Asked by Logan Machen on May 07, 2024

Verified

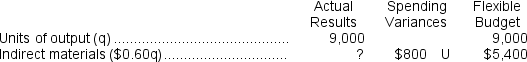

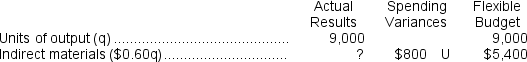

Tos Corporation's flexible budget cost formula for indirect materials, a variable cost, is $0.60 per unit of output.If the company's performance report for last month shows an $800 unfavorable spending variance for indirect materials and if 9,000 units of output were produced last month, then the actual costs incurred for indirect materials for the month must have been:

A) $5,600

B) $4,600

C) $5,400

D) $6,200

Indirect Materials

Materials used in the production process that are not directly traceable to a finished product, such as lubricants and cleaning supplies for machines.

Unfavorable Spending Variance

This occurs when the actual spending on something is higher than the budgeted or planned spending, indicating a cost management problem.

- Execute and assess variation analysis in budgeting, taking into account spending, revenue, and operating income discrepancies.

- Identify the customary charges and price differences in budget formulation.

Verified Answer

JM

Joseph MichaelMay 10, 2024

Final Answer :

D

Explanation :

The flexible budget formula for indirect materials is $0.60 per unit of output, which means that for every unit produced, the company expects to spend $0.60 on indirect materials.

To calculate the expected cost of indirect materials for the month, we need to multiply the output (9,000 units) by the cost per unit ($0.60).

9,000 units x $0.60 per unit = $5,400

This is the amount that the company should have spent on indirect materials, based on the flexible budget formula.

However, the performance report shows an unfavorable spending variance of $800, which means that the actual cost of indirect materials was higher than expected.

To calculate the actual cost of indirect materials, we need to add the unfavorable variance to the expected cost.

$5,400 + $800 = $6,200

Therefore, the actual cost incurred for indirect materials for the month was $6,200.

The correct answer is D) $6,200.

To calculate the expected cost of indirect materials for the month, we need to multiply the output (9,000 units) by the cost per unit ($0.60).

9,000 units x $0.60 per unit = $5,400

This is the amount that the company should have spent on indirect materials, based on the flexible budget formula.

However, the performance report shows an unfavorable spending variance of $800, which means that the actual cost of indirect materials was higher than expected.

To calculate the actual cost of indirect materials, we need to add the unfavorable variance to the expected cost.

$5,400 + $800 = $6,200

Therefore, the actual cost incurred for indirect materials for the month was $6,200.

The correct answer is D) $6,200.

Explanation :  Flexible budget = $0.60 × 9,000 = $5,400

Flexible budget = $0.60 × 9,000 = $5,400  Unfavorable Spending Variance implies Actual Results > Flexible Budget

Unfavorable Spending Variance implies Actual Results > Flexible Budget

$800 = Actual results - Flexible budget

$800 = Actual results - $5,400

Actual results = $5,400 + $800 = $6,200

Flexible budget = $0.60 × 9,000 = $5,400

Flexible budget = $0.60 × 9,000 = $5,400  Unfavorable Spending Variance implies Actual Results > Flexible Budget

Unfavorable Spending Variance implies Actual Results > Flexible Budget$800 = Actual results - Flexible budget

$800 = Actual results - $5,400

Actual results = $5,400 + $800 = $6,200

Learning Objectives

- Execute and assess variation analysis in budgeting, taking into account spending, revenue, and operating income discrepancies.

- Identify the customary charges and price differences in budget formulation.

Related questions

Ramkissoon Midwifery's Cost Formula for Its Wages and Salaries Is ...

Lightsey Natural Dying Corporation Measures Its Activity in Terms of ...

At Jacobson Company, Indirect Labor Is a Variable Cost That ...

Lenci Corporation Manufactures and Sells a Single Product ...

Variances from Standard Costs Are Usually Not Included in Reports ...