AA

Ashley Ann Edmund

Answers (8)

AA

Answered

Zachary,who has been authorized to write a check from a company account to pay employees,draws bonus checks from the company account for five imaginary employees; he then endorses the checks in their names and deposits the checks into his own bank account.Which of the following is true regarding whether the company will be required to take the loss on the checks?

A) Under the fictitious payee rule,the company will be required to take the loss on the checks unless the company can obtain the funds from Zachary.

B) Under the imposter rule,the company will be required to take the loss on the checks unless the company can obtain the funds from Zachary.

C) Under the transferor rule,the company will be required to take the loss on the checks unless the company can obtain the funds from Zachary.

D) Under the employee-liability rule,the company will be able to recover from any bank that cashed the check in addition to Zachary.

E) Under the Banking Liability Enhancement Act of 2009,the company will be able to recover from any bank that cashed the check in addition to Zachary.

A) Under the fictitious payee rule,the company will be required to take the loss on the checks unless the company can obtain the funds from Zachary.

B) Under the imposter rule,the company will be required to take the loss on the checks unless the company can obtain the funds from Zachary.

C) Under the transferor rule,the company will be required to take the loss on the checks unless the company can obtain the funds from Zachary.

D) Under the employee-liability rule,the company will be able to recover from any bank that cashed the check in addition to Zachary.

E) Under the Banking Liability Enhancement Act of 2009,the company will be able to recover from any bank that cashed the check in addition to Zachary.

On Aug 01, 2024

A

AA

Answered

The ________ accepts the risk of loss in return for a premium.

A) insured

B) insurer

C) beneficiary

D) benefactor

A) insured

B) insurer

C) beneficiary

D) benefactor

On Jul 29, 2024

B

AA

Answered

Carpet Woes.Beau went shopping at ABC Carpet.He saw some carpet he liked but could not make up his mind.The manager at ABC Carpet wrote down the proposed purchase price for him along with a statement that the price would be good for three months.Two months later Beau went back to ABC Carpet to purchase the carpet.Unfortunately,the price had gone up.Beau showed the manager his writing and guaranteed price,but the manager said that the offer was no longer good.Although he had to pay more than the ABC manager had initially promised,Beau proceeded to purchase his carpet from ABC Carpet,and he also contracted with ABC to do the installation.Unfortunately,Beau almost immediately started to have problems with the carpet.Beau told the sales manager of ABC Carpet that he was planning on bringing suit for breach of warranty.The sales manager,however,told him that the breach of warranty provisions only applied to sales of goods and that the carpet purchase was for installation,a service.What kind of offer did the manager at ABC Carpet make to Beau?

A) An unenforceable offer

B) A firm offer

C) A consideration offer

D) An illusory offer

E) A mirror offer

A) An unenforceable offer

B) A firm offer

C) A consideration offer

D) An illusory offer

E) A mirror offer

On Jul 02, 2024

B

AA

Answered

The principle of similarity means that consumers tend to group together objects that share physical characteristics; as an example, Coca-Cola, Sprite, and Dad's Old-Fashioned Root Beer are all "carbonated soft drinks."

On Jun 29, 2024

True

AA

Answered

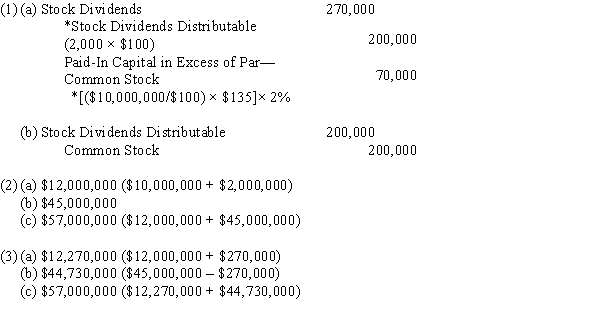

The following account balances appear on the balance sheet of Osgood Industries:

Common Stock (300,000 shares authorized, $100 par): $10,000,000

Paid-In Capital in Excess of Par-Common Stock: $2,000,000

Retained Earnings: $45,000,000

The board of directors declared a 2% stock dividend when the market price of the stock was $135 a share.

Required:

(1)Journalize the entries to record

(a)the declaration of the dividend, capitalizing an amount equal to market value

(b)the issuance of the stock certificates

(2)Determine the following amounts before the stock dividend was declared:

(a)Total paid-in capital

(b)Total retained earnings

(c)Total stockholders' equity

(3)Determine the following amounts after the stock dividend was declared and closing entries were recorded at the end of the year:

(a)Total paid-in capital

(b)Total retained earnings

(c)Total stockholders' equity

Common Stock (300,000 shares authorized, $100 par): $10,000,000

Paid-In Capital in Excess of Par-Common Stock: $2,000,000

Retained Earnings: $45,000,000

The board of directors declared a 2% stock dividend when the market price of the stock was $135 a share.

