DM

Devon Marrero

Answers (6)

DM

Answered

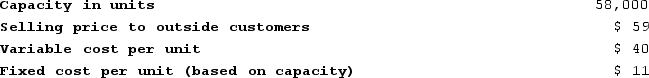

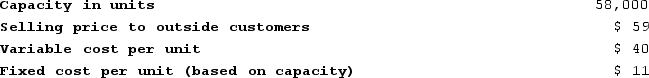

Yearout Products, Incorporated, has a Valve Division that manufactures and sells a number of products, including a standard valve that could be used by another division in the company, the Pump Division, in one of its products. Data concerning that valve appear below:  The Pump Division is currently purchasing 9,000 of these valves per year from an overseas supplier at a cost of $53 per valve.Assume that the Valve Division is selling all of the valves it can produce to outside customers. Does there exist a transfer price that would make both the Valve and Pump Division financially better off than if the Pump Division were to continue buying its valves from the outside supplier?

The Pump Division is currently purchasing 9,000 of these valves per year from an overseas supplier at a cost of $53 per valve.Assume that the Valve Division is selling all of the valves it can produce to outside customers. Does there exist a transfer price that would make both the Valve and Pump Division financially better off than if the Pump Division were to continue buying its valves from the outside supplier?

A) Yes, the minimum transfer price that the selling division should be willing to accept is less than the maximum transfer price that the buying division should be willing to accept.

B) No, the minimum transfer price that the selling division should be willing to accept exceeds the maximum transfer price that the buying division should be willing to accept.

C) The answer cannot be determined from the information that has been provided.

D) Yes, both divisions are always better off regardless of whether the selling division has enough idle capacity to handle all of the buying division's needs.

The Pump Division is currently purchasing 9,000 of these valves per year from an overseas supplier at a cost of $53 per valve.Assume that the Valve Division is selling all of the valves it can produce to outside customers. Does there exist a transfer price that would make both the Valve and Pump Division financially better off than if the Pump Division were to continue buying its valves from the outside supplier?

The Pump Division is currently purchasing 9,000 of these valves per year from an overseas supplier at a cost of $53 per valve.Assume that the Valve Division is selling all of the valves it can produce to outside customers. Does there exist a transfer price that would make both the Valve and Pump Division financially better off than if the Pump Division were to continue buying its valves from the outside supplier?A) Yes, the minimum transfer price that the selling division should be willing to accept is less than the maximum transfer price that the buying division should be willing to accept.

B) No, the minimum transfer price that the selling division should be willing to accept exceeds the maximum transfer price that the buying division should be willing to accept.

C) The answer cannot be determined from the information that has been provided.

D) Yes, both divisions are always better off regardless of whether the selling division has enough idle capacity to handle all of the buying division's needs.

On Jul 25, 2024

B

DM

Answered

Taxes affect market participants by increasing the price paid by the buyer and received by the seller.

On Jul 24, 2024

False

DM

Answered

Having too many choices in the marketplace is referred to as:

A) purchase momentum.

B) consumer hyperchoice.

C) pseudo-choice.

D) maximizing.

A) purchase momentum.

B) consumer hyperchoice.

C) pseudo-choice.

D) maximizing.

On Jun 25, 2024

B

DM

Answered

Which statement is true?

A) An effective price ceiling is above equilibrium price and causes surpluses.

B) An effective price ceiling is above equilibrium price and causes shortages.

C) An effective price ceiling is below equilibrium price and causes surpluses.

D) An effective price ceiling is below equilibrium price and causes shortages.

A) An effective price ceiling is above equilibrium price and causes surpluses.

B) An effective price ceiling is above equilibrium price and causes shortages.

C) An effective price ceiling is below equilibrium price and causes surpluses.

D) An effective price ceiling is below equilibrium price and causes shortages.

On Jun 23, 2024

D

DM

Answered

A(n) ________ refers to the meeting of a departing employee with the employee's supervisor and/or a human resource specialist to discuss the employee's reasons for leaving.

A) exit interview

B) affirmative action

C) carve-out

D) observation interview

E) summary dismissal

A) exit interview

B) affirmative action

C) carve-out

D) observation interview

E) summary dismissal

On May 25, 2024

A

DM

Answered

Accounting for the sale of stock is the same for both the cost and the equity methods of accounting for investments.

On May 24, 2024

True