HS

Harsimran Singh

Answers (6)

HS

Answered

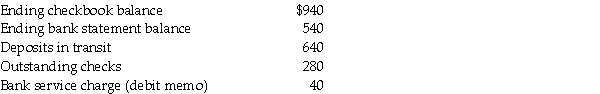

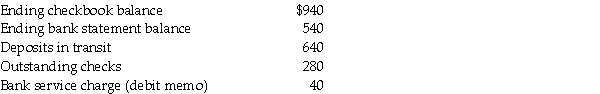

Construct the bank reconciliation for Bill's Tutoring, as of October 31, from the following information:

On Jul 22, 2024

HS

Answered

What is the purpose of the minor's right to disaffirm contracts?

A) To reduce the judicial caseload for breach of contract actions

B) To allow minors a windfall in terms of keeping property without paying for it

C) To punish adults who contract with minors

D) To give minors superior bargaining power in negotiating contracts

E) To protect the minor from competent parties that might otherwise take advantage of the minor

A) To reduce the judicial caseload for breach of contract actions

B) To allow minors a windfall in terms of keeping property without paying for it

C) To punish adults who contract with minors

D) To give minors superior bargaining power in negotiating contracts

E) To protect the minor from competent parties that might otherwise take advantage of the minor

On Jul 20, 2024

E

HS

Answered

Generally,a taxpayer uses Schedule C to report royalty income.

On Jun 21, 2024

False

HS

Answered

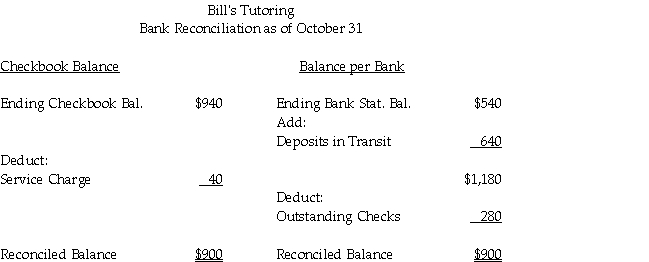

Use the following company information to prepare a schedule of significant noncash investing and financing activities:

(a)Sold a building with a book value of $300,000 for $225,000 cash and sold land with a book value of $40,000 for $65,000 cash.

(b)Issued 15,000 shares of $10 par value common stock in exchange for equipment with a market value of $175,000.

(c)Retired a $100,000,8% bond by issuing another $100,000,7% bond issue.

(d)Acquired land by issuing a twenty-year,5%,$73,000 note payable.

(a)Sold a building with a book value of $300,000 for $225,000 cash and sold land with a book value of $40,000 for $65,000 cash.

(b)Issued 15,000 shares of $10 par value common stock in exchange for equipment with a market value of $175,000.

(c)Retired a $100,000,8% bond by issuing another $100,000,7% bond issue.

(d)Acquired land by issuing a twenty-year,5%,$73,000 note payable.