Required:

(1)Journalize the entries to record

(a)the declaration of the dividend, capitalizing an amount equal to market value

(b)the issuance of the stock certificates

(2)Determine the following amounts before the stock dividend was declared:

(a)Total paid-in capital

(b)Total retained earnings

(c)Total stockholders' equity

(3)Determine the following amounts after the stock dividend was declared and closing entries were recorded at the end of the year:

(a)Total paid-in capital

(b)Total retained earnings

(c)Total stockholders' equity

On Jun 01, 2024

AA

Answered

Bill Braddock is considering opening a Fast 'n Clean Car Service Center. He estimates that the following costs will be incurred during his first year of operations: Rent $9200 Depreciation on equipment $7000 Wages $16400 Motor oil $2.00 per quart. He estimates that each oil change will require 5 quarts of oil. Oil filters will cost $3.00 each. He must also pay The Fast 'n Clean Corporation a franchise fee of $1.10 per oil change since he will operate the business as a franchise. In addition utility costs are expected to behave in relation to the number of oil changes as follows: Number of Oil Changes Utility Costs 4,000$6,0006,000$7,3009,000$9,60012,000$12,60014,000$15,000\begin{array} { c c } \text { Number of Oil Changes } & \text { Utility Costs } \\\hline 4,000 & \$ 6,000 \\6,000 & \$ 7,300 \\9,000 & \$ 9,600 \\12,000 & \$ 12,600 \\14,000 & \$ 15,000\end{array} Number of Oil Changes 4,0006,0009,00012,00014,000 Utility Costs $6,000$7,300$9,600$12,600$15,000 Bill Braddock anticipates that he can provide the oil change service with a filter at $25 each.

Instructions

(a) Using the high-low method determine variable costs per unit and total fixed costs.

(b) Determine the break-even point in number of oil changes and sales dollars.

(c) Without regard to your answers in parts (a) and (b) determine the oil changes required to earn net income of $20000 assuming fixed costs are $32000 and the contribution margin per unit is $8.

Instructions

(a) Using the high-low method determine variable costs per unit and total fixed costs.

(b) Determine the break-even point in number of oil changes and sales dollars.

(c) Without regard to your answers in parts (a) and (b) determine the oil changes required to earn net income of $20000 assuming fixed costs are $32000 and the contribution margin per unit is $8.

On May 30, 2024

(a) Separation of mixed costs:

Change in cost/Change in quantity: ($15,000−$6,000)(14,000−4,000)=$9,00010,000=$.90\frac { ( \$ 15,000 - \$ 6,000 ) } { ( 14,000 - 4,000 ) } = \frac { \$ 9,000 } { 10,000 } = \$ .90(14,000−4,000)($15,000−$6,000)=10,000$9,000=$.90 per oil change

Variable costs: Fixed costs: Oil (5 quarts ×$2.00)$10.00 Rent $9,200 Filter 3.00 Depreciation 7,000 Franchise fee 1.10 Wages 16.400 Utility costs (variable) .90‾ Utility costs 2.400∗ Total variable $15.00‾ Total $3500‾‾\begin{array} { l r l r } \text { Variable costs: } & \text { Fixed costs: } \\ \text { Oil } ( 5 \text { quarts } \times \$ 2.00 ) & \$ 10.00 & \text { Rent } & \$ 9,200 \\ \text { Filter } & 3.00 & \text { Depreciation } & 7,000 \\ \text { Franchise fee } & 1.10 & \text { Wages } & 16.400 \\ \text { Utility costs (variable) } & \underline { .90 } & \text { Utility costs } & 2.400 ^ { * } \\ \quad \text { Total variable } & \underline { \$ 15.00 } & \text { Total } & \underline { \underline { \$ 3500 } } \end{array} Variable costs: Oil (5 quarts ×$2.00) Filter Franchise fee Utility costs (variable) Total variable Fixed costs: $10.003.001.10.90$15.00 Rent Depreciation Wages Utility costs Total $9,2007,00016.4002.400∗$3500

$$6,000−(4,000×.90)=$2,400\$ \$ 6,000 - ( 4,000 \times .90 ) = \$ 2,400$$6,000−(4,000×.90)=$2,400 (b) (1) Break-even oil changes in units:

Fixed costs Unit contribution margin =$35,000$10.00∗=3,500 oil changes \frac{\text { Fixed costs }}{\text { Unit contribution margin }}=\frac{\$ 35,000}{\$ 10.00^{*}}=3,500 \text { oil changes } Unit contribution margin Fixed costs =$10.00∗$35,000=3,500 oil changes

(2) Break-even sales in dollars:

Fixed costs Contribution margin ratio =$35,000.40=$87,500\frac { \text { Fixed costs } } { \text { Contribution margin ratio } } = \frac { \$ 35,000 } { .40 } = \$ 87,500 Contribution margin ratio Fixed costs =.40$35,000=$87,500

*Selling price per unit (a) $25 Variable cost per unit $5‾ Unit contribution margin (b) $10%‾ Contribution margin ratio (b) ÷ (a) 40%‾\begin{array} { l r } \text { *Selling price per unit (a) } & \$ 25 \\ \text { Variable cost per unit } & \underline { \$ 5 } \\ \text { Unit contribution margin (b) } & \underline { \$ 10 \% } \\ \text { Contribution margin ratio (b) } \div \text { (a) } & \underline { 40 \% } \end{array} *Selling price per unit (a) Variable cost per unit Unit contribution margin (b) Contribution margin ratio (b) ÷ (a) $25$5$10%40%

