GS

Gurpreet Singh

Answers (5)

GS

Answered

David Engler lives in a state having a sales tax of 8%. Compute the amount of tax David Engler will pay on purchases totaling $90.

On Jun 24, 2024

$7.20

GS

Answered

Insured A, age 27, purchased a $35,000, 20-payment life policy with premiums payable annually. Insured B, also age 27, purchased a $35,000 straight-life policy with premiums payable semiannually. Both A and B lived 40 more years. How much more in premiums did insured B pay the insurance company during his lifetime than insured A paid during hers? Refer to Table 12-1. (1 year = 12 months.)

On Jun 22, 2024

$4,389

GS

Answered

Rick Rios has an asphalt paving business. He is trying to calculate whether he should replace some of his current equipment. Rick estimates that he will spend $8,000 every 6 months over the next 4 years to maintain the current equipment. At a rate of 8% compounded semiannually, what is the total present value of the estimated maintenance payments? Use Tables 23-2A and 23-2B or a calculator.

On May 24, 2024

$8,000 × 6.73274 = $53,861.92 present value

GS

Answered

Allen Baker purchased ten $500 convertible bonds at face value. Each bond was convertible into 20 shares of common stock. After several years, when the stock was selling at 40, Allen converted all ten bonds. What was Allen's gain upon conversion of the bonds?

On May 23, 2024

$3,000

GS

Answered

Compute the present value in each of the following problems. Use Tables 16-1A&B or 16-2A&B or a calculator.

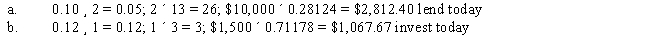

a.Compute the amount that you must lend today at 10% compounded semiannually to be repaid a total (principal and interest) of $10,000 in 13 years.

b.Compute the amount that you must invest today at 12% compounded annually to have $1,500 in 3 years.

a.Compute the amount that you must lend today at 10% compounded semiannually to be repaid a total (principal and interest) of $10,000 in 13 years.

b.Compute the amount that you must invest today at 12% compounded annually to have $1,500 in 3 years.

On May 21, 2024