BS

Brock Shively

Answers (8)

BS

Answered

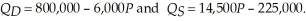

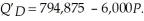

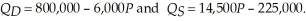

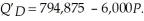

The local community is considering two options to raise money to finance a new civic center. The first option is to institute a per unit tax on restaurant meals of $2.46. The market demand and supply functions for restaurant meals are:  Calculate consumer and producer surplus with the per unit tax. The second option the community is considering implementing is an income tax. If an income tax is implemented, the new demand for restaurant meals is:

Calculate consumer and producer surplus with the per unit tax. The second option the community is considering implementing is an income tax. If an income tax is implemented, the new demand for restaurant meals is:  Calculate the level of consumer and producer surplus in the restaurant market with the income tax. Which of the two options will reduce the sum of consumer and producer surplus the least?

Calculate the level of consumer and producer surplus in the restaurant market with the income tax. Which of the two options will reduce the sum of consumer and producer surplus the least?

Calculate consumer and producer surplus with the per unit tax. The second option the community is considering implementing is an income tax. If an income tax is implemented, the new demand for restaurant meals is:

Calculate consumer and producer surplus with the per unit tax. The second option the community is considering implementing is an income tax. If an income tax is implemented, the new demand for restaurant meals is:  Calculate the level of consumer and producer surplus in the restaurant market with the income tax. Which of the two options will reduce the sum of consumer and producer surplus the least?

Calculate the level of consumer and producer surplus in the restaurant market with the income tax. Which of the two options will reduce the sum of consumer and producer surplus the least?On Jul 30, 2024

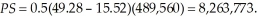

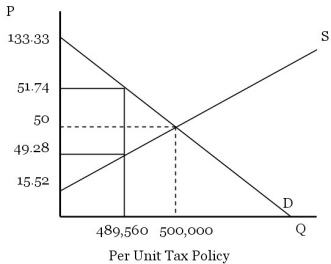

First we must determine the market equilibrium quantity and price. To do this, we set quantity demanded equal to quantity supplied and solve for equilibrium price consumers pay with the tax.

QD = 800,000 - 6,000 Pb = Qs = 14,500(Pb - 2.46) - 225,000

Pb = 51.74

The quantity exchanged will be: 489,560. The choke price (lowest price such that no units are transacted) is 133.33.

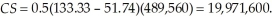

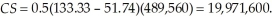

Consumer surplus is Producer surplus is

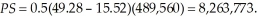

Producer surplus is  Government tax receipts are $1,204,317.60.

Government tax receipts are $1,204,317.60.

Consumer and producer surplus with the tax is 28,235,373. With an income tax, we need to determine the new equilibrium price and quantity.

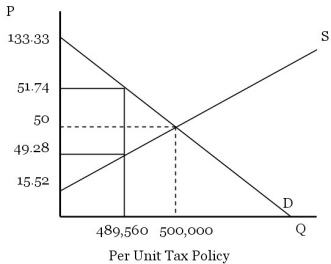

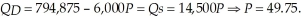

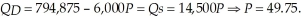

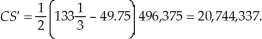

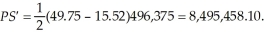

With an income tax, we need to determine the new equilibrium price and quantity.  At a price of $49.75, the quantity exchanged will be: 496,375. The choke price (lowest price such that no units are transacted) is $133

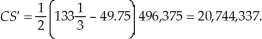

At a price of $49.75, the quantity exchanged will be: 496,375. The choke price (lowest price such that no units are transacted) is $133  . The highest price such that no meals will be produced is $15.52. Consumer surplus is

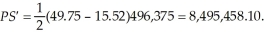

. The highest price such that no meals will be produced is $15.52. Consumer surplus is  Producer surplus is

Producer surplus is  The sum of consumer and producer surplus with the income tax is $29,239,795.10. Since consumer and producer surplus is higher for the income tax, the income tax does the least harm to societal welfare than the per unit tax.