(c) Fixed costs + Net income Unit contribution margin =$32,000+$20,000$8=6,500\frac { \text { Fixed costs + Net income } } { \text { Unit contribution margin } } = \frac { \$ 32,000 + \$ 20,000 } { \$ 8 } = 6,500 Unit contribution margin Fixed costs + Net income =$8$32,000+$20,000=6,500 oil changes

Change in cost/Change in quantity: ($15,000−$6,000)(14,000−4,000)=$9,00010,000=$.90\frac { ( \$ 15,000 - \$ 6,000 ) } { ( 14,000 - 4,000 ) } = \frac { \$ 9,000 } { 10,000 } = \$ .90(14,000−4,000)($15,000−$6,000)=10,000$9,000=$.90 per oil change

Variable costs: Fixed costs: Oil (5 quarts ×$2.00)$10.00 Rent $9,200 Filter 3.00 Depreciation 7,000 Franchise fee 1.10 Wages 16.400 Utility costs (variable) .90‾ Utility costs 2.400∗ Total variable $15.00‾ Total $3500‾‾\begin{array} { l r l r } \text { Variable costs: } & \text { Fixed costs: } \\ \text { Oil } ( 5 \text { quarts } \times \$ 2.00 ) & \$ 10.00 & \text { Rent } & \$ 9,200 \\ \text { Filter } & 3.00 & \text { Depreciation } & 7,000 \\ \text { Franchise fee } & 1.10 & \text { Wages } & 16.400 \\ \text { Utility costs (variable) } & \underline { .90 } & \text { Utility costs } & 2.400 ^ { * } \\ \quad \text { Total variable } & \underline { \$ 15.00 } & \text { Total } & \underline { \underline { \$ 3500 } } \end{array} Variable costs: Oil (5 quarts ×$2.00) Filter Franchise fee Utility costs (variable) Total variable Fixed costs: $10.003.001.10.90$15.00 Rent Depreciation Wages Utility costs Total $9,2007,00016.4002.400∗$3500

$$6,000−(4,000×.90)=$2,400\$ \$ 6,000 - ( 4,000 \times .90 ) = \$ 2,400$$6,000−(4,000×.90)=$2,400 (b) (1) Break-even oil changes in units:

Fixed costs Unit contribution margin =$35,000$10.00∗=3,500 oil changes \frac{\text { Fixed costs }}{\text { Unit contribution margin }}=\frac{\$ 35,000}{\$ 10.00^{*}}=3,500 \text { oil changes } Unit contribution margin Fixed costs =$10.00∗$35,000=3,500 oil changes

(2) Break-even sales in dollars:

Fixed costs Contribution margin ratio =$35,000.40=$87,500\frac { \text { Fixed costs } } { \text { Contribution margin ratio } } = \frac { \$ 35,000 } { .40 } = \$ 87,500 Contribution margin ratio Fixed costs =.40$35,000=$87,500

*Selling price per unit (a) $25 Variable cost per unit $5‾ Unit contribution margin (b) $10%‾ Contribution margin ratio (b) ÷ (a) 40%‾\begin{array} { l r } \text { *Selling price per unit (a) } & \$ 25 \\ \text { Variable cost per unit } & \underline { \$ 5 } \\ \text { Unit contribution margin (b) } & \underline { \$ 10 \% } \\ \text { Contribution margin ratio (b) } \div \text { (a) } & \underline { 40 \% } \end{array} *Selling price per unit (a) Variable cost per unit Unit contribution margin (b) Contribution margin ratio (b) ÷ (a) $25$5$10%40%

(c) Fixed costs + Net income Unit contribution margin =$32,000+$20,000$8=6,500\frac { \text { Fixed costs + Net income } } { \text { Unit contribution margin } } = \frac { \$ 32,000 + \$ 20,000 } { \$ 8 } = 6,500 Unit contribution margin Fixed costs + Net income =$8$32,000+$20,000=6,500 oil changes

AA

Answered

To the option holder, put options are worth ______ when the exercise price is higher; call options are worth ______ when the exercise price is higher.

A) more; more

B) more; less

C) less; more

D) less; less

E) It doesn't matter-they are too risky to be included in a reasonable person's portfolio.

A) more; more

B) more; less

C) less; more

D) less; less

E) It doesn't matter-they are too risky to be included in a reasonable person's portfolio.

On May 02, 2024

B

AA

Answered

Discuss sexism.

On Apr 30, 2024

Male chauvinism is a feeling of male superiority over females, which is also known as sexism. A man who has attitudes and stereotypes of women in society, may choose to see them as being of less worth-in other words, he might dehumanize women. This can happen in different ways.Women in most societies are expected to be feminine, a term associated with disempowering behavior like dependence, instability, emotional insecurity, a willingness to take orders but not give them, and passivity. When these expectations toward women exist in a workplace, so does prejudice.