DS

Destinee S Robinson

Answers (6)

DS

Answered

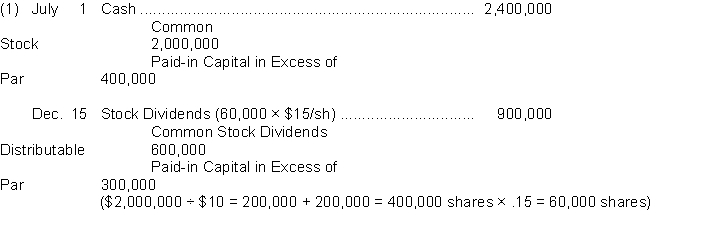

On January 1 2017 Raleish Corporation had $2000000 of $10 par value common stock outstanding that was issued at par and retained earnings of $1000000. The company issued 200000 shares of common stock at $12 per share on July 1. On December 15 the board of directors declared a 15% stock dividend to stockholders of record on December 31 2017 payable on January 15 2018. The market value of Raleish Corporation stock was $15 per share on December 15 and $16 per share on December 31. Net income for 2017 was $500000.

Instructions

(1) Journalize the issuance of stock on July 1 and the declaration of the stock dividend on December 15.

(2) Prepare the stockholders' equity section of the balance sheet for Raleish Corporation at December 31 2017.

Instructions

(1) Journalize the issuance of stock on July 1 and the declaration of the stock dividend on December 15.

(2) Prepare the stockholders' equity section of the balance sheet for Raleish Corporation at December 31 2017.

On Jul 25, 2024

(2) Stockholders' equity Paid-in capital Capital stock

(2) Stockholders' equity Paid-in capital Capital stockCommon stock, $10 par value, 400,000 shares issued and outstanding $4,000,000 Common stock dividends distributable 600,000 Total capital stock 4,600,000 Additional paid-in capital in excess of par 700,000 Total paid-in capital 5,300,000 Retained earnings 600,000 Total stockholders’ equity 5,900,000\begin{array}{cr}\text {Common stock, \(\$ 10\) par value, 400,000 shares issued and }\\\text { outstanding }& \$ 4,000,000 \\\text { Common stock dividends distributable }& 600,000 \\\text { Total capital stock }& 4,600,000 \\\text { Additional paid-in capital in excess of par } & 700,000 \\\text { Total paid-in capital } & 5,300,000\\\text { Retained earnings } &600,000 \\\text { Total stockholders' equity } &\ 5,900,000\end{array}Common stock, $10 par value, 400,000 shares issued and outstanding Common stock dividends distributable Total capital stock Additional paid-in capital in excess of par Total paid-in capital Retained earnings Total stockholders’ equity $4,000,000600,0004,600,000700,0005,300,000600,000 5,900,000

DS

Answered

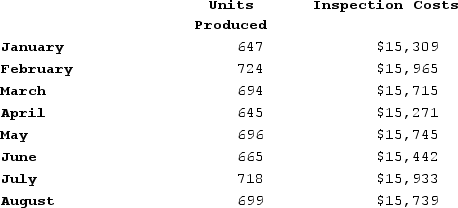

Lacourse Incorporated's inspection costs are listed below:  Management believes that inspection cost is a mixed cost that depends on units produced.Using the least-squares regression method, the estimate of the fixed component of inspection cost per month is closest to:

Management believes that inspection cost is a mixed cost that depends on units produced.Using the least-squares regression method, the estimate of the fixed component of inspection cost per month is closest to:

A) $9,608

B) $15,640

C) $9,587

D) $15,271

Management believes that inspection cost is a mixed cost that depends on units produced.Using the least-squares regression method, the estimate of the fixed component of inspection cost per month is closest to:

Management believes that inspection cost is a mixed cost that depends on units produced.Using the least-squares regression method, the estimate of the fixed component of inspection cost per month is closest to:A) $9,608

B) $15,640

C) $9,587

D) $15,271

On Jul 22, 2024

C

DS

Answered

In which of the following cases will total revenue increase?

A) Price falls and demand is inelastic.

B) Price falls and supply is elastic.

C) Price rises and demand is inelastic.

D) Price rises and demand is elastic.

A) Price falls and demand is inelastic.

B) Price falls and supply is elastic.

C) Price rises and demand is inelastic.

D) Price rises and demand is elastic.

On Jun 24, 2024

C

DS

Answered

To have a good understanding of a team, a manager should also understand the underlying behaviors of ______.

A) individuals

B) departments

C) teams

D) organizations

A) individuals

B) departments

C) teams

D) organizations

On Jun 21, 2024

A

DS

Answered

As the dollar value of a product decreases, its inventory value decreases.

On May 25, 2024

True

DS

Answered

Real gross domestic product (GDP) is measured in terms of _____.

A) current-year prices

B) base-year prices

C) foreign currencies

D) the quality of goods produced

E) hours of employment

A) current-year prices

B) base-year prices

C) foreign currencies

D) the quality of goods produced

E) hours of employment

On May 22, 2024

B