Asked by Abigail Martinez on May 01, 2024

Verified

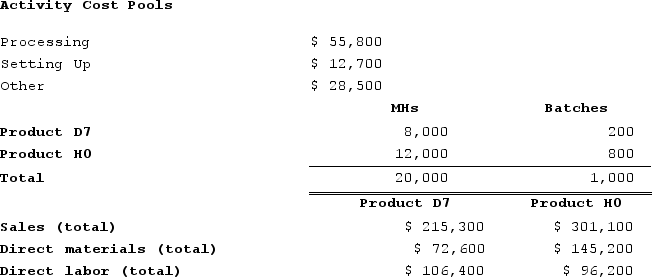

Zwahlen Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. Costs in the Processing cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs and activity-based costing system appear below:

Required:a. Calculate activity rates for each activity cost pool using activity-based costing.b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.c. Determine the product margins for each product using activity-based costing.

Required:a. Calculate activity rates for each activity cost pool using activity-based costing.b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.c. Determine the product margins for each product using activity-based costing.

Activity Cost Pools

Aggregations of individual costs, categorised based on the activities performed within an organization.

Batches

Batches refer to groups or sets of goods produced at one time, used in manufacturing to describe the production process or in inventory to describe how products are managed.

Product Margins

The difference between the selling price of a product and its production costs.

- Be informed about the fundamental principles of Activity-Based Costing (ABC).

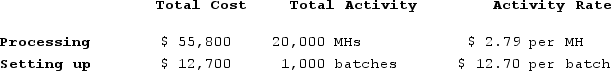

- Estimate activity rates within various cost pools under an Activity-Based Costing system.

- Allocate overhead finances to products by employing calculated activity rates.

Verified Answer

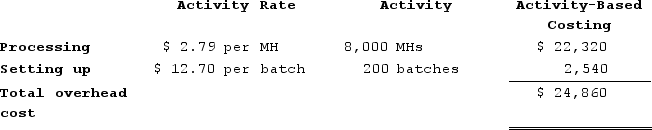

b. The overhead cost charged to Product D7 is:

b. The overhead cost charged to Product D7 is: The overhead cost charged to Product H0 is:

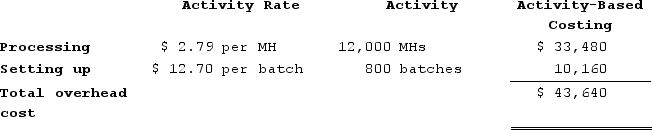

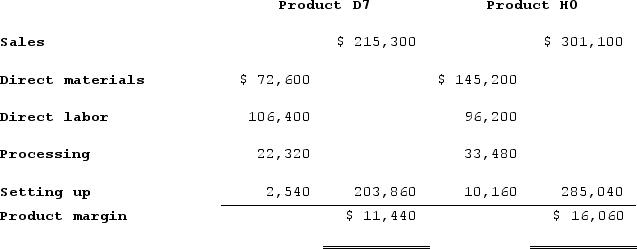

The overhead cost charged to Product H0 is: c. Determine product margins:

c. Determine product margins:

Learning Objectives

- Be informed about the fundamental principles of Activity-Based Costing (ABC).

- Estimate activity rates within various cost pools under an Activity-Based Costing system.

- Allocate overhead finances to products by employing calculated activity rates.

Related questions

Archie Corporation Uses the Following Activity Rates from Its Activity-Based ...

Dane Housecleaning Provides Housecleaning Services to Its Clients ...

Ciulla Corporation Manufactures Two Products: Product J12N and Product H63J ...

Kretlow Corporation Has Provided the Following Data from Its Activity-Based ...

Groleau Corporation Has an Activity-Based Costing System with Three Activity ...