Asked by TRISHA MARTINEZ on Jun 27, 2024

Verified

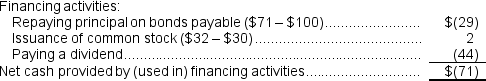

The net cash provided by (used in) financing activities for the year was:

A) $(44)

B) $(71)

C) $2

D) $(29)

Financing Activities

Transactions involving raising capital or repaying funds to and from investors and creditors, as reflected in the cash flow statement.

Net Cash

The amount of cash that remains after deducting all operational, financial, and investment activities over a period.

Cash Basis

An accounting method where revenues and expenses are recorded when they are actually received or paid, not when they are incurred.

- Differentiate among the net cash inflows from operations, investments, and financial actions.

Verified Answer

Reference: APP13A-Ref4

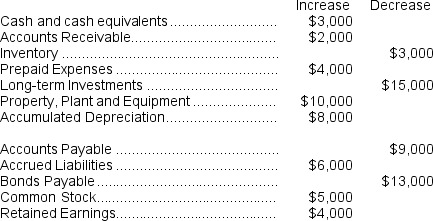

Reference: APP13A-Ref4The change in each of Kendall Corporation's balance sheet accounts last year follows:

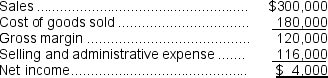

Kendall Corporation's income statement for the year was:

Kendall Corporation's income statement for the year was:  There were no sales or retirements of property, plant, and equipment and no dividends paid during the year.The company pays no income taxes and it did not purchase any long-term investments, issue any bonds payable, or repurchase any of its own common stock.The net cash provided by (used in)operating activities on the statement of cash flows is determined using the direct method.

There were no sales or retirements of property, plant, and equipment and no dividends paid during the year.The company pays no income taxes and it did not purchase any long-term investments, issue any bonds payable, or repurchase any of its own common stock.The net cash provided by (used in)operating activities on the statement of cash flows is determined using the direct method.

Learning Objectives

- Differentiate among the net cash inflows from operations, investments, and financial actions.

Related questions

The Net Cash Provided by (Used In)operating Activities Last Year ...

The Net Cash Provided by (Used In)financing Activities Last Year ...

The Net Cash Provided by (Used In)financing Activities Last Year ...

Preparing the Financing Activities Section of the Statement of Cash ...

Declaration and Issue of a Stock Dividend ...