Asked by aravind balaji on Apr 25, 2024

Verified

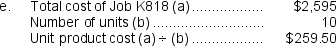

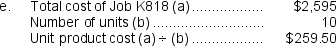

The unit product cost for Job K818 is closest to:

A) $51.90

B) $259.50

C) $232.00

D) $119.50

Unit Product Cost

The cost associated with producing a single unit of a product, encompassing materials, labor, and overhead.

Job K818

Specific reference to a job or project, indicating a unique identifier within a production or manufacturing setting.

- Calculate the unit product cost for specific jobs.

Verified Answer

KC

Kendra Corona7 days ago

Final Answer :

B

Explanation :

Estimated total manufacturing overhead cost = Estimated total fixed manufacturing overhead cost + (Estimated variable overhead cost per unit of the allocation base × Estimated total amount of the allocation base)= $162,000 + ($2.80 per direct labor-hour × 60,000 direct labor-hours)= $162,000 + $168,000 = $330,000

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $330,000 ÷ 60,000 direct labor-hours = $5.50 per direct labor-hour

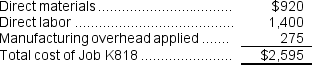

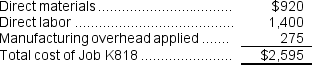

Overhead applied to a particular job = Predetermined overhead rate x Amount of the allocation base incurred by the job = $5.50 per direct labor-hour × 50 direct labor-hours = $275

Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $330,000 ÷ 60,000 direct labor-hours = $5.50 per direct labor-hour

Overhead applied to a particular job = Predetermined overhead rate x Amount of the allocation base incurred by the job = $5.50 per direct labor-hour × 50 direct labor-hours = $275

Learning Objectives

- Calculate the unit product cost for specific jobs.

Related questions

The Unit Product Cost for Job A496 Is Closest To

Cardosa Corporation Uses a Job-Order Costing System with a Single ...

Materials Costs of $600000 and Conversion Costs of $642600 Were ...

Byrd Company Decided to Analyze Certain Costs for June of ...

Crawford Company Has the Following Equivalent Units for July: Materials ...