Asked by Jennifer Marcoccia on Jul 14, 2024

Verified

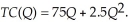

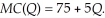

Trisha's Fashion Boutique is considering a profit sharing arrangement with her employees. Currently, the employees receive an annual bonus. In a "Boom" market, Trisha can sell all the output she produces for $225 per unit. In a "Bust" market, Trisha can sell all the output she produces for $125 per unit. The probability of a "Boom" market is 75% and the probability of a bust market is 25%. Trisha's total cost function (including bonus payments to employees) is:  The marginal cost function is:

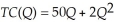

The marginal cost function is:  The profit sharing plan would pay employees 30% of profits. However, due to greater cost saving initiatives from employees, Trisha's total cost function becomes:

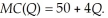

The profit sharing plan would pay employees 30% of profits. However, due to greater cost saving initiatives from employees, Trisha's total cost function becomes:  . The relevant marginal cost function becomes:

. The relevant marginal cost function becomes:  Which plan offers Trisha the greatest expected profits for herself? Suppose the employees will only approve a profit sharing plan if they are guaranteed their portion of profits will be at least $400. Will the employees approve of the profit sharing program?

Which plan offers Trisha the greatest expected profits for herself? Suppose the employees will only approve a profit sharing plan if they are guaranteed their portion of profits will be at least $400. Will the employees approve of the profit sharing program?

Profit Sharing

An incentive program that grants employees a share in the company's profits as part of their compensation.

Expected Profits

The anticipated financial gain from an investment or business activity, calculated by multiplying possible outcomes by their probabilities and summing the results.

Cost Function

Function relating cost of production to level of output and other variables that the firm can control.

- Analyze the effects of strategic leadership decisions on company revenue, worker actions, and perceptions within the marketplace.

- Compute anticipated results and provide advice based on economic frameworks that consider risks and uncertainties in commercial activities.

Verified Answer

KM

Khaled MahmudJul 20, 2024

Final Answer :

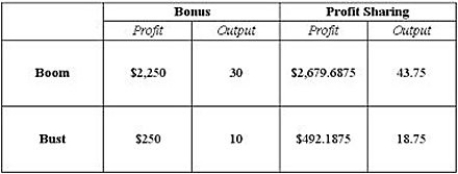

The table below displays Trisha's profit maximizing output level and profits under each of the market scenarios.  The following table lists Trisha's employees' portion of the profits under the profit sharing program.

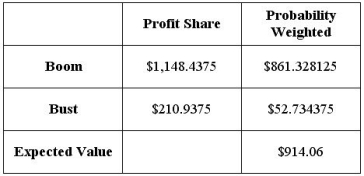

The following table lists Trisha's employees' portion of the profits under the profit sharing program.  Since the profit sharing plan provides only $210.94 in a "Bust" market, the employees will not approve of the plan.

Since the profit sharing plan provides only $210.94 in a "Bust" market, the employees will not approve of the plan.

The following table lists Trisha's employees' portion of the profits under the profit sharing program.

The following table lists Trisha's employees' portion of the profits under the profit sharing program.  Since the profit sharing plan provides only $210.94 in a "Bust" market, the employees will not approve of the plan.

Since the profit sharing plan provides only $210.94 in a "Bust" market, the employees will not approve of the plan.

Learning Objectives

- Analyze the effects of strategic leadership decisions on company revenue, worker actions, and perceptions within the marketplace.

- Compute anticipated results and provide advice based on economic frameworks that consider risks and uncertainties in commercial activities.