Asked by David Chang on Jun 07, 2024

Verified

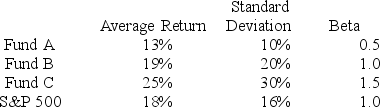

You want to evaluate three mutual funds using the Treynor measure for performance evaluation. The risk-free return during the sample period is 6%. The average returns, standard deviations, and betas for the three funds are given below, in addition to information regarding the S&P 500 Index.

The fund with the highest Treynor measure is

A) Fund A.

B) Fund B.

C) Fund C.

D) Funds A and B (tied for highest) .

E) Funds A and C (tied for highest) .

Treynor Measure

A performance metric for determining how well an investment compensates the investor for the risk taken, considering systematic risk.

Risk-Free Return

The theoretical return of an investment with zero risk, often represented by the yield of government bonds like U.S. Treasury bonds.

Betas

A metric that assesses the systematic risk or volatility faced by a security or portfolio in contrast to the entire market.

- Digest the range of performance evaluating measures (Sharpe, Treynor, Jensen's alpha, M2, and information ratio) and the mechanics of their computation.

- Discern the criticality of risk-free returns in the scrutiny of investment performance.

Verified Answer

Learning Objectives

- Digest the range of performance evaluating measures (Sharpe, Treynor, Jensen's alpha, M2, and information ratio) and the mechanics of their computation.

- Discern the criticality of risk-free returns in the scrutiny of investment performance.

Related questions

You Want to Evaluate Three Mutual Funds Using the Sharpe ...

The Following Data Are Available Relating to the Performance of ...

Suppose Two Portfolios Have the Same Average Return and the ...

Suppose Two Portfolios Have the Same Average Return and the ...

Suppose Two Portfolios Have the Same Average Return and the ...