JL

Joseph Lodovichetti

Answers (6)

JL

Answered

The case in the text,Kruser v.Bank of America NT & SA,reinforces the principal that:

A) courts are sympathetic to consumers and consumers are entitled to time extensions.

B) the EFTA was enacted to protect the consumer and will protect against all instances of fraud.

C) the EFTA requires a customer to provide timely notification of any unauthorized use of a credit card to limit his liability.

D) the consumer is responsible for any loss that occurred from his negligence.

A) courts are sympathetic to consumers and consumers are entitled to time extensions.

B) the EFTA was enacted to protect the consumer and will protect against all instances of fraud.

C) the EFTA requires a customer to provide timely notification of any unauthorized use of a credit card to limit his liability.

D) the consumer is responsible for any loss that occurred from his negligence.

On Jul 25, 2024

C

JL

Answered

A grocery store benefits when a new furniture factory moves to town and hires workers because the:

A) new jobs at the factory will increase local incomes,some of which will be spent at the grocery store.

B) new factory will eliminate scarcity in the area.

C) presence of a new factory will guarantee that resources are used efficiently.

D) local circular flow will be smaller with a new factory in town.

A) new jobs at the factory will increase local incomes,some of which will be spent at the grocery store.

B) new factory will eliminate scarcity in the area.

C) presence of a new factory will guarantee that resources are used efficiently.

D) local circular flow will be smaller with a new factory in town.

On Jul 24, 2024

A

JL

Answered

When a firm is operating with the optimal capital structure, the weighted average cost of capital will be at its minimal point.

On Jun 25, 2024

True

JL

Answered

What are some advantages and disadvantages of making decisions by voting versus discussion to consensus?

On Jun 24, 2024

There are several advantages and disadvantages to making decisions by voting versus through discussion to consensus.

Advantages of making decisions by voting include:

1. Efficiency: Voting can be a quicker way to reach a decision, especially in large groups or organizations.

2. Clarity: The outcome of a vote is clear and definitive, leaving little room for ambiguity or misunderstanding.

3. Equal representation: Each individual's opinion carries the same weight in a vote, ensuring that everyone has an equal say in the decision-making process.

Disadvantages of making decisions by voting include:

1. Polarization: Voting can lead to a winner-takes-all mentality, potentially alienating those who are on the losing side of the vote.

2. Lack of collaboration: Voting may not allow for the exploration of alternative solutions or compromise, as it often results in a binary decision.

3. Minority voices may be overlooked: In a voting system, the preferences of the majority may overshadow the needs and perspectives of minority groups.

Advantages of making decisions through discussion to consensus include:

1. Collaboration: Consensus decision-making encourages open dialogue and the consideration of multiple perspectives, leading to more creative and inclusive solutions.

2. Relationship-building: Consensus decision-making can foster a sense of unity and cooperation among group members, as it values the input of all individuals.

3. Flexibility: Consensus decision-making allows for the exploration of various options and the potential for compromise, leading to more adaptable and sustainable decisions.

Disadvantages of making decisions through discussion to consensus include:

1. Time-consuming: Consensus decision-making can be a lengthy process, as it requires thorough discussion and the consideration of multiple viewpoints.

2. Potential for conflict: Consensus decision-making may lead to disagreements and conflicts among group members, especially if consensus is difficult to achieve.

3. Risk of indecision: In some cases, the pursuit of consensus may result in a lack of clear direction or a failure to make a decision altogether.

Ultimately, the choice between voting and consensus decision-making depends on the specific context and goals of the group or organization. Both approaches have their own strengths and weaknesses, and the most effective decision-making process may involve a combination of both methods.

Advantages of making decisions by voting include:

1. Efficiency: Voting can be a quicker way to reach a decision, especially in large groups or organizations.

2. Clarity: The outcome of a vote is clear and definitive, leaving little room for ambiguity or misunderstanding.

3. Equal representation: Each individual's opinion carries the same weight in a vote, ensuring that everyone has an equal say in the decision-making process.

Disadvantages of making decisions by voting include:

1. Polarization: Voting can lead to a winner-takes-all mentality, potentially alienating those who are on the losing side of the vote.

2. Lack of collaboration: Voting may not allow for the exploration of alternative solutions or compromise, as it often results in a binary decision.

3. Minority voices may be overlooked: In a voting system, the preferences of the majority may overshadow the needs and perspectives of minority groups.

Advantages of making decisions through discussion to consensus include:

1. Collaboration: Consensus decision-making encourages open dialogue and the consideration of multiple perspectives, leading to more creative and inclusive solutions.

