BW

Brooke Waszak

Answers (10)

BW

Answered

Under incentive pay, piecework rates are most suited for routine, standardized jobs with output that is easy to measure.

On Jul 14, 2024

True

BW

Answered

Tax incidence may be defined as the

A) average tax rate of a given group of taxpayers.

B) degree to which a tax falls on a particular person or group.

C) tax burden, or taxes as a percent of GDP.

D) number and range of goods and services that are taxed.

A) average tax rate of a given group of taxpayers.

B) degree to which a tax falls on a particular person or group.

C) tax burden, or taxes as a percent of GDP.

D) number and range of goods and services that are taxed.

On Jun 30, 2024

B

BW

Answered

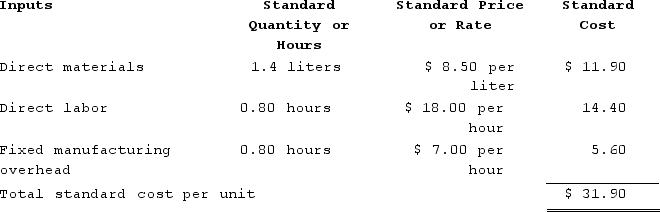

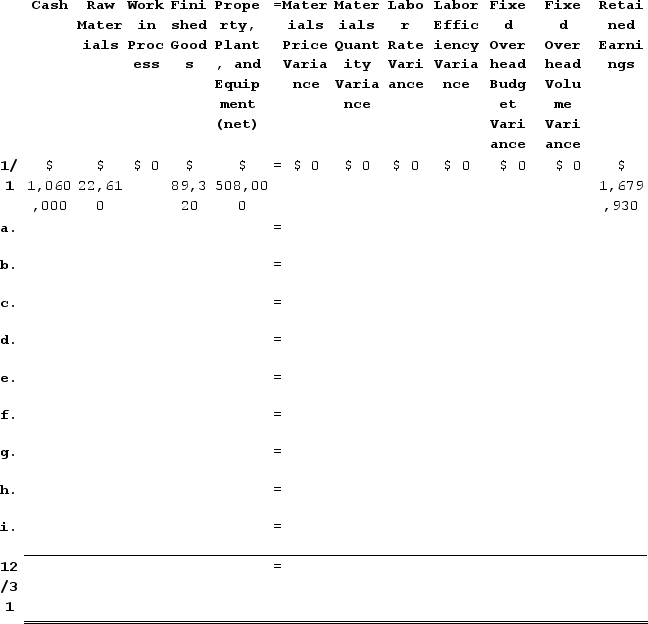

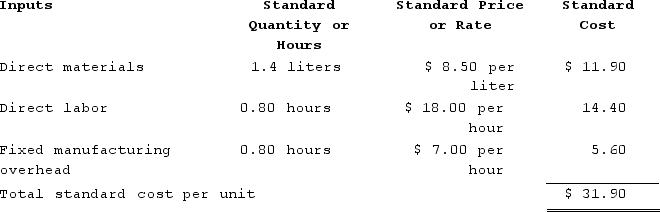

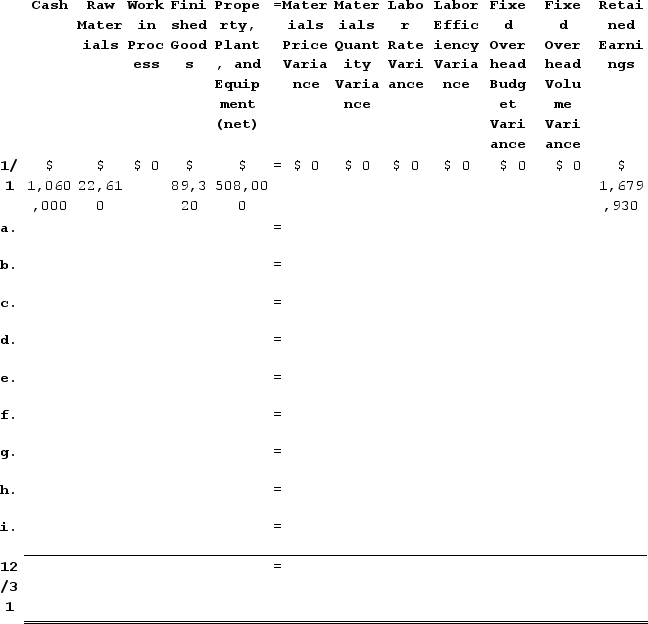

Samples Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:  The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $140,000 and budgeted activity of 20,000 hours.During the year, the company completed the following transactions:Purchased 49,500 liters of raw material at a price of $8.00 per liter. The materials price variance was $24,750 Favorable.Used 45,820 liters of the raw material to produce 32,800 units of work in process. The materials quantity variance was $850 Favorable.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 28,440 hours at an average cost of $17.00 per hour. The direct labor rate variance was $28,440 Favorable. The labor efficiency variance was $39,600 Unfavorable.Applied fixed overhead to the 32,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $154,700. Of this total, $83,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $71,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $14,700 Unfavorable. The fixed manufacturing overhead volume variance was $43,680 Favorable.Completed and transferred 32,800 units from work in process to finished goods.Sold (for cash) 32,000 units to customers at a price of $38.20 per unit.Transferred the standard cost associated with the 32,000 units sold from finished goods to cost of goods sold.Paid $133,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.To answer the following questions, it would be advisable to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $140,000 and budgeted activity of 20,000 hours.During the year, the company completed the following transactions:Purchased 49,500 liters of raw material at a price of $8.00 per liter. The materials price variance was $24,750 Favorable.Used 45,820 liters of the raw material to produce 32,800 units of work in process. The materials quantity variance was $850 Favorable.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 28,440 hours at an average cost of $17.00 per hour. The direct labor rate variance was $28,440 Favorable. The labor efficiency variance was $39,600 Unfavorable.Applied fixed overhead to the 32,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $154,700. Of this total, $83,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $71,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $14,700 Unfavorable. The fixed manufacturing overhead volume variance was $43,680 Favorable.Completed and transferred 32,800 units from work in process to finished goods.Sold (for cash) 32,000 units to customers at a price of $38.20 per unit.Transferred the standard cost associated with the 32,000 units sold from finished goods to cost of goods sold.Paid $133,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.To answer the following questions, it would be advisable to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When the company closes its standard cost variances, the Cost of Goods Sold will increase (decrease) by:

