Asked by Riley Runnells on May 28, 2024

Verified

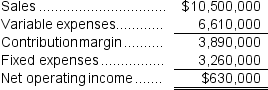

Youns Inc.reported the following results from last year's operations:  The company's average operating assets were $5,000,000. At the beginning of this year, the company has a $1,400,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $616,000, and a contribution margin ratio of 30% of sales.

The company's average operating assets were $5,000,000. At the beginning of this year, the company has a $1,400,000 investment opportunity that involves sales of $2,800,000, fixed expenses of $616,000, and a contribution margin ratio of 30% of sales.

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined turnover for the entire company will be closest to:

A) 9.50

B) 1.64

C) 2.66

D) 2.08

Turnover

This is a measure of how quickly inventory is sold or how often employees are replaced within a business.

Investment Opportunity

A potential financial venture, project, or asset that could generate a return on investment.

- Examine the repercussions of investment strategies on a business's fiscal performance metrics.

Verified Answer

CP

Chandon PorterJun 02, 2024

Final Answer :

D

Explanation :

Sales = $10,500,000 + $2,800,000 = $13,300,000

Average operating assets = $5,000,000 + $1,400,000 = $6,400,000

Turnover = Sales ÷ Average operating assets = $13,300,000 ÷ $6,400,000 = 2.08

Average operating assets = $5,000,000 + $1,400,000 = $6,400,000

Turnover = Sales ÷ Average operating assets = $13,300,000 ÷ $6,400,000 = 2.08

Learning Objectives

- Examine the repercussions of investment strategies on a business's fiscal performance metrics.