2. Relationship-building: Consensus decision-making can foster a sense of unity and cooperation among group members, as it values the input of all individuals.

3. Flexibility: Consensus decision-making allows for the exploration of various options and the potential for compromise, leading to more adaptable and sustainable decisions.

Disadvantages of making decisions through discussion to consensus include:

1. Time-consuming: Consensus decision-making can be a lengthy process, as it requires thorough discussion and the consideration of multiple viewpoints.

2. Potential for conflict: Consensus decision-making may lead to disagreements and conflicts among group members, especially if consensus is difficult to achieve.

3. Risk of indecision: In some cases, the pursuit of consensus may result in a lack of clear direction or a failure to make a decision altogether.

Ultimately, the choice between voting and consensus decision-making depends on the specific context and goals of the group or organization. Both approaches have their own strengths and weaknesses, and the most effective decision-making process may involve a combination of both methods.

JL

Answered

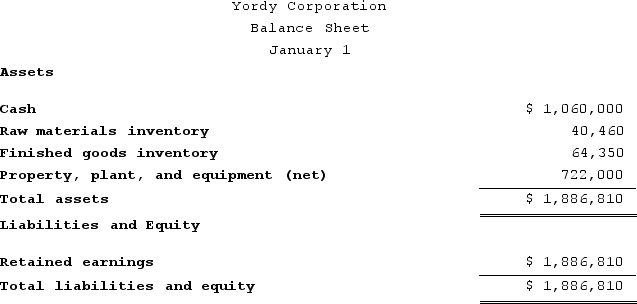

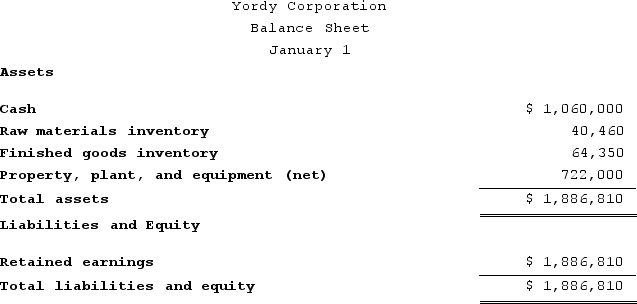

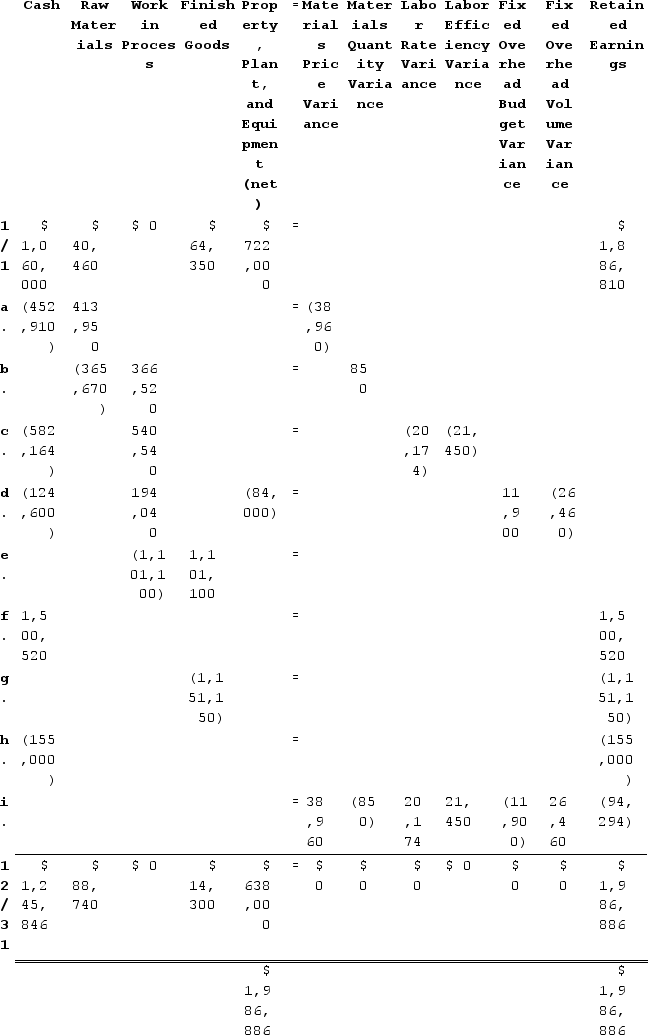

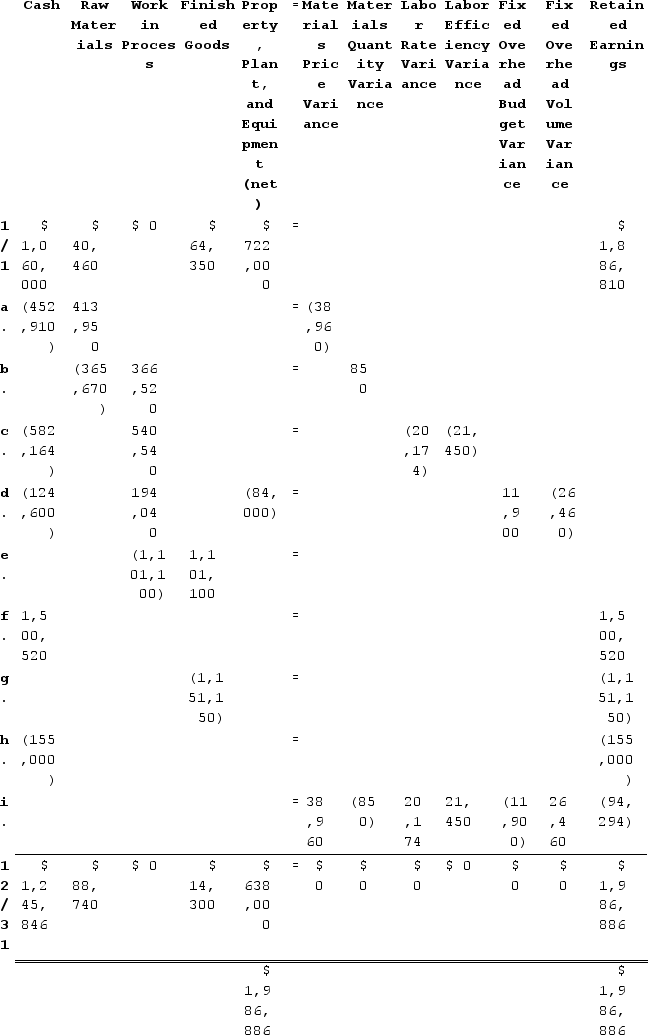

Yordy Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The company's balance sheet at the beginning of the year was as follows:

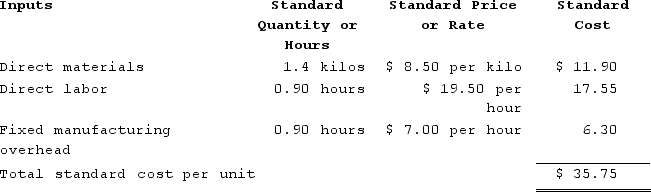

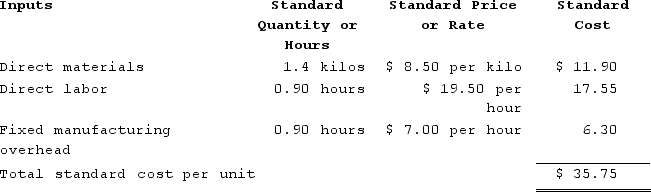

The standard cost card for the company's only product is as follows:

The standard cost card for the company's only product is as follows:

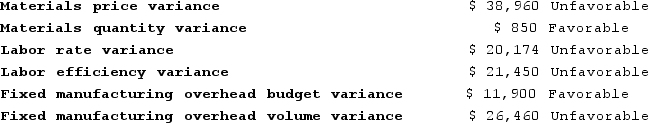

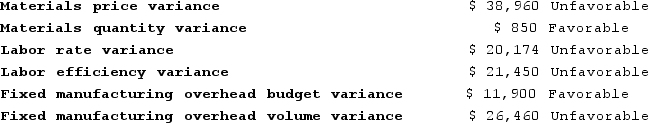

The company calculated the following variances for the year:

The company calculated the following variances for the year:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $220,500 and budgeted activity of 31,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $220,500 and budgeted activity of 31,500 hours.

