Asked by Libby Marie on Jun 23, 2024

Verified

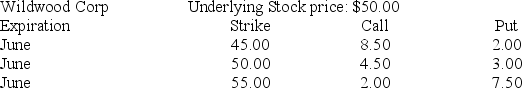

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

To establish a bull money spread with calls, you would ________.

A) buy the 55 call and sell the 45 call

B) buy the 45 call and buy the 55 call

C) buy the 45 call and sell the 55 call

D) sell the 45 call and sell the 55 call

Bull Money Spread

An options strategy involving the purchase of a call option with a lower strike price and the sale of another call option with a higher strike price, aiming to profit from a moderate increase in the price of the underlying asset.

Calls

Financial derivative options that give buyers the right, but not the obligation, to buy a security at a specified price within a specified duration.

Option Position

An option position refers to an investment strategy involving the buying or selling of options, which are derivatives based on the value of underlying securities like stocks.

- Understand the application of investment strategies that include protective puts, covered calls, and both bull and bear spreads.

Verified Answer

FT

Farhan tasleemJun 28, 2024

Final Answer :

C

Explanation :

To establish a bullish money spread, we want to buy a call option with a lower strike price and sell a call option with a higher strike price. This will limit the cost of our option position while still allowing us to profit if the stock price increases. Therefore, we should buy the 45 call with a premium of $8 and sell the 55 call with a premium of $1. This creates a net debit of $7, which is the maximum potential loss. The maximum potential profit is the difference between the strike prices minus the net debit, which is $3 ($55 - $45 - $7). Overall, this strategy limits our risk while still allowing us to profit if the stock price increases.

Learning Objectives

- Understand the application of investment strategies that include protective puts, covered calls, and both bull and bear spreads.