On Jun 20, 2024

HS

Answered

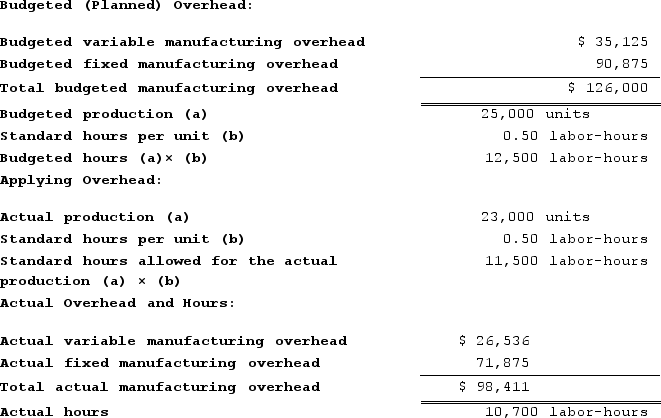

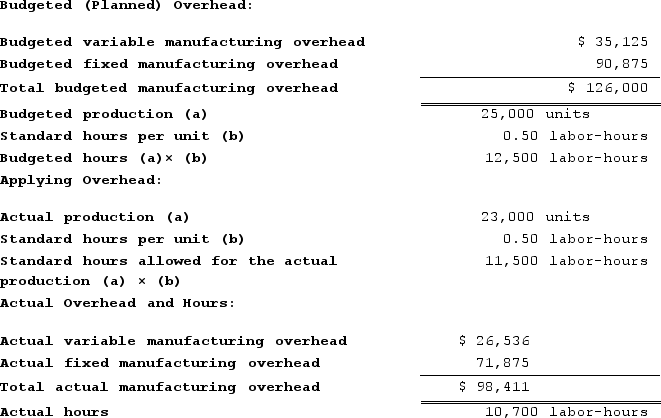

Warrenfeltz Incorporated makes a single product--a cooling coil used in commercial refrigerators. The company has a standard cost system in which it applies overhead to this product based on the standard labor-hours allowed for the actual output of the period. Data concerning the most recent year appear below:

Required:

Required:

a. Compute the variable component of the company's predetermined overhead rate.

b. Compute the fixed component of the company's predetermined overhead rate.

c. Compute the company's predetermined overhead rate.

d. Determine the variable overhead rate variance for the year.

e. Determine the variable overhead efficiency variance for the year.

f. Determine the fixed overhead budget variance for the year.

g. Determine the fixed overhead volume variance for the year.

Required:

Required:a. Compute the variable component of the company's predetermined overhead rate.

b. Compute the fixed component of the company's predetermined overhead rate.

c. Compute the company's predetermined overhead rate.

d. Determine the variable overhead rate variance for the year.

e. Determine the variable overhead efficiency variance for the year.

f. Determine the fixed overhead budget variance for the year.

g. Determine the fixed overhead volume variance for the year.

On May 22, 2024

a. Variable component of the predetermined overhead rate = $35,125/12,500 labor-hours

= $2.81 per labor-hour

b. Fixed component of the predetermined overhead rate = $90,875/12,500 labor-hours

= $7.27 per labor-hour

c. Predetermined overhead rate = $126,000/12,500 labor-hours = $10.08 per labor-hour

d. Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= ($26,536) − (10,700 labor-hours × $2.81 per labor-hour)

= ($26,536) − ($30,067)

= $3,531 Favorable

e. Variable overhead efficiency variance = (Actual hours − Standard hours) × Standard rate

= (10,700 labor-hours − 11,500 labor-hours) × $2.81 per labor-hour

= (−800 labor-hours) × $2.81 per labor-hour

= $2,248 Favorable

f. Budget variance = Actual fixed overhead − Budgeted fixed overhead

= $71,875 − $90,875 = $19,000 Favorable

g. Volume variance = Budgeted fixed overhead − Fixed overhead applied to work in process

= $90,875 − ($7.27 per labor-hour × 11,500 labor-hours)

= $90,875 − ($83,605)

= $7,270 Unfavorable

= $2.81 per labor-hour

b. Fixed component of the predetermined overhead rate = $90,875/12,500 labor-hours

= $7.27 per labor-hour

c. Predetermined overhead rate = $126,000/12,500 labor-hours = $10.08 per labor-hour

d. Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= ($26,536) − (10,700 labor-hours × $2.81 per labor-hour)

= ($26,536) − ($30,067)

= $3,531 Favorable

e. Variable overhead efficiency variance = (Actual hours − Standard hours) × Standard rate

= (10,700 labor-hours − 11,500 labor-hours) × $2.81 per labor-hour

= (−800 labor-hours) × $2.81 per labor-hour

= $2,248 Favorable

f. Budget variance = Actual fixed overhead − Budgeted fixed overhead

= $71,875 − $90,875 = $19,000 Favorable

g. Volume variance = Budgeted fixed overhead − Fixed overhead applied to work in process

= $90,875 − ($7.27 per labor-hour × 11,500 labor-hours)

= $90,875 − ($83,605)

= $7,270 Unfavorable

HS

Answered

When a company accepts a note in settlement of a past due account, what is the effect on the accounting equation?

A) an increase in a liability and a decrease in an asset

B) an increase in an asset and a decrease in an asset

C) a decrease in an asset and a decrease in stockholders' equity (expense)

D) a decrease in a liability and an increase in stockholders' equity (revenue)

A) an increase in a liability and a decrease in an asset

B) an increase in an asset and a decrease in an asset

C) a decrease in an asset and a decrease in stockholders' equity (expense)

D) a decrease in a liability and an increase in stockholders' equity (revenue)

On May 21, 2024

B