AF

Ajmal Faizy

Answers (6)

AF

Answered

The quantity theory of money assumes that money supply and price level are the only variables in the equation of exchange that are free to fluctuate.

On Jul 13, 2024

False

AF

Answered

An employee prepared an appraisal of a property for his real-estate development company. The employee had been told that the appraisal would be used by the company to attract a potential investor, Mr. Jones, for the company's client, Mr. Lee. Because the appraiser carelessly forgot to check the recent changes in the zoning by-laws, the appraisal was not accurate. Mr. Jones was misled about the value of the land and suffered a financial loss of $200,000. On these facts, which of the following is true?

A) Mr. Jones could not take any action because he had no contract with the company or the appraiser.

B) A person cannot be sued for words that cause loss, only for actions that cause physical injury.

C) If Jones sues the appraiser, he cannot also sue the employer company.

D) The cause of action most likely to be taken by the investor is defamation.

E) To win in an action against the appraiser, Jones must prove that the appraiser owed him a duty of care, fell below the standard of care owed, and thereby caused him a foreseeable loss because of his reliance on the information.

A) Mr. Jones could not take any action because he had no contract with the company or the appraiser.

B) A person cannot be sued for words that cause loss, only for actions that cause physical injury.

C) If Jones sues the appraiser, he cannot also sue the employer company.

D) The cause of action most likely to be taken by the investor is defamation.

E) To win in an action against the appraiser, Jones must prove that the appraiser owed him a duty of care, fell below the standard of care owed, and thereby caused him a foreseeable loss because of his reliance on the information.

On Jul 12, 2024

E

AF

Answered

Any work schedule that allows a full-time job to be completed in less than the standard five days is known as the __________.

On Jun 13, 2024

compressed workweek

AF

Answered

If the total costs of producing 1,500 units of output is $15,000 and this output sold to consumers for a total of $16,500, then the firm would earn economic profits of

A) $31,500.

B) $16,500.

C) $1,500.

D) $15,000.

A) $31,500.

B) $16,500.

C) $1,500.

D) $15,000.

On Jun 12, 2024

C

AF

Answered

To access every transaction that has impacted a specific account through QBO Chart of Accounts a user of QBO must:

A) Select the Create (+) icon,then select Other,then select Journal Entry.

B) Select the Search icon,then select Advanced Search,then Reports.

C) Select the Search icon,then select Transactions,then select Recent Transactions.

D) Select the Gear icon,then select Chart of Accounts,and select View Register for a specific account.

A) Select the Create (+) icon,then select Other,then select Journal Entry.

B) Select the Search icon,then select Advanced Search,then Reports.

C) Select the Search icon,then select Transactions,then select Recent Transactions.

D) Select the Gear icon,then select Chart of Accounts,and select View Register for a specific account.

On May 14, 2024

D

AF

Answered

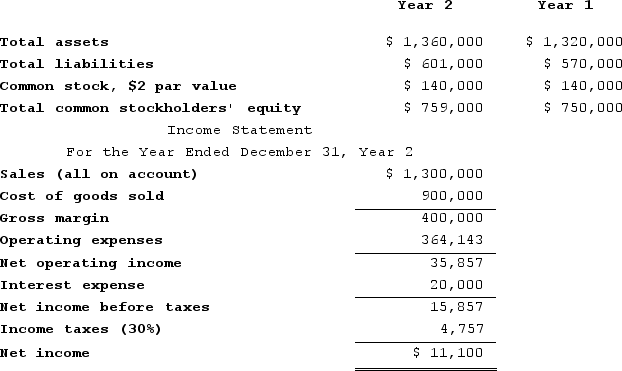

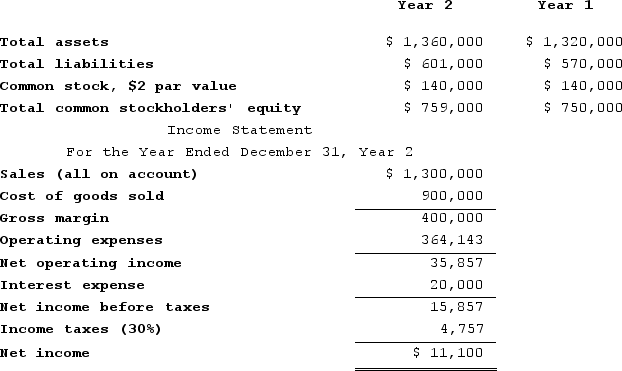

Brill Corporation has provided the following financial data:

Dividends on common stock during Year 2 totaled $2,100. The market price of common stock at the end of Year 2 was $2.32 per share.Required:a. What is the company's times interest earned ratio for Year 2?b. What is the company's debt-to-equity ratio at the end of Year 2?c. What is the company's equity multiplier at the end of Year 2?d. What is the company's net profit margin percentage for Year 2?e. What is the company's gross margin percentage for Year 2?f. What is the company's return on total assets for Year 2?g. What is the company's return on equity for Year 2?h. What is the company's earnings per share for Year 2?i. What is the company's price-earnings ratio for Year 2?j. What is the company's dividend payout ratio for Year 2?k. What is the company's dividend yield ratio for Year 2?l. What is the company's book value per share at the end of Year 2?

