BC

Business Chemicals

Answers (6)

BC

Answered

In the case in the text Cincinnati Insurance Company v.Wachovia Bank National Association,what was the court's holding?

A) The bank was not liable because it limited its liability in the contract.

B) The bank was not liable because it acted in good faith.

C) The bank was liable because it did not provide any precautions to prevent fraud.

D) The bank was liable because it could not waive its liability in the contract.

A) The bank was not liable because it limited its liability in the contract.

B) The bank was not liable because it acted in good faith.

C) The bank was liable because it did not provide any precautions to prevent fraud.

D) The bank was liable because it could not waive its liability in the contract.

On Jul 16, 2024

A

BC

Answered

Which of the following statements regarding the six major categories identified by researchers is correct?

A) The fear category may contain alarm and anxiety.

B) The calm category may contain contentment and relaxation.

C) The respect category may contain reverence and integrity.

D) The ethics category may contain morals and values.

E) The surprise category may contain concern and wonder.

A) The fear category may contain alarm and anxiety.

B) The calm category may contain contentment and relaxation.

C) The respect category may contain reverence and integrity.

D) The ethics category may contain morals and values.

E) The surprise category may contain concern and wonder.

On Jul 15, 2024

A

BC

Answered

Which of the following is an exception to a consideration requirement?

A) Bargained-for exchange

B) Charitable subscription

C) Nominal consideration

D) Adequacy of consideration

A) Bargained-for exchange

B) Charitable subscription

C) Nominal consideration

D) Adequacy of consideration

On Jun 16, 2024

B

BC

Answered

Which of the following refers to the fact that some people stay on their jobs, even when they decide they are unhappy and should leave?

A) Job embeddedness

B) Normative commitment

C) Affective commitment

D) Job enrichment

A) Job embeddedness

B) Normative commitment

C) Affective commitment

D) Job enrichment

On Jun 15, 2024

A

BC

Answered

A director has the right to inspect corporate books and records that contain corporate information essential to the director's performance of her duties.