The sum of consumer and producer surplus with the income tax is $29,239,795.10. Since consumer and producer surplus is higher for the income tax, the income tax does the least harm to societal welfare than the per unit tax.

QD = 800,000 - 6,000 Pb = Qs = 14,500(Pb - 2.46) - 225,000

Pb = 51.74

The quantity exchanged will be: 489,560. The choke price (lowest price such that no units are transacted) is 133.33.

Consumer surplus is

Producer surplus is

Producer surplus is  Government tax receipts are $1,204,317.60.

Government tax receipts are $1,204,317.60.Consumer and producer surplus with the tax is 28,235,373.

With an income tax, we need to determine the new equilibrium price and quantity.

With an income tax, we need to determine the new equilibrium price and quantity.  At a price of $49.75, the quantity exchanged will be: 496,375. The choke price (lowest price such that no units are transacted) is $133

At a price of $49.75, the quantity exchanged will be: 496,375. The choke price (lowest price such that no units are transacted) is $133  . The highest price such that no meals will be produced is $15.52. Consumer surplus is

. The highest price such that no meals will be produced is $15.52. Consumer surplus is  Producer surplus is

Producer surplus is  The sum of consumer and producer surplus with the income tax is $29,239,795.10. Since consumer and producer surplus is higher for the income tax, the income tax does the least harm to societal welfare than the per unit tax.

The sum of consumer and producer surplus with the income tax is $29,239,795.10. Since consumer and producer surplus is higher for the income tax, the income tax does the least harm to societal welfare than the per unit tax.BS

Answered

People are consciously aware of most emotions they experience.

On Jul 01, 2024

False

BS

Answered

According to behavioral economists, someone suffering from myopia is most likely to

A) spend too little on present consumption and save more than is necessary for the future.

B) vote only for economic policies that serve his or her short- and long-term interests.

C) rely too much on System 2 of the brain.

D) spend too much on present consumption and not save enough for the future.

A) spend too little on present consumption and save more than is necessary for the future.

B) vote only for economic policies that serve his or her short- and long-term interests.

C) rely too much on System 2 of the brain.

D) spend too much on present consumption and not save enough for the future.

On Jun 30, 2024

D

BS

Answered

According to Donald Kirkpatrick, three decisions need to be made when selecting participants for a training program: (1) Who can benefit? (2) What programs are required by law? (3) Should the training be voluntary or compulsory?

On Jun 01, 2024

False

BS

Answered

When government purchases increase,the spending multiplier indicates the _____.

A) amount of movement along the aggregate demand curve

B) amount of movement along the aggregate supply curve

C) size of the rightward shift of the aggregate demand curve at a given price level

D) size of the rightward shift of the aggregate supply curve at a given price level

E) size of the expansionary gap

A) amount of movement along the aggregate demand curve

B) amount of movement along the aggregate supply curve

C) size of the rightward shift of the aggregate demand curve at a given price level

D) size of the rightward shift of the aggregate supply curve at a given price level

E) size of the expansionary gap

On May 31, 2024

C

BS

Answered

Lessees may try to avoid having a lease be classified as a capital lease.Explain why a lessee might want to avoid a capital lease and how the FASB rules may be overcome to allow classification as an operating lease.

On May 02, 2024

Lessees may try to avoid a capital lease so that they do not have to report a liability on their balance sheet.They may hope that readers of the financial statements won't understand the required disclosures that report the forthcoming payments associated with operating leases for five years.A method used to overcome the FASB rules is to protect the lessor's risk associated with the residual value by not having the lessee, but a third party, guarantee the residual value.

BS

Answered

Which depreciation method does NOT use the current book value in calculating depreciation expense?

A) Straight-line

B) Double declining-balance

C) Units-of-production

D) Both A and C

A) Straight-line

B) Double declining-balance

C) Units-of-production

D) Both A and C

On May 01, 2024

D

BS

Answered

The demand for bread is less elastic than the demand for donuts; hence, a tax on bread will create a larger deadweight loss than will the same tax on donuts, other things equal.

On Apr 29, 2024

False