Asked by Nicole Krane on Jun 29, 2024

Verified

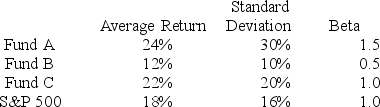

You want to evaluate three mutual funds using the Sharpe measure for performance evaluation. The risk-free return during the sample period is 6%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index.

The fund with the highest Sharpe measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest) .

E) Funds A and C (tied for highest) .

Sharpe Measure

A ratio used to evaluate the risk-adjusted performance of an investment, considering both the return and the volatility of the investment.

Risk-Free Return

The theoretical return on investment with no risk of financial loss, typically associated with government bonds.

Standard Deviations

A statistical measure that quantifies the dispersion or spread of a set of data points relative to its mean, often used in the context of investment returns to measure volatility.

- Master the concepts surrounding different performance evaluation metrics (Sharpe, Treynor, Jensen's alpha, M2, and information ratio) and the procedures for their calculation.

- Appreciate the role of risk-free returns in the examination of investment performance.

Verified Answer

Learning Objectives

- Master the concepts surrounding different performance evaluation metrics (Sharpe, Treynor, Jensen's alpha, M2, and information ratio) and the procedures for their calculation.

- Appreciate the role of risk-free returns in the examination of investment performance.

Related questions

The Following Data Are Available Relating to the Performance of ...

You Want to Evaluate Three Mutual Funds Using the Treynor ...

Suppose Two Portfolios Have the Same Average Return and the ...

Suppose Two Portfolios Have the Same Average Return and the ...

Suppose Two Portfolios Have the Same Average Return and the ...