On May 17, 2024

True

BC

Answered

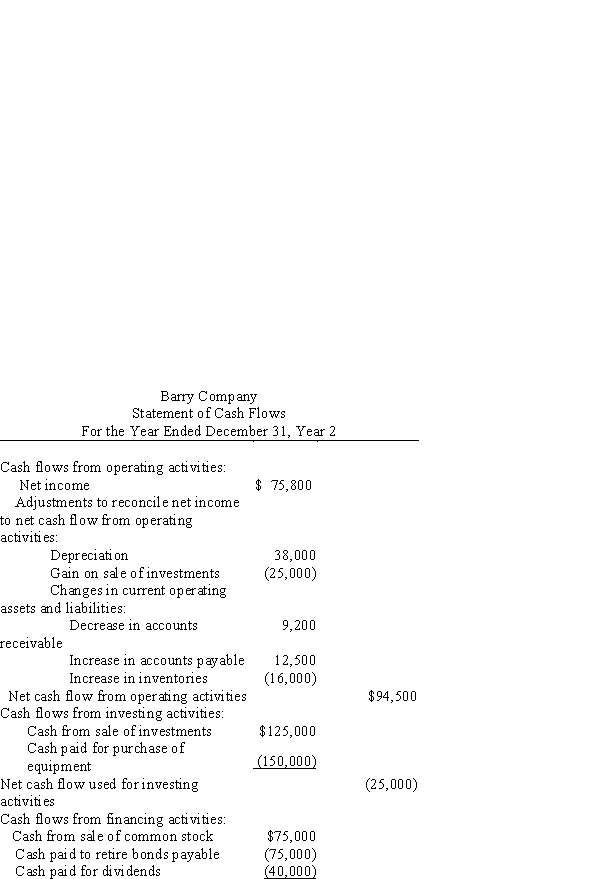

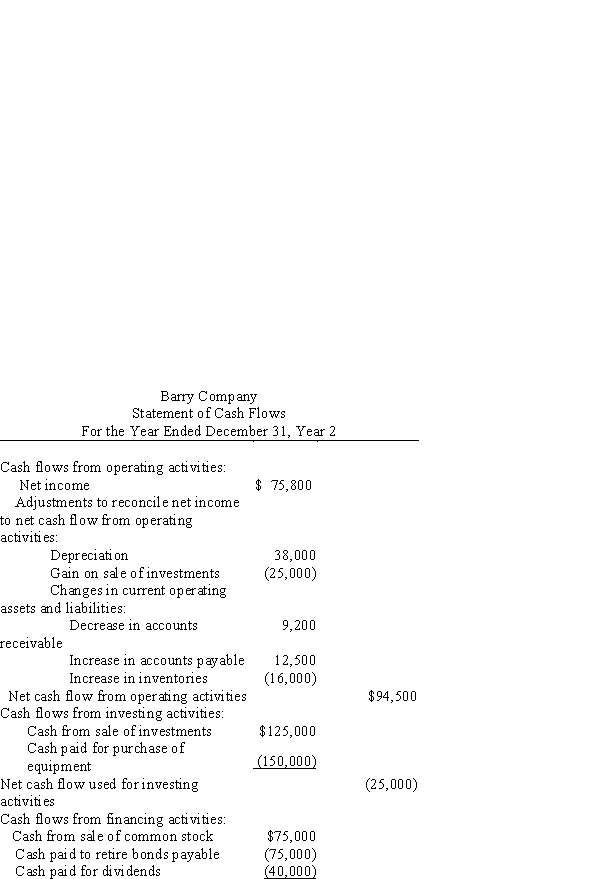

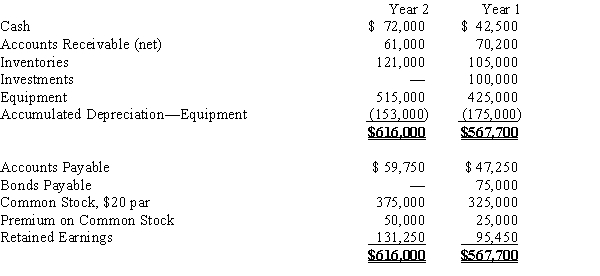

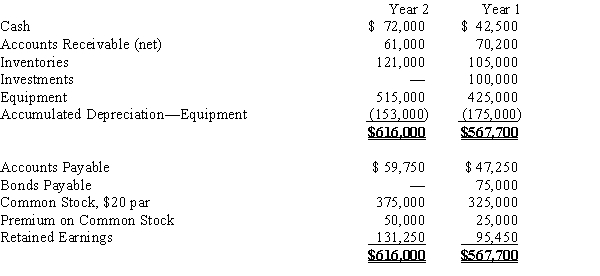

The comparative balance sheets of Barry Company, for Years 1 and 2 ended December 31, appear below in condensed form.  Additional data for the current year are as follows:

Additional data for the current year are as follows:

(a)Net income, $75,800.

(b)Depreciation reported on income statement, $38,000.

(c)Fully depreciated equipment costing $60,000 was scrapped, no salvage, and equipment was purchased for $150,000.

(d)Bonds payable for $75,000 were retired by payment at their face amount.

(e)2,500 shares of common stock were issued at $30 for cash.

(f)Cash dividends declared and paid, $40,000.

(g)Investments of $100,000 were sold for $125,000.Prepare a statement of cash flows using the indirect method.

Additional data for the current year are as follows:

Additional data for the current year are as follows:(a)Net income, $75,800.

(b)Depreciation reported on income statement, $38,000.

(c)Fully depreciated equipment costing $60,000 was scrapped, no salvage, and equipment was purchased for $150,000.

(d)Bonds payable for $75,000 were retired by payment at their face amount.

(e)2,500 shares of common stock were issued at $30 for cash.

(f)Cash dividends declared and paid, $40,000.

(g)Investments of $100,000 were sold for $125,000.Prepare a statement of cash flows using the indirect method.

On May 16, 2024