Asked by SHIVANGI MALHOTRA on Jun 15, 2024

Verified

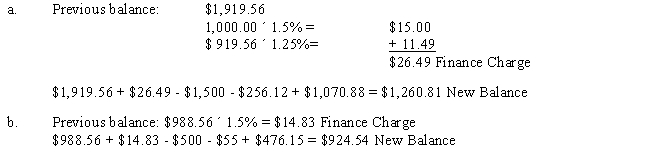

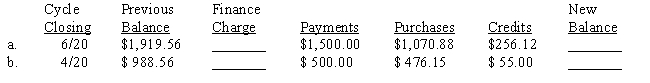

Western Farm Machinery has the following credit terms: "The finance charge, if any, is based on the previous balance before payments or credits are deducted. The rates are 1.5% per month up to $1,000 and 1.25% per month on amounts in excess of $1,000. These are annual percentage rates of 18% and 15%, respectively. There is no finance charge if the full amount of the new balance is paid within 30 days after the cycle closing date."Compute the finance charge and the new balance for the two customers shown below. Assume that both payments were made within the 30-day period.

Finance Charge

The total cost of borrowing, including interest and other charges, on a loan or on credit provided.

Previous Balance

The amount of money that was owed at the end of the last billing cycle in financial accounts and credit statements.

Cycle Closing

Cycle Closing refers to the process of finalizing all transactions and balances for a specific accounting period, ensuring that all financial activities within that period are accounted for and concluded.

- Master and utilize the terms and conditions associated with credit, encompassing finance costs and payment plans.

- Determine net balances, financing charges, and fresh balances under varying credit terms.

Verified Answer

QC

Learning Objectives

- Master and utilize the terms and conditions associated with credit, encompassing finance costs and payment plans.

- Determine net balances, financing charges, and fresh balances under varying credit terms.