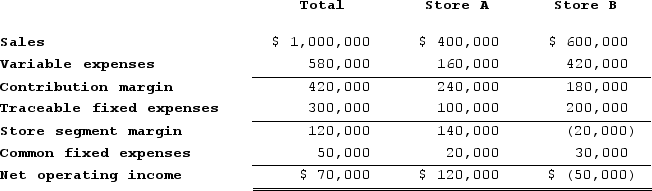

The most recent monthly income statement for Benner Stores is given below:

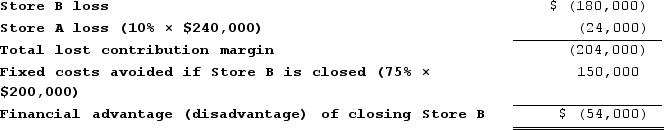

Due to its poor showing, consideration is being given to closing Store B. Studies show that if Store B is closed, one-fourth of its traceable fixed expenses will continue unchanged. The studies also show that closing Store B would result in a 10 percent decrease in sales in Store A. The company allocates common fixed expenses to the stores on the basis of sales dollars.

Due to its poor showing, consideration is being given to closing Store B. Studies show that if Store B is closed, one-fourth of its traceable fixed expenses will continue unchanged. The studies also show that closing Store B would result in a 10 percent decrease in sales in Store A. The company allocates common fixed expenses to the stores on the basis of sales dollars.

Required:

Determine the monthly financial advantage (disadvantage) of closing Store B.

Traceable Fixed Expenses

Fixed costs that can be directly linked to a specific product, department, or segment of a company, making it easier to allocate expenses accurately.

Common Fixed Expenses

Expenses shared across different departments or product lines within a company that do not change with production or sales volume.

Sales Dollars

A measurement of revenue generated from sales activities, expressed in the currency of dollars.

- Analyze the pecuniary repercussions of terminating a product or segment by evaluating related costs and rewards.

Verified Answer

KR

Learning Objectives

- Analyze the pecuniary repercussions of terminating a product or segment by evaluating related costs and rewards.