Asked by Dheandra Armyra on May 28, 2024

Verified

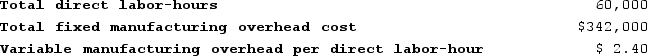

Verry Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on the following data:

Recently Job X711 was completed and required 90 direct labor-hours.Required:a. Calculate the estimated total manufacturing overhead for the year.b. Calculate the predetermined overhead rate for the year.c. Calculate the amount of overhead applied to Job X711.

Recently Job X711 was completed and required 90 direct labor-hours.Required:a. Calculate the estimated total manufacturing overhead for the year.b. Calculate the predetermined overhead rate for the year.c. Calculate the amount of overhead applied to Job X711.

Job-Order Costing

A costing method used to calculate the production costs of individual units or batches of products, making it especially useful for customized orders in manufacturing or service industries.

Plantwide Overhead Rate

An overhead allocation rate applied uniformly to all products or services based on overall plant activity, ignoring individual departmental differences.

Direct Labor-Hours

Refers to the measurable amounts of work effort contributed directly by laborers on the manufacturing floor towards the production of goods.

- Calculate the estimated total manufacturing overhead for the year.

- Calculate the predetermined overhead rate for the year.

- Calculate the amount of overhead applied to specific jobs.

Verified Answer

Learning Objectives

- Calculate the estimated total manufacturing overhead for the year.

- Calculate the predetermined overhead rate for the year.

- Calculate the amount of overhead applied to specific jobs.

Related questions

Fillmore Corporation Uses a Job-Order Costing System with a Single ...

Florek Corporation Uses a Job-Order Costing System with a Single ...

Trevigne Corporation Uses a Predetermined Overhead Rate Base on Machine-Hours ...

The Management of Plitt Corporation Would Like to Investigate the ...

Meenach Corporation Uses a Job-Order Costing System with a Single ...