Asked by Sandra Belgarde on Jul 05, 2024

Verified

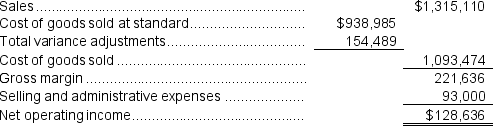

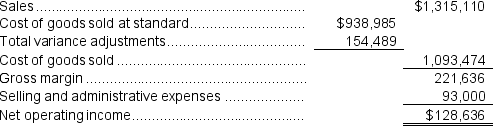

The net operating income for the year is closest to:

A) $45,952

B) $128,636

C) $226,034

D) $283,125

Net Operating Income

A company's revenue minus its operating expenses, excluding taxes and interest.

- Determine the annual net operating income.

Verified Answer

DC

Darrion ChaversJul 08, 2024

Final Answer :

B

Explanation :

Net operating income is calculated as total revenue minus total expenses.

Total revenue = $612,850 + $571,200 = $1,184,050

Total expenses = ($466,320 + $80,400) + ($48,000 + $59,880) + ($77,676 + $67,800) = $800,076

Net operating income = $1,184,050 - $800,076 = $383,974

However, the question is asking for the net operating income for the year, which means we need to divide the amount by the number of months in the year:

Net operating income for the year = $383,974/3 x 12 = $128,636

Therefore, the best choice is B, with the explanation above.

Total revenue = $612,850 + $571,200 = $1,184,050

Total expenses = ($466,320 + $80,400) + ($48,000 + $59,880) + ($77,676 + $67,800) = $800,076

Net operating income = $1,184,050 - $800,076 = $383,974

However, the question is asking for the net operating income for the year, which means we need to divide the amount by the number of months in the year:

Net operating income for the year = $383,974/3 x 12 = $128,636

Therefore, the best choice is B, with the explanation above.

Explanation :  Reference: APP10B-Ref7

Reference: APP10B-Ref7

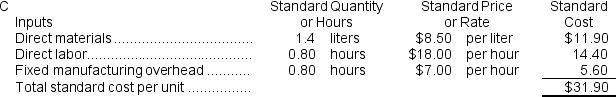

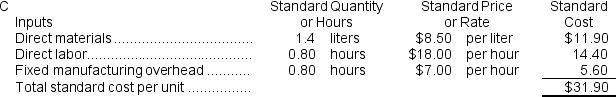

Samples Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.

The standard cost card for the company's only product is as follows: The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $140,000 and budgeted activity of 20,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $140,000 and budgeted activity of 20,000 hours.

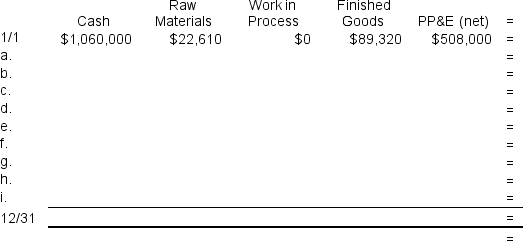

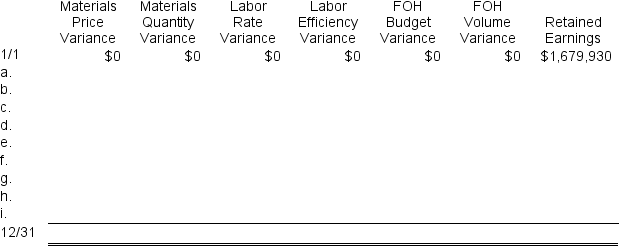

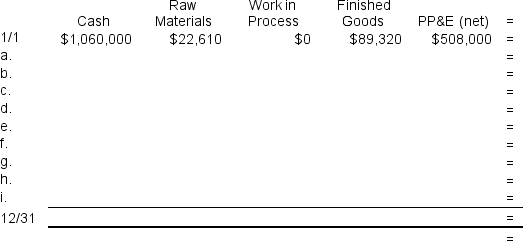

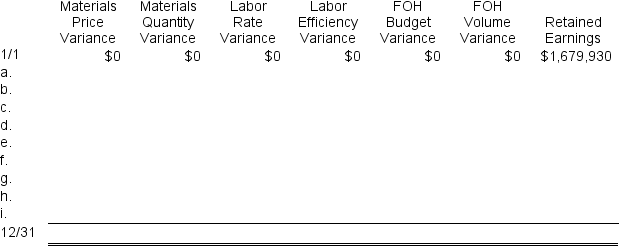

During the year, the company completed the following transactions:

a.Purchased 49,500 liters of raw material at a price of $8.00 per liter.The materials price variance was $24,750 F.

b.Used 45,820 liters of the raw material to produce 32,800 units of work in process.The materials quantity variance was $850 F.

c.Assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 28,440 hours at an average cost of $17.00 per hour.The direct labor rate variance was $28,440 F.The labor efficiency variance was $39,600 U.

d.Applied fixed overhead to the 32,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed.Actual fixed overhead costs for the year were $154,700.Of this total, $83,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $71,000 related to depreciation of manufacturing equipment.The fixed manufacturing overhead budget variance was $14,700 U.The fixed manufacturing overhead volume variance was $43,680 F.

e.Completed and transferred 32,800 units from work in process to finished goods.

f.Sold (for cash)32,000 units to customers at a price of $38.20 per unit.

g.Transferred the standard cost associated with the 32,000 units sold from finished goods to cost of goods sold.

h.Paid $133,000 of selling and administrative expenses.

i.Closed all standard cost variances to cost of goods sold.

To answer the following questions, it would be advisable to record transactions a through i in the worksheet below.This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page.PP&E (net)stands for Property, Plant, and Equipment net of depreciation.

Reference: APP10B-Ref7

Reference: APP10B-Ref7Samples Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.

The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $140,000 and budgeted activity of 20,000 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $140,000 and budgeted activity of 20,000 hours.During the year, the company completed the following transactions:

a.Purchased 49,500 liters of raw material at a price of $8.00 per liter.The materials price variance was $24,750 F.

b.Used 45,820 liters of the raw material to produce 32,800 units of work in process.The materials quantity variance was $850 F.

c.Assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 28,440 hours at an average cost of $17.00 per hour.The direct labor rate variance was $28,440 F.The labor efficiency variance was $39,600 U.

d.Applied fixed overhead to the 32,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed.Actual fixed overhead costs for the year were $154,700.Of this total, $83,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $71,000 related to depreciation of manufacturing equipment.The fixed manufacturing overhead budget variance was $14,700 U.The fixed manufacturing overhead volume variance was $43,680 F.

e.Completed and transferred 32,800 units from work in process to finished goods.

f.Sold (for cash)32,000 units to customers at a price of $38.20 per unit.

g.Transferred the standard cost associated with the 32,000 units sold from finished goods to cost of goods sold.

h.Paid $133,000 of selling and administrative expenses.

i.Closed all standard cost variances to cost of goods sold.

To answer the following questions, it would be advisable to record transactions a through i in the worksheet below.This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page.PP&E (net)stands for Property, Plant, and Equipment net of depreciation.

Learning Objectives

- Determine the annual net operating income.

Related questions

Which of the Following Transactions Will Result in an Increase ...

Last Year a Company Had Sales of $600,000, a Turnover ...

The Following Information Relates to Last Year's Operations at the ...

Knappert Corporation Makes One Product and Has Provided the Following ...

Wasilko Corporation Produces and Sells One Product ...