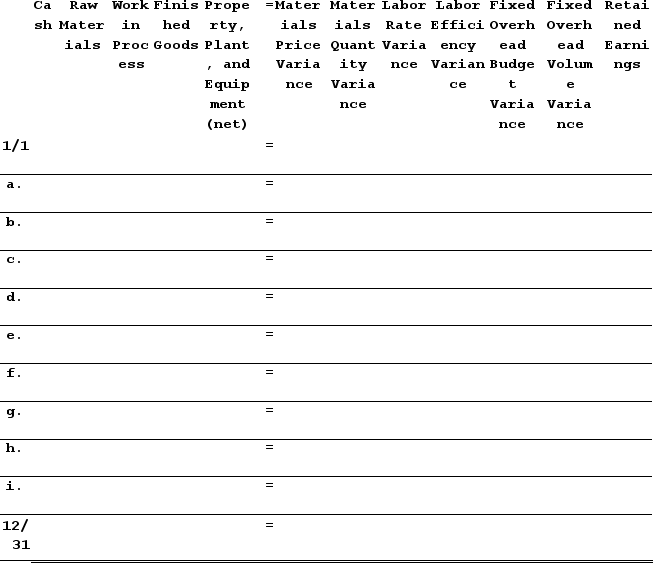

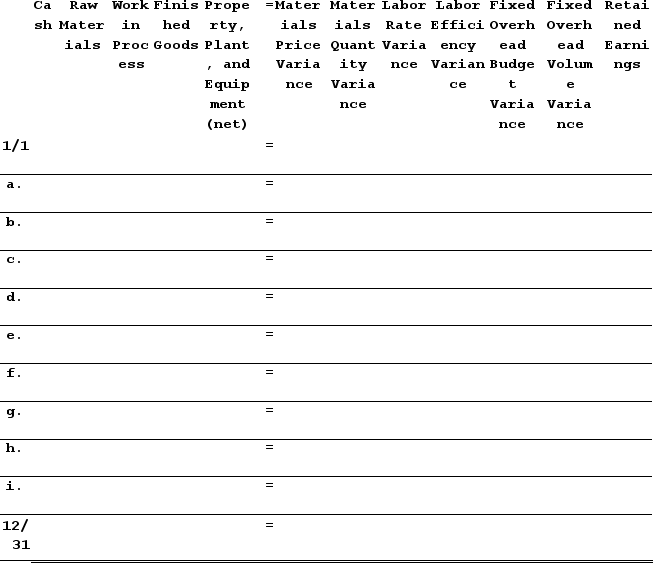

During the year, the company completed the following transactions:a. Purchased 48,700 kilos of raw material at a price of $9.30 per kilo.b. Used 43,020 kilos of the raw material to produce 30,800 units of work in process.c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 28,820 hours at an average cost of $20.20 per hour.d. Applied fixed overhead to the 30,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $208,600. Of this total, $124,600 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $84,000 related to depreciation of manufacturing equipment.e. Transferred 30,800 units from work in process to finished goods.f. Sold for cash 32,200 units to customers at a price of $46.60 per unit.g. Completed and transferred the standard cost associated with the 32,200 units sold from finished goods to cost of goods sold.h. Paid $155,000 of selling and administrative expenses.i. Closed all standard cost variances to cost of goods sold.Required:1. Enter the beginning balances and record the above transactions in the worksheet that appears below.

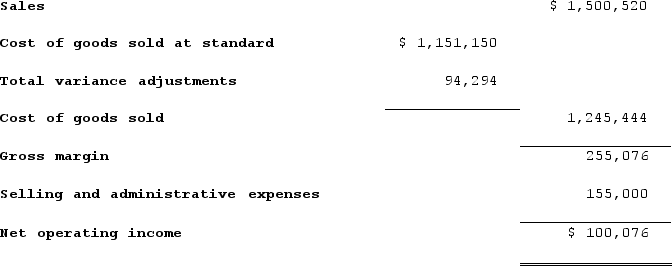

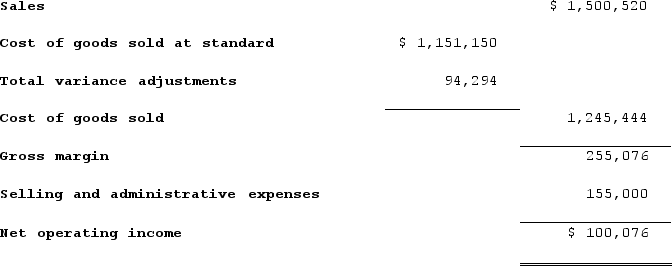

2.Determine the ending balance (e.g., 12/31 balance) in each account.3. Prepare an income statement for the year.

2.Determine the ending balance (e.g., 12/31 balance) in each account.3. Prepare an income statement for the year.