Dividends on common stock during Year 2 totaled $2,100. The market price of common stock at the end of Year 2 was $2.32 per share.Required:a. What is the company's times interest earned ratio for Year 2?b. What is the company's debt-to-equity ratio at the end of Year 2?c. What is the company's equity multiplier at the end of Year 2?d. What is the company's net profit margin percentage for Year 2?e. What is the company's gross margin percentage for Year 2?f. What is the company's return on total assets for Year 2?g. What is the company's return on equity for Year 2?h. What is the company's earnings per share for Year 2?i. What is the company's price-earnings ratio for Year 2?j. What is the company's dividend payout ratio for Year 2?k. What is the company's dividend yield ratio for Year 2?l. What is the company's book value per share at the end of Year 2?

Dividends on common stock during Year 2 totaled $2,100. The market price of common stock at the end of Year 2 was $2.32 per share.Required:a. What is the company's times interest earned ratio for Year 2?b. What is the company's debt-to-equity ratio at the end of Year 2?c. What is the company's equity multiplier at the end of Year 2?d. What is the company's net profit margin percentage for Year 2?e. What is the company's gross margin percentage for Year 2?f. What is the company's return on total assets for Year 2?g. What is the company's return on equity for Year 2?h. What is the company's earnings per share for Year 2?i. What is the company's price-earnings ratio for Year 2?j. What is the company's dividend payout ratio for Year 2?k. What is the company's dividend yield ratio for Year 2?l. What is the company's book value per share at the end of Year 2?

Dividends on common stock during Year 2 totaled $2,100. The market price of common stock at the end of Year 2 was $2.32 per share.Required:a. What is the company's times interest earned ratio for Year 2?b. What is the company's debt-to-equity ratio at the end of Year 2?c. What is the company's equity multiplier at the end of Year 2?d. What is the company's net profit margin percentage for Year 2?e. What is the company's gross margin percentage for Year 2?f. What is the company's return on total assets for Year 2?g. What is the company's return on equity for Year 2?h. What is the company's earnings per share for Year 2?i. What is the company's price-earnings ratio for Year 2?j. What is the company's dividend payout ratio for Year 2?k. What is the company's dividend yield ratio for Year 2?l. What is the company's book value per share at the end of Year 2?On May 13, 2024

a.Times interest earned ratio = Earnings before interest expense and income taxes ÷ Interest expense= $35,857 ÷ $20,000 = 1.79 (rounded)b.Debt-to-equity ratio = Total liabilities ÷ Stockholders' equity= $601,000 ÷ $759,000 = 0.79 (rounded)c.Equity multiplier = Average total assets* ÷ Average stockholders' equity*= $1,340,000÷$754,500 = 1.78 (rounded)*Average total assets = ($1,360,000 + $1,320,000) ÷ 2 = $1,340,000**Average stockholders' equity = ($759,000 + $750,000) ÷ 2 = $754,500d.Net profit margin percentage = Net income ÷ Sales= $11,100÷$1,300,000 = 0.9% (rounded)e.Gross margin percentage = Gross margin ÷ Sales= $400,000 ÷ $1,300,000 = 30.8% (rounded)f.Return on total assets = Adjusted net income* ÷ Average total assets**= $25,100 ÷ $1,340,000 = 1.87% (rounded)*Adjusted net income = Net income + [Interest expense × (1 − Tax rate)]= $11,100 + [$20,000 × (1 − 0.30)] = $25,100**Average total assets = ($1,360,000 + $1,320,000) ÷ 2 = $1,340,000g.Return on equity = Net income ÷ Average stockholders' equity*= $11,100 ÷ $754,500 = 1.47% (rounded)*Average stockholders' equity = ($759,000 + $750,000) ÷ 2 = $754,500h.Earnings per share = Net Income ÷ Average number of common shares outstanding*= $11,100 ÷ 70,000 shares = $0.16 per share (rounded)*Number of common shares outstanding = Common stock ÷ Par value= $140,000 ÷ $2 per share = 70,000 sharesi.Earnings per share = Net Income ÷ Average number of common shares outstanding*= $11,100 ÷ 70,000 shares = $0.16 per share (rounded)*Number of common shares outstanding = Common stock ÷ Par value= $140,000 ÷ $2 per share = 70,000 sharesPrice-earnings ratio = Market price per share ÷ Earnings per share= $2.32 ÷ $0.16 = 14.50 (rounded)j.Earnings per share = Net Income ÷ Average number of common shares outstanding*= $11,100 ÷ 70,000 shares = $0.16 per share (rounded)*Number of common shares outstanding = Common stock ÷ Par value= $140,000 ÷ $2 per share = 70,000 sharesDividend payout ratio = Dividends per share* ÷ Earnings per share= $0.03 ÷ $0.16 = 18.8% (rounded)*Dividends per share = Common dividends ÷ Common shares (see above)= $2,100 ÷ 70,000 shares = $0.03 per share (rounded)k.Dividend yield ratio = Dividends per share* ÷ Market price per share= $0.03 ÷ $2.32 = 1.29% (rounded)*Dividends per share = Common dividends ÷ Common shares (see above)= $2,100 ÷ 70,000 shares = $0.03 per share (rounded)l.Book value per share = Common stockholders' equity ÷ Number of common shares outstanding*= $759,000 ÷ 70,000 shares = $10.84 per share (rounded)*Number of common shares outstanding = Common stock ÷ Par value= $140,000 ÷ $2 per share =70,000 shares