Asked by Nolan Blackwell on Jun 25, 2024

Verified

The overhead applied to each unit of Product W2 under activity-based costing is closest to:

A) $501.74 per unit

B) $639.59 per unit

C) $627.18 per unit

D) $351.03 per unit

Overhead Applied

The assigning of overhead costs to goods produced based on a predetermined rate or basis such as machine hours or labor hours.

Activity-Based Costing

An accounting technique that tags and apportions the costs of organizational activities to every product and service in line with their real consumption.

- Identify differences in overhead application between traditional and activity-based costing systems.

Verified Answer

ZK

Zybrea KnightJul 02, 2024

Final Answer :

B

Explanation :

To calculate the overhead applied to each unit of Product W2 under activity-based costing, we need to use the following formula:

Total overhead cost / Total units produced

Total overhead cost = $5,103,480

Total units produced = 40,000

Therefore, overhead applied per unit = $5,103,480 / 40,000 = $127.59 per unit

Now, we need to add this to the direct material cost and direct labor cost per unit:

Direct material cost = $150 per unit

Direct labor cost = $362.00 per unit

Total cost per unit = $150 + $362.00 + $127.59 = $639.59 per unit

Therefore, the closest answer is B, which is $639.59 per unit.

Total overhead cost / Total units produced

Total overhead cost = $5,103,480

Total units produced = 40,000

Therefore, overhead applied per unit = $5,103,480 / 40,000 = $127.59 per unit

Now, we need to add this to the direct material cost and direct labor cost per unit:

Direct material cost = $150 per unit

Direct labor cost = $362.00 per unit

Total cost per unit = $150 + $362.00 + $127.59 = $639.59 per unit

Therefore, the closest answer is B, which is $639.59 per unit.

Explanation :

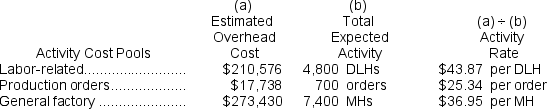

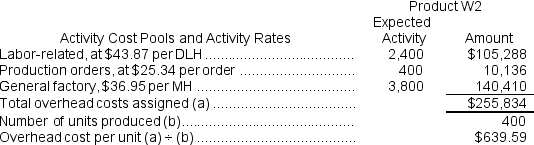

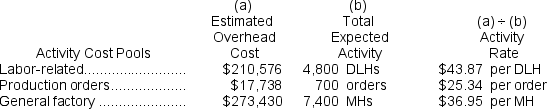

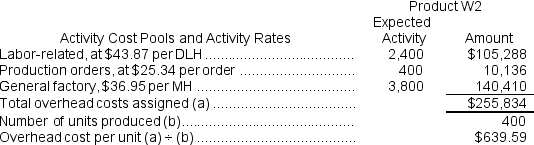

Computation of activity rates:  Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.

Computation of the overhead cost per unit under activity-based costing.

Learning Objectives

- Identify differences in overhead application between traditional and activity-based costing systems.

Related questions

In Activity-Based Costing, a Plantwide Overhead Rate Is Used to ...

Departmental Overhead Rates Applied on the Basis of a Volume ...

Coble Woodworking Corporation Produces Fine Cabinets ...

Coble Woodworking Corporation Produces Fine Cabinets ...

The Overhead Applied to Each Unit of Product X2 Under ...