The standard cost card for the company's only product is as follows:

The standard cost card for the company's only product is as follows: The company calculated the following variances for the year:

The company calculated the following variances for the year: The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $220,500 and budgeted activity of 31,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $220,500 and budgeted activity of 31,500 hours.During the year, the company completed the following transactions:a. Purchased 48,700 kilos of raw material at a price of $9.30 per kilo.b. Used 43,020 kilos of the raw material to produce 30,800 units of work in process.c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 28,820 hours at an average cost of $20.20 per hour.d. Applied fixed overhead to the 30,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $208,600. Of this total, $124,600 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $84,000 related to depreciation of manufacturing equipment.e. Transferred 30,800 units from work in process to finished goods.f. Sold for cash 32,200 units to customers at a price of $46.60 per unit.g. Completed and transferred the standard cost associated with the 32,200 units sold from finished goods to cost of goods sold.h. Paid $155,000 of selling and administrative expenses.i. Closed all standard cost variances to cost of goods sold.Required:1. Enter the beginning balances and record the above transactions in the worksheet that appears below.

2.Determine the ending balance (e.g., 12/31 balance) in each account.3. Prepare an income statement for the year.

2.Determine the ending balance (e.g., 12/31 balance) in each account.3. Prepare an income statement for the year.On May 26, 2024

1. & 2.

The explanations for transactions a through i are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 48,700 kilos × $9.30 per kilo = $452,910. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 48,700 kilos × $8.50 per kilo = $413,950. The materials price variance is $38,960 Unfavorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 43,020 kilos × $8.50 per kilo = $365,670. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (30,800 units × 1.4 kilos per unit) × $8.50 per kilo = 43,120 kilos × $8.50 per kilo = $366,520. The difference is the Materials Quantity Variance which is $850 Favorable.c. Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 28,820 hours × $20.20 per hour = $582,164. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (30,800 units × 0.90 hours per unit) × $19.50 per hour = 27,720 hours × $19.50 per hour = $540,540. The difference consists of the Labor Rate Variance which is $20,174 Unfavorable and the Labor Efficiency Variance which is $21,450 Unfavorable.d. Cash decreases by the actual amount paid for various fixed overhead costs, which is $124,600. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (30,800 units × 0.90 hours per unit) × $7.00 per hour = 27,720 hours × $7.00 per hour = $194,040. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $84,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $11,900 Favorable and the Fixed Overhead (FOH) Volume Variance which is $26,460 Unfavorable.e. Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 30,800 units × $35.75 per unit = $1,101,100. Finished Goods increases by the same amount.f. Cash increases by the number of units sold multiplied by the selling price per unit, which is 32,200 units × $46.60 per unit = $1,500,520. Retained Earnings increases by the same amount.g. Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 32,200 units × $35.75 per unit = $1,151,150. Retained Earnings decreases by the same amount.h. Cash and Retained Earnings decrease by $155,000 to record the selling and administrative expenses.i. All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).3.

The explanations for transactions a through i are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 48,700 kilos × $9.30 per kilo = $452,910. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 48,700 kilos × $8.50 per kilo = $413,950. The materials price variance is $38,960 Unfavorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 43,020 kilos × $8.50 per kilo = $365,670. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (30,800 units × 1.4 kilos per unit) × $8.50 per kilo = 43,120 kilos × $8.50 per kilo = $366,520. The difference is the Materials Quantity Variance which is $850 Favorable.c. Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 28,820 hours × $20.20 per hour = $582,164. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (30,800 units × 0.90 hours per unit) × $19.50 per hour = 27,720 hours × $19.50 per hour = $540,540. The difference consists of the Labor Rate Variance which is $20,174 Unfavorable and the Labor Efficiency Variance which is $21,450 Unfavorable.d. Cash decreases by the actual amount paid for various fixed overhead costs, which is $124,600. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (30,800 units × 0.90 hours per unit) × $7.00 per hour = 27,720 hours × $7.00 per hour = $194,040. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $84,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $11,900 Favorable and the Fixed Overhead (FOH) Volume Variance which is $26,460 Unfavorable.e. Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 30,800 units × $35.75 per unit = $1,101,100. Finished Goods increases by the same amount.f. Cash increases by the number of units sold multiplied by the selling price per unit, which is 32,200 units × $46.60 per unit = $1,500,520. Retained Earnings increases by the same amount.g. Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 32,200 units × $35.75 per unit = $1,151,150. Retained Earnings decreases by the same amount.h. Cash and Retained Earnings decrease by $155,000 to record the selling and administrative expenses.i. All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).3.

