Asked by kkoln kkijknjn on Apr 26, 2024

Verified

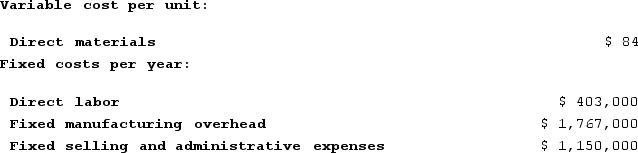

Valcarcel Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:

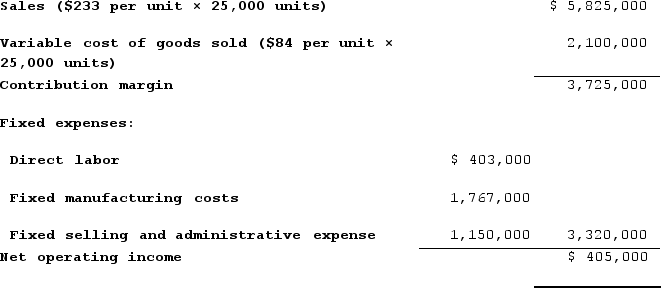

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 31,000 units and sold 25,000 units. The company's only product is sold for $233 per unit.Required:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 31,000 units and sold 25,000 units. The company's only product is sold for $233 per unit.Required:

a. Assume the company uses super-variable costing. Compute the unit product cost for the year and prepare an income statement for the year.b. Assume that the company uses a variable costing system that assigns $13 of direct labor cost to each unit that is produced. Compute the unit product cost for the year and prepare an income statement for the year.c. Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net incomes.

Variable Costing

An accounting method that includes only variable production costs—direct materials, direct labor, and variable manufacturing overhead—in product costs, excluding fixed overhead.

Direct Labor Cost

The total cost of labor directly involved in the production of goods, including wages and benefits.

- Comprehend the principles and methodology for calculating unit product cost within super-variable costing.

- Cultivate abilities in crafting an income statement using the super-variable costing method.

- Comprehend the principles of variable costing, including the allocation of direct labor costs.

Verified Answer

ÑB

Ñàñà bù??ë?May 01, 2024

Final Answer :

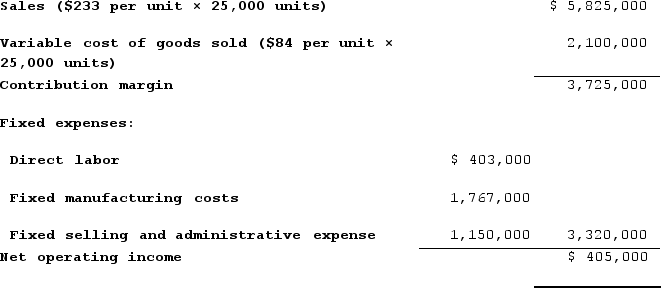

a.Under super-variable costing, the unit product cost is just the direct materials cost of $84 per unit.Super-variable costing income statement:

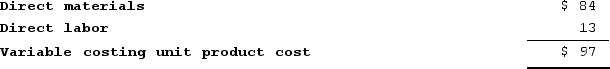

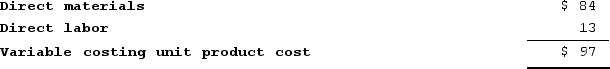

b.Variable costing unit product cost:

b.Variable costing unit product cost:

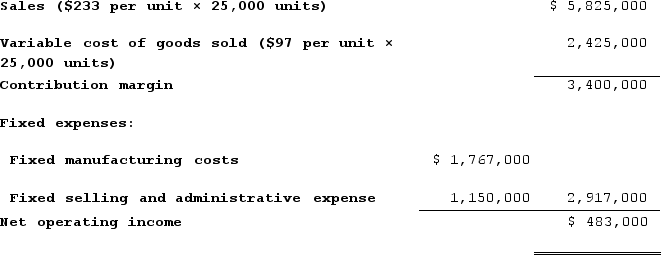

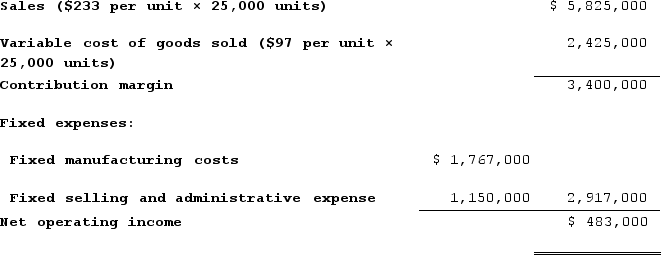

Variable costing income statement:

Variable costing income statement:

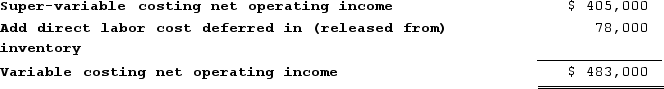

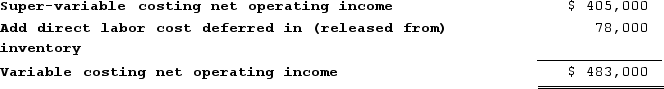

c.Reconciliation of super-variable costing and variable costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 31,000 units − 25,000 units = 6,000 unitsDirect labor cost deferred in (released from) inventory = Direct labor cost in ending inventory − Direct labor cost in beginning inventory = ($13 per unit × 6,000 units) − $0 = $78,000

c.Reconciliation of super-variable costing and variable costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 31,000 units − 25,000 units = 6,000 unitsDirect labor cost deferred in (released from) inventory = Direct labor cost in ending inventory − Direct labor cost in beginning inventory = ($13 per unit × 6,000 units) − $0 = $78,000

b.Variable costing unit product cost:

b.Variable costing unit product cost: Variable costing income statement:

Variable costing income statement: c.Reconciliation of super-variable costing and variable costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 31,000 units − 25,000 units = 6,000 unitsDirect labor cost deferred in (released from) inventory = Direct labor cost in ending inventory − Direct labor cost in beginning inventory = ($13 per unit × 6,000 units) − $0 = $78,000

c.Reconciliation of super-variable costing and variable costing net incomes: Ending inventory = Beginning inventory + Units produced − Units sold = 0 + 31,000 units − 25,000 units = 6,000 unitsDirect labor cost deferred in (released from) inventory = Direct labor cost in ending inventory − Direct labor cost in beginning inventory = ($13 per unit × 6,000 units) − $0 = $78,000

Learning Objectives

- Comprehend the principles and methodology for calculating unit product cost within super-variable costing.

- Cultivate abilities in crafting an income statement using the super-variable costing method.

- Comprehend the principles of variable costing, including the allocation of direct labor costs.