GM

Gissel Moraah

Answers (4)

GM

Answered

Allison Yu purchased five $1,000 convertible bonds at face value. Each bond was convertible into 25 shares of common stock. After several years, when the stock was selling at 46, Allison converted all five bonds. What was Allison's gain upon conversion of the bonds?

On Jun 26, 2024

$750

GM

Answered

If the U.S. dollar is valued at $1.9687 per British pound, compute the amount of U.S. currency necessary to buy 200 British pounds.

On Jun 25, 2024

$393.74

GM

Answered

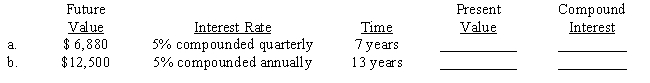

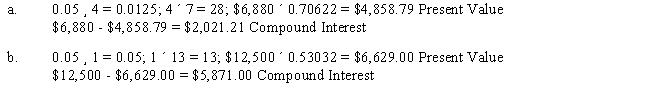

Compute the present value (principal) and the compound interest earned for each of the following investments. Use Tables 16-1A&B or 16-2A&B or a calculator.

On May 27, 2024

GM

Answered

John and Loretta Smith are in the 28% tax bracket.Their joint taxable income is $134,899.If the first $16,050 is taxed at 10%,with the remainder at 28%,how much tax will they owe?

A) $29,371.72

B) $30,271.75

C) $34,882.72

D) $38,724.75

A) $29,371.72

B) $30,271.75

C) $34,882.72

D) $38,724.75

On May 26, 2024

C