Asked by Pasha Harmidy on Jul 14, 2024

Verified

Which of the following journal entries is correct when a company has incurred an expense for work performed but has not yet paid for theses wages to employees?

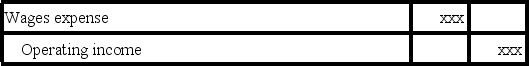

A)

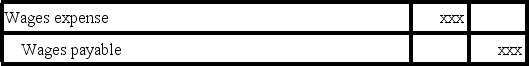

B)

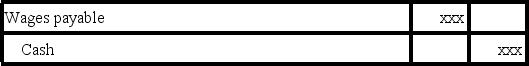

C)

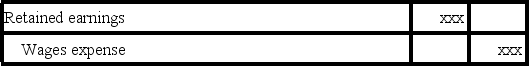

D)

Journal Entries

A record of financial transactions in accounting that includes details like the date of the transaction, amounts involved, accounts affected, and a brief description.

Incurred Expense

An expense that a company has recognized on its books, representing a cost that has been encountered in the operation of the business.

Wages Paid

This refers to the total amount of remuneration paid by an employer to an employee, including salaries, commissions, and bonuses, for work performed during a specific period.

- Acquire knowledge on the accrual method of accounting, highlighting the timing of expense and revenue recognition to coincide with their occurrence rather than the exchange of cash.

Verified Answer

KR

Kelsey RichmanJul 19, 2024

Final Answer :

B

Explanation :

The correct journal entry when a company has incurred an expense for work performed but has not yet paid for these wages to employees is to debit the Wages Expense account and credit the Wages Payable account. Option B shows this transaction correctly. Option A debits the Wages Payable account, which is incorrect. Option C credits the Wages Expense account, which is incorrect. Option D debits the Cash account, which is also incorrect since payment has not been made yet.

Learning Objectives

- Acquire knowledge on the accrual method of accounting, highlighting the timing of expense and revenue recognition to coincide with their occurrence rather than the exchange of cash.