When the company closes its standard cost variances, the Cost of Goods Sold will increase (decrease) by:

A) $43,420

B) ($28,980)

C) $28,980

D) ($43,420)

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $140,000 and budgeted activity of 20,000 hours.During the year, the company completed the following transactions:Purchased 49,500 liters of raw material at a price of $8.00 per liter. The materials price variance was $24,750 Favorable.Used 45,820 liters of the raw material to produce 32,800 units of work in process. The materials quantity variance was $850 Favorable.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 28,440 hours at an average cost of $17.00 per hour. The direct labor rate variance was $28,440 Favorable. The labor efficiency variance was $39,600 Unfavorable.Applied fixed overhead to the 32,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $154,700. Of this total, $83,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $71,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $14,700 Unfavorable. The fixed manufacturing overhead volume variance was $43,680 Favorable.Completed and transferred 32,800 units from work in process to finished goods.Sold (for cash) 32,000 units to customers at a price of $38.20 per unit.Transferred the standard cost associated with the 32,000 units sold from finished goods to cost of goods sold.Paid $133,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.To answer the following questions, it would be advisable to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $140,000 and budgeted activity of 20,000 hours.During the year, the company completed the following transactions:Purchased 49,500 liters of raw material at a price of $8.00 per liter. The materials price variance was $24,750 Favorable.Used 45,820 liters of the raw material to produce 32,800 units of work in process. The materials quantity variance was $850 Favorable.Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 28,440 hours at an average cost of $17.00 per hour. The direct labor rate variance was $28,440 Favorable. The labor efficiency variance was $39,600 Unfavorable.Applied fixed overhead to the 32,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $154,700. Of this total, $83,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $71,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $14,700 Unfavorable. The fixed manufacturing overhead volume variance was $43,680 Favorable.Completed and transferred 32,800 units from work in process to finished goods.Sold (for cash) 32,000 units to customers at a price of $38.20 per unit.Transferred the standard cost associated with the 32,000 units sold from finished goods to cost of goods sold.Paid $133,000 of selling and administrative expenses.Closed all standard cost variances to cost of goods sold.To answer the following questions, it would be advisable to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation. When the company closes its standard cost variances, the Cost of Goods Sold will increase (decrease) by:

When the company closes its standard cost variances, the Cost of Goods Sold will increase (decrease) by:A) $43,420

B) ($28,980)

C) $28,980

D) ($43,420)

On Jun 14, 2024

D

BW

Answered

Elin owes Floyd $10,000. Floyd assigns the claim to Gary. Gary does not notify Elin of the assignment. Later, Floyd assigns the same claim to Holly. Holly immediately notifies Elin of the assignment. Holly has priority to payment in

A) all states.

B) states that follow the English rule.

C) no state.

D) most states.

A) all states.

B) states that follow the English rule.

C) no state.

D) most states.

On May 31, 2024

B

BW

Answered

It is more difficult to focus on sustainability at the supply chain level than at the individual firm level.

On May 03, 2024

True

BW

Answered

A firm that follows a strict residual dividend policy is likely to maintain a stable pattern of dividends over time.

On May 01, 2024

False

BW

Answered

The feature that distinguishes monopolistic competition from monopolies and oligopolies is that monopolistically competitive firms

A) cannot influence market price by virtue of their size alone.

B) benefit from barriers to entry.

C) are price takers.

D) do not have price as a decision variable.

A) cannot influence market price by virtue of their size alone.

B) benefit from barriers to entry.

C) are price takers.

D) do not have price as a decision variable.

On Apr 30, 2024

A

BW

Answered

The improvement of an employee's performance varies according to the employee's ability and level of motivation.

On Apr 30, 2024

True

BW

Answered

Privacy rights are triggered under the Fourth Amendment:

A) when a corporation has authorized an agent with direct authority to perform an electronic search of an employee's e-mail account.

B) when the government is monitoring a person's movements in public.

C) when the government is conducting a search.

D) during an archival search of e-mails on a corporation's server in response to a lawsuit that was filed by a competitor.

A) when a corporation has authorized an agent with direct authority to perform an electronic search of an employee's e-mail account.

B) when the government is monitoring a person's movements in public.

C) when the government is conducting a search.

D) during an archival search of e-mails on a corporation's server in response to a lawsuit that was filed by a competitor.

On Apr 29, 2024

C

BW

Answered

Describe three benefits of comparing notes with other students in a study group, Supplemental Instruction session, or learning community.

On Apr 28, 2024

Three benefits of comparing notes with other students include the following: You will probably take better notes when you know that someone else will see them; you can tell whether your notes are as clear and organized as those of other students; and you can use your comparisons to see whether you agree on the most important points. Other valid responses are also acceptable.