Asked by Tania Zamora on Jul 15, 2024

Verified

What would be the competitor's prediction of total expected costs at 18,000 units?

A) $16,860

B) $26,400

C) $29,100

D) $30,000

Expected Costs

Anticipated or forecasted costs for a project, activity, or production based on historical data, current conditions, and future projections.

Total Fixed Cost

The aggregate sum of all expenses within a company that remain constant regardless of the level of production or sales.

- Project future costs or expenses based on given data.

Verified Answer

SC

Sandra ChuuluJul 17, 2024

Final Answer :

B

Explanation :

The competitor's prediction of total expected costs at 18,000 units can be calculated as follows:

Total Variable Costs = 18,000 x $0.60 = $10,800

Total Fixed Costs = $15,000

Total Expected Costs = Total Variable Costs + Total Fixed Costs

Total Expected Costs = $10,800 + $15,000 = $25,800

Therefore, the closest option is B) $26,400.

Total Variable Costs = 18,000 x $0.60 = $10,800

Total Fixed Costs = $15,000

Total Expected Costs = Total Variable Costs + Total Fixed Costs

Total Expected Costs = $10,800 + $15,000 = $25,800

Therefore, the closest option is B) $26,400.

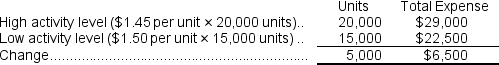

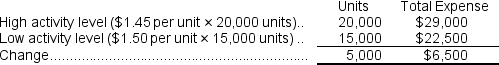

Explanation :  Variable cost = Change in cost ÷ Change in activity = $6,500 ÷ 5,000 units = $1.30 per unit

Variable cost = Change in cost ÷ Change in activity = $6,500 ÷ 5,000 units = $1.30 per unit

Fixed cost element = Total cost - Variable cost element

= $29,000 - ($1.30 per unit × 20,000 units)= $3,000

Y = a + bX = $3,000 + ($1.30 per unit × 18,000 units)= $26,400

Reference: APP06A-Ref2

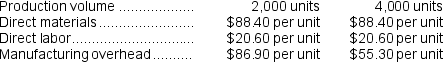

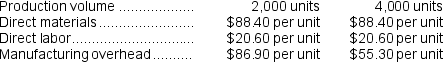

(Appendix 6A)The following production and average cost data for two levels of monthly production volume have been supplied by a company that produces a single product:

Variable cost = Change in cost ÷ Change in activity = $6,500 ÷ 5,000 units = $1.30 per unit

Variable cost = Change in cost ÷ Change in activity = $6,500 ÷ 5,000 units = $1.30 per unitFixed cost element = Total cost - Variable cost element

= $29,000 - ($1.30 per unit × 20,000 units)= $3,000

Y = a + bX = $3,000 + ($1.30 per unit × 18,000 units)= $26,400

Reference: APP06A-Ref2

(Appendix 6A)The following production and average cost data for two levels of monthly production volume have been supplied by a company that produces a single product:

Learning Objectives

- Project future costs or expenses based on given data.

Related questions

If Casablanca Expects to Incur 185,000 Machine Hours Next Month ...

From the Following List of Costs, Calculate the Amount of ...

Tos Corporation's Flexible Budget Cost Formula for Indirect Materials, a ...

Bluemel Air Uses Two Measures of Activity, Flights and Passengers ...

Dunbar Footwear Corporation's Flexible Budget Cost Formula for Supplies, a ...