BS

Bradley Smith

Answers (6)

BS

Answered

In U.S. markets, there are many substitute products for Head & Shoulders dandruff shampoo, suggesting the price elasticity of demand for Head & Shoulders is high.

On Jul 18, 2024

True

BS

Answered

Baka Corporation applies manufacturing overhead on the basis of direct labor-hours. At the beginning of the most recent year, the company based its predetermined overhead rate on total estimated overhead of $240,200 and 4,780 estimated direct labor-hours. Actual manufacturing overhead for the year amounted to $242,000 and actual direct labor-hours were 4,610.The predetermined overhead rate for the year was closest to:

A) $52.49

B) $48.46

C) $50.25

D) $50.63

A) $52.49

B) $48.46

C) $50.25

D) $50.63

On Jul 15, 2024

C

BS

Answered

The percentage of net income that is added to retained earnings is called the:

A) Payout ratio.

B) Profit margin.

C) Retention ratio.

D) Internal growth rate.

E) Intensity ratio.

A) Payout ratio.

B) Profit margin.

C) Retention ratio.

D) Internal growth rate.

E) Intensity ratio.

On Jun 18, 2024

C

BS

Answered

A new machine costing $1,800,000 cash and estimated to have a $60,000 salvage value was purchased on January 1.The machine is expected to produce 600,000 units of product during its 8-year useful life.Calculate the depreciation expense in the first year under the following independent situations:

1.The company uses the units-of-production method and the machine produces 70,000 units of product during its first year.

2.The company uses the double-declining-balance method.

3.The company uses the straight-line method.

1.The company uses the units-of-production method and the machine produces 70,000 units of product during its first year.

2.The company uses the double-declining-balance method.

3.The company uses the straight-line method.

On Jun 15, 2024

1.($1,800,000 - $60,000)/600,000 units = $2.90/unit; 70,000 units * $2.90/unit = $203,000

2.$1,800,000 * 25% = $450,000

3.($1,800,000 - $60,000)/8 years = $217,500

2.$1,800,000 * 25% = $450,000

3.($1,800,000 - $60,000)/8 years = $217,500

BS

Answered

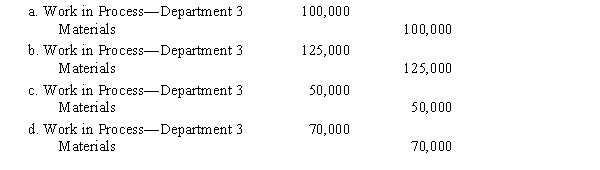

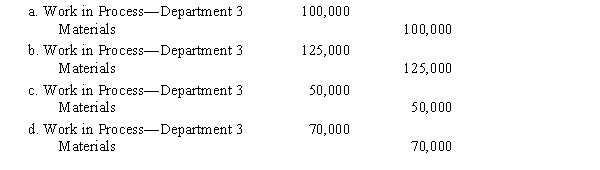

Mocha Company manufactures a single product by a continuous process involving three production departments. The records indicate that direct materials, direct labor, and applied factory overhead for Department 2 were $100,000, $125,000, and $150,000, respectively. The records further indicate that direct materials, direct labor, and applied factory overhead for Department 3 were $50,000, $60,000, and $70,000, respectively. In addition, work in process at the beginning of the period for Department 3 totaled $75,000, and work in process at the end of the period totaled $60,000. The journal entry to record the flow of costs into Department 3 during the period for direct materials is

On May 19, 2024

C

BS

Answered

The amount of income tax owed by a family is

A) unaffected by deductions.

B) total income minus tax credits.

C) not simply proportional to its total income.

D) a constant fraction of income.

A) unaffected by deductions.

B) total income minus tax credits.

C) not simply proportional to its total income.

D) a constant fraction of income.

On May 16, 2024

C