AB

Arnav Ballani

Answers (6)

AB

Answered

The method of estimating inventory that uses records of the selling prices of the merchandise is called

A) retail method

B) gross profit method

C) inventory turnover method

D) average cost method

A) retail method

B) gross profit method

C) inventory turnover method

D) average cost method

On Jul 24, 2024

A

AB

Answered

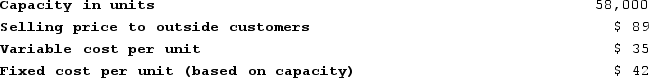

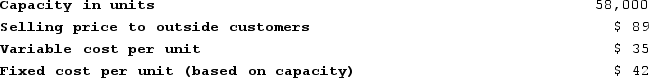

Godina Products, Incorporated, has a Receiver Division that manufactures and sells a number of products, including a standard receiver that could be used by another division in the company, the Industrial Products Division, in one of its products. Data concerning that receiver appear below:  The Industrial Products Division is currently purchasing 10,000 of these receivers per year from an overseas supplier at a cost of $81 per receiver. Assume that the Receiver Division is selling all of the receivers it can produce to outside customers. Does there exist a transfer price that would make both the Receiver and Industrial Products Division financially better off than if the Industrial Products Division were to continue buying its receivers from the outside supplier?

The Industrial Products Division is currently purchasing 10,000 of these receivers per year from an overseas supplier at a cost of $81 per receiver. Assume that the Receiver Division is selling all of the receivers it can produce to outside customers. Does there exist a transfer price that would make both the Receiver and Industrial Products Division financially better off than if the Industrial Products Division were to continue buying its receivers from the outside supplier?

A) Yes, both divisions are always better off regardless of whether the selling division has enough idle capacity to handle all of the buying division's needs.

B) Yes, the minimum transfer price that the selling division should be willing to accept is less than the maximum transfer price that the buying division should be willing to accept.

C) The answer cannot be determined from the information that has been provided.

D) No, the minimum transfer price that the selling division should be willing to accept exceeds the maximum transfer price that the buying division should be willing to accept.

The Industrial Products Division is currently purchasing 10,000 of these receivers per year from an overseas supplier at a cost of $81 per receiver. Assume that the Receiver Division is selling all of the receivers it can produce to outside customers. Does there exist a transfer price that would make both the Receiver and Industrial Products Division financially better off than if the Industrial Products Division were to continue buying its receivers from the outside supplier?

The Industrial Products Division is currently purchasing 10,000 of these receivers per year from an overseas supplier at a cost of $81 per receiver. Assume that the Receiver Division is selling all of the receivers it can produce to outside customers. Does there exist a transfer price that would make both the Receiver and Industrial Products Division financially better off than if the Industrial Products Division were to continue buying its receivers from the outside supplier?A) Yes, both divisions are always better off regardless of whether the selling division has enough idle capacity to handle all of the buying division's needs.

B) Yes, the minimum transfer price that the selling division should be willing to accept is less than the maximum transfer price that the buying division should be willing to accept.

C) The answer cannot be determined from the information that has been provided.

D) No, the minimum transfer price that the selling division should be willing to accept exceeds the maximum transfer price that the buying division should be willing to accept.

On Jul 22, 2024

D

AB

Answered

Where should be endowment contributions presented in the financial statements of a not-for-profit organization under the deferral method?

A) They are reflected in the notes to the financial statements.

B) They are used to effect a reduction to a related expense account.

C) They are reflected in the statement of changes in net assets.

D) They are shown in the statement of operations.

A) They are reflected in the notes to the financial statements.

B) They are used to effect a reduction to a related expense account.

C) They are reflected in the statement of changes in net assets.

D) They are shown in the statement of operations.

On Jun 24, 2024

C

AB

Answered

In value engineering and value analysis,value can be expressed as: Price ÷ Cost.

On Jun 22, 2024

False

AB

Answered

In the Cournot model, each firm chooses its actions on the assumption that its rivals will react by changing their quantities in such a way as to maximize their own profits.

On May 25, 2024

False

AB

Answered

A freehold estate is:

A) a right to possession of real property

B) a right of ownership of real property for an indefinite time (fee estate) .

C) a right of ownership of real property for the life of a person (life estate) .

D) All of these.

A) a right to possession of real property

B) a right of ownership of real property for an indefinite time (fee estate) .

C) a right of ownership of real property for the life of a person (life estate) .

D) All of these.

On May 23, 2024

D