JB

Jacob Bucher

Answers (6)

JB

Answered

The demand for labor is a derived demand, whereas the demand for capital is not.

On Jul 05, 2024

False

JB

Answered

Only a few states use state-run lotteries to increase their revenues and pay for expenditures.

On Jun 30, 2024

False

JB

Answered

Horizontal analysis is used to reveal patterns in data covering two or more successive periods.

On Jun 04, 2024

True

JB

Answered

Efficiency gains from migration

A) will tend to be greater when workers migrate from nations with high unemployment to nations experiencing full employment.

B) imply that all workers, domestic and migrant, are financially better off as a result of migration.

C) will tend to be greater in countries experiencing "brain drain."

D) usually benefit one nation at the expense of another.

A) will tend to be greater when workers migrate from nations with high unemployment to nations experiencing full employment.

B) imply that all workers, domestic and migrant, are financially better off as a result of migration.

C) will tend to be greater in countries experiencing "brain drain."

D) usually benefit one nation at the expense of another.

On May 31, 2024

A

JB

Answered

Define plant assets and identify the four primary issues in accounting for them.

On May 02, 2024

Plant assets are tangible assets used in the operations of a company that have a useful life of more than one accounting period.The four main accounting issues include (1)computing their costs,(2)allocating their costs against revenues during the periods they benefit,(3)accounting for expenditures such as repairs and improvements,(4)and recording their disposal.

JB

Answered

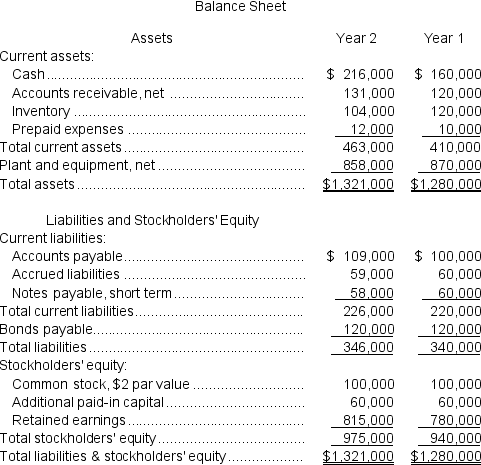

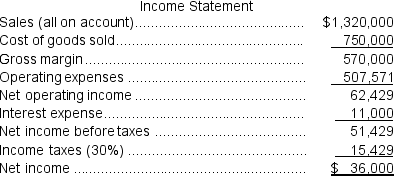

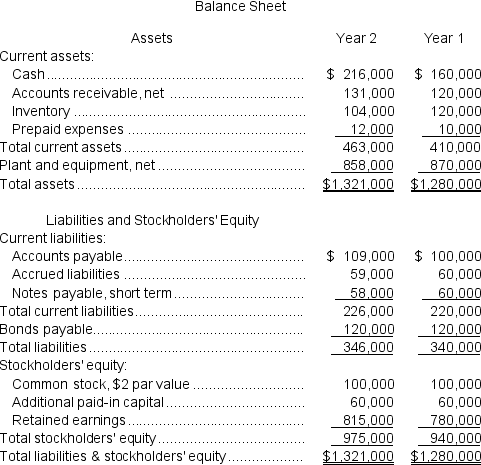

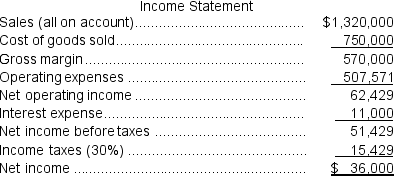

Neiger Corporation has provided the following financial data:

Required:

Required:

a.What is the company's working capital at the end of Year 2?

b.What is the company's current ratio at the end of Year 2?

c.What is the company's acid-test (quick)ratio at the end of Year 2?

d.What is the company's times interest earned ratio for Year 2?

e.What is the company's debt-to-equity ratio at the end of Year 2?

f.What is the company's equity multiplier at the end of Year 2?

Required:

Required:a.What is the company's working capital at the end of Year 2?

b.What is the company's current ratio at the end of Year 2?

c.What is the company's acid-test (quick)ratio at the end of Year 2?

d.What is the company's times interest earned ratio for Year 2?

e.What is the company's debt-to-equity ratio at the end of Year 2?

f.What is the company's equity multiplier at the end of Year 2?

On May 01, 2024

a.Working capital = Current assets - Current liabilities

= $463,000 - $226,000 = $237,000

b.Current ratio = Current assets ÷ Current liabilities

= $463,000 ÷ $226,000 = 2.05 (rounded)

c.Acid-test (quick)ratio = Quick assets* ÷ Current liabilities

= $347,000 ÷ $226,000 = 1.54 (rounded)

*Quick assets = Cash + Marketable securities + Current receivables

= $216,000 + $0 + $131,000 = $347,000

d.Times interest earned = Earnings before interest expense and income taxes ÷ Interest expense

= $62,429 ÷ $11,000 = 5.68 (rounded)

e.Debt-to-equity ratio = Total liabilities ÷ Stockholders' equity

= $346,000 ÷ $975,000 = 0.35 (rounded)

f.Equity multiplier = Average total assets* ÷ Average stockholders' equity*

= $1,300,500 ÷ $957,500 = 1.36 (rounded)

*Average total assets = ($1,321,000 + $1,280,000)÷ 2 = $1,300,500

**Average stockholders' equity = ($975,000 + $940,000)÷ 2 = $957,500

= $463,000 - $226,000 = $237,000

b.Current ratio = Current assets ÷ Current liabilities

= $463,000 ÷ $226,000 = 2.05 (rounded)

c.Acid-test (quick)ratio = Quick assets* ÷ Current liabilities

= $347,000 ÷ $226,000 = 1.54 (rounded)

*Quick assets = Cash + Marketable securities + Current receivables

= $216,000 + $0 + $131,000 = $347,000

d.Times interest earned = Earnings before interest expense and income taxes ÷ Interest expense

= $62,429 ÷ $11,000 = 5.68 (rounded)

e.Debt-to-equity ratio = Total liabilities ÷ Stockholders' equity

= $346,000 ÷ $975,000 = 0.35 (rounded)

f.Equity multiplier = Average total assets* ÷ Average stockholders' equity*

= $1,300,500 ÷ $957,500 = 1.36 (rounded)

*Average total assets = ($1,321,000 + $1,280,000)÷ 2 = $1,300,500

**Average stockholders' equity = ($975,000 + $940,000)÷ 2 = $957,500