Asked by Prabha Karki on Jul 16, 2024

Verified

You have been asked to evaluate the purchase of a new machine for your company. It will cost $60,000, and it falls into the MACRS 3-year class (Yr. 1 - 33.3%; Yr. 2 - 44.4%; Yr. 3 - 14.8%; Yr. 4 - 7.5%). The purchase will require a $6,000 increase in repair parts inventory. Parts are expensed for tax purposes at the time they are acquired. The machine will replace one $25,000/year operator. It is expected to last for four years when it can be sold including any spare parts still on hand for $5,000. The tax rate is 40% and your company's cost of capital is 12%.

Project the project's cash flows and calculate its NPV and IRR

MACRS

MACRS, or Modified Accelerated Cost Recovery System, is a method of depreciation in the United States that allows for faster asset expense recovery over time for tax purposes.

Cash Flows

The movement of money into and out of a business or project, considered crucial for gauging its financial health.

- Evaluate the preliminary expenses, cash inflows from operations, and ultimate cash flows for investment projects.

- Execute the Modified Accelerated Cost Recovery System (MACRS) methodology for purposes of tax depreciation.

- Examine financial viability of capital projects by employing Net Present Value (NPV) and Internal Rate of Return (IRR) analyses.

Verified Answer

??

???????? ?????Jul 21, 2024

Final Answer :

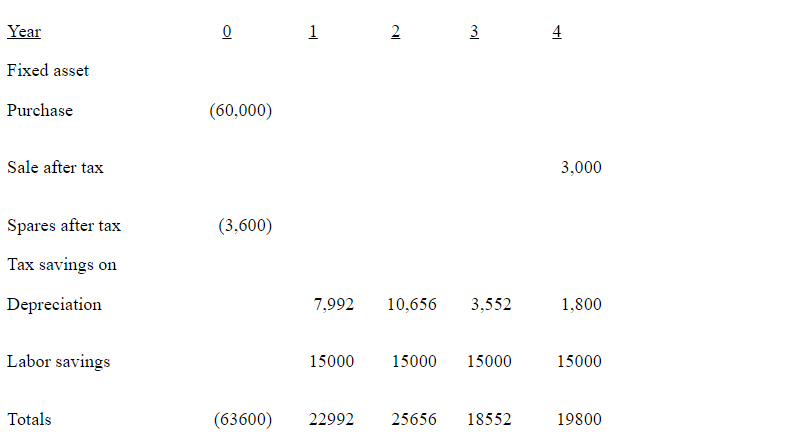

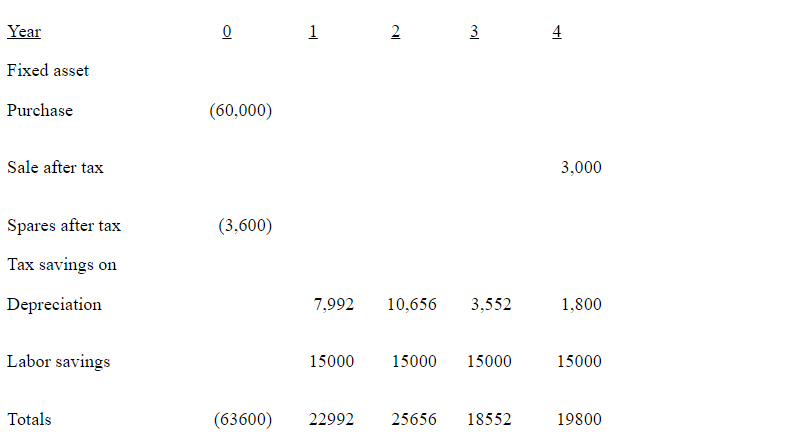

Project cash flows

CFo = -63,600, C01 = 22,992, C02 = 25,656, C03 = 18,552, C04 = 19,800; NPV: I = 12

CFo = -63,600, C01 = 22,992, C02 = 25,656, C03 = 18,552, C04 = 19,800; NPV: I = 12

NPV=3,170 IRR = 14.4%

CFo = -63,600, C01 = 22,992, C02 = 25,656, C03 = 18,552, C04 = 19,800; NPV: I = 12

CFo = -63,600, C01 = 22,992, C02 = 25,656, C03 = 18,552, C04 = 19,800; NPV: I = 12 NPV=3,170 IRR = 14.4%

Learning Objectives

- Evaluate the preliminary expenses, cash inflows from operations, and ultimate cash flows for investment projects.

- Execute the Modified Accelerated Cost Recovery System (MACRS) methodology for purposes of tax depreciation.

- Examine financial viability of capital projects by employing Net Present Value (NPV) and Internal Rate of Return (IRR) analyses.

Related questions

The Modified Accelerated Cost Recovery System (MACRS)is Often Used by ...

In Previous Chapters, We Calculated NPV Based on a Project's ...

You Are Evaluating a Project for the Ultimate Recreational Tennis ...

Given the Following Information and Assuming Straight-Line Depreciation to Zero ...

Holding All Other Variables Constant, an Increase in the Cost ...