The explanations for transactions a through i are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 48,700 kilos × $9.30 per kilo = $452,910. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 48,700 kilos × $8.50 per kilo = $413,950. The materials price variance is $38,960 Unfavorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 43,020 kilos × $8.50 per kilo = $365,670. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (30,800 units × 1.4 kilos per unit) × $8.50 per kilo = 43,120 kilos × $8.50 per kilo = $366,520. The difference is the Materials Quantity Variance which is $850 Favorable.c. Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 28,820 hours × $20.20 per hour = $582,164. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (30,800 units × 0.90 hours per unit) × $19.50 per hour = 27,720 hours × $19.50 per hour = $540,540. The difference consists of the Labor Rate Variance which is $20,174 Unfavorable and the Labor Efficiency Variance which is $21,450 Unfavorable.d. Cash decreases by the actual amount paid for various fixed overhead costs, which is $124,600. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (30,800 units × 0.90 hours per unit) × $7.00 per hour = 27,720 hours × $7.00 per hour = $194,040. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $84,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $11,900 Favorable and the Fixed Overhead (FOH) Volume Variance which is $26,460 Unfavorable.e. Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 30,800 units × $35.75 per unit = $1,101,100. Finished Goods increases by the same amount.f. Cash increases by the number of units sold multiplied by the selling price per unit, which is 32,200 units × $46.60 per unit = $1,500,520. Retained Earnings increases by the same amount.g. Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 32,200 units × $35.75 per unit = $1,151,150. Retained Earnings decreases by the same amount.h. Cash and Retained Earnings decrease by $155,000 to record the selling and administrative expenses.i. All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).3.

The explanations for transactions a through i are as follows:a. Cash decreases by the actual cost of the raw materials purchased, which is Actual quantity × Average price = 48,700 kilos × $9.30 per kilo = $452,910. Raw Materials increase by the standard cost of the raw materials purchased, which is Actual quantity × Standard price = 48,700 kilos × $8.50 per kilo = $413,950. The materials price variance is $38,960 Unfavorable.b. Raw Materials decrease by the standard cost of the raw materials used in production, which is Actual quantity × Standard price = 43,020 kilos × $8.50 per kilo = $365,670. Work in Process increases by the standard cost of the standard quantity of raw materials allowed for the actual output, which is Standard quantity × Standard price = (30,800 units × 1.4 kilos per unit) × $8.50 per kilo = 43,120 kilos × $8.50 per kilo = $366,520. The difference is the Materials Quantity Variance which is $850 Favorable.c. Cash decreases by the actual amount paid to direct laborers, which is Actual hours × Actual rate = 28,820 hours × $20.20 per hour = $582,164. Work in Process increases by the standard cost of the standard amount of hours allowed for the actual output, which is Standard hours × Standard rate = (30,800 units × 0.90 hours per unit) × $19.50 per hour = 27,720 hours × $19.50 per hour = $540,540. The difference consists of the Labor Rate Variance which is $20,174 Unfavorable and the Labor Efficiency Variance which is $21,450 Unfavorable.d. Cash decreases by the actual amount paid for various fixed overhead costs, which is $124,600. Work in Process increases by the standard amount of hours allowed for the actual output multiplied by the predetermined overhead rate, which is (30,800 units × 0.90 hours per unit) × $7.00 per hour = 27,720 hours × $7.00 per hour = $194,040. Property, Plant, and Equipment (net) decreases by the amount of depreciation for the period, which is $84,000. The difference is the Fixed Overhead (FOH) Budget Variance which is $11,900 Favorable and the Fixed Overhead (FOH) Volume Variance which is $26,460 Unfavorable.e. Work in Process decreases by the number of units transferred to Finished Goods multiplied by the standard cost per unit = 30,800 units × $35.75 per unit = $1,101,100. Finished Goods increases by the same amount.f. Cash increases by the number of units sold multiplied by the selling price per unit, which is 32,200 units × $46.60 per unit = $1,500,520. Retained Earnings increases by the same amount.g. Finished Goods decreases by the number of units sold multiplied by their standard cost per unit, which is 32,200 units × $35.75 per unit = $1,151,150. Retained Earnings decreases by the same amount.h. Cash and Retained Earnings decrease by $155,000 to record the selling and administrative expenses.i. All variance accounts take their balance to zero and they are closed to Cost of Goods Sold (which resides within Retained Earnings).3.

JL

Answered

Which of the following types of inventory will be held by a retail company?

A) Supplies

B) Finished goods

C) Work in process

D) Raw materials

A) Supplies

B) Finished goods

C) Work in process

D) Raw materials

On May 25, 2024

B