JM

Julia Muralova

Answers (8)

JM

Answered

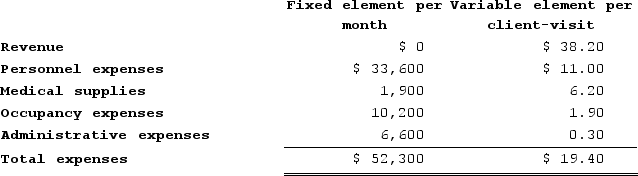

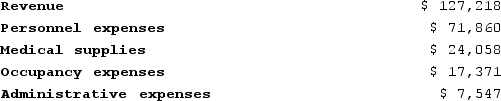

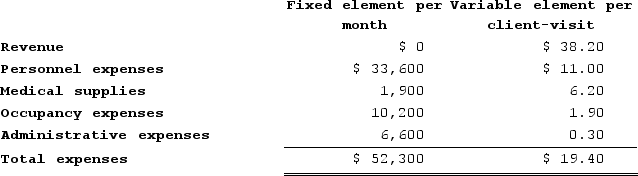

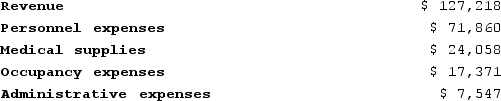

Bartosiewicz Clinic uses client-visits as its measure of activity. During January, the clinic budgeted for 3,500 client-visits, but its actual level of activity was 3,490 client-visits. The clinic has provided the following data concerning the formulas used in its budgeting and its actual results for January:Data used in budgeting:  Actual results for January:

Actual results for January:

The net operating income in the flexible budget for January would be closest to:

The net operating income in the flexible budget for January would be closest to:

A) $6,364

B) $13,500

C) $13,312

D) $6,400

Actual results for January:

Actual results for January: The net operating income in the flexible budget for January would be closest to:

The net operating income in the flexible budget for January would be closest to:A) $6,364

B) $13,500

C) $13,312

D) $6,400

On Jul 30, 2024

C

JM

Answered

Under IFRS, which of the following statements is true?

A) The hedge of a forecasted transaction is accounted for using a fair-value hedge.

B) The hedge of a firm commitment is accounted for using a cash-flow hedge.

C) The gain or loss on a hedging instrument under a cash-flow hedge is first reported as other comprehensive income and then reclassified to income when the hedged item affects income.

D) The gain or loss on a hedging instrument under a fair-value hedge is first reported as other comprehensive income and then reclassified to income when the hedged item affects income.

A) The hedge of a forecasted transaction is accounted for using a fair-value hedge.

B) The hedge of a firm commitment is accounted for using a cash-flow hedge.

C) The gain or loss on a hedging instrument under a cash-flow hedge is first reported as other comprehensive income and then reclassified to income when the hedged item affects income.

D) The gain or loss on a hedging instrument under a fair-value hedge is first reported as other comprehensive income and then reclassified to income when the hedged item affects income.

On Jul 27, 2024

C

JM

Answered

On a snowy day in early January,Jeremy is visiting his friend Manny at Manny's apartment at the Snooty Fox.While walking up the exterior wooden steps to get to Manny's third floor apartment,one of the steps-which is rotten-breaks.Jeremy falls through to the ground and is severely injured.What result?

A) The Snooty Fox is liable based on ejectment in a common area.

B) The Snooty Fox is not liable based on unlawful detainer.

C) The Snooty Fox is not liable because of the weather conditions.

D) The Snooty Fox is liable based on defect in a common area.

A) The Snooty Fox is liable based on ejectment in a common area.

B) The Snooty Fox is not liable based on unlawful detainer.

C) The Snooty Fox is not liable because of the weather conditions.

D) The Snooty Fox is liable based on defect in a common area.

On Jun 30, 2024

D

JM

Answered

If a defendant enters a plea in which they do not admit guilt but agrees not to contest the charges further, this is known as:

A) A partial defense.

B) An Information.

C) A nuisance plea.

D) Nolo contendere.

E) Plea of avoidance.

A) A partial defense.

B) An Information.

C) A nuisance plea.

D) Nolo contendere.

E) Plea of avoidance.

On Jun 27, 2024

D

JM

Answered

If the property tax rates are increased, this change in fixed costs will result in a decrease in the break-even point.

On May 31, 2024

False

JM

Answered

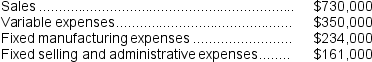

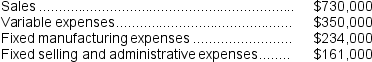

Product U23N has been considered a drag on profits at Jinkerson Corporation for some time and management is considering discontinuing the product altogether.Data from the company's budget for the upcoming year appear below:  In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $144,000 of the fixed manufacturing expenses and $93,000 of the fixed selling and administrative expenses are avoidable if product U23N is discontinued.The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be:

In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $144,000 of the fixed manufacturing expenses and $93,000 of the fixed selling and administrative expenses are avoidable if product U23N is discontinued.The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be:

A) $15,000

B) $143,000

C) ($143,000)

D) ($15,000)

In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $144,000 of the fixed manufacturing expenses and $93,000 of the fixed selling and administrative expenses are avoidable if product U23N is discontinued.The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be:

In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $144,000 of the fixed manufacturing expenses and $93,000 of the fixed selling and administrative expenses are avoidable if product U23N is discontinued.The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be:A) $15,000

B) $143,000

C) ($143,000)

D) ($15,000)

On May 28, 2024

C

JM

Answered

Critics of industrial regulation say that such regulation:

A) benefits small firms at the expense of large firms.

B) perpetuates monopoly long after new technology has eroded natural monopoly.

C) creates insurmountable principal-agent problems.

D) has resulted mainly from the paradox of voting.

A) benefits small firms at the expense of large firms.

B) perpetuates monopoly long after new technology has eroded natural monopoly.

C) creates insurmountable principal-agent problems.

D) has resulted mainly from the paradox of voting.

On May 01, 2024

B

JM

Answered

Which of the following statements best describes externalities?

A) An externality is a situation where a project would have an adverse effect on some other part of the firm's overall operations. If the project would have a favourable effect on other operations, then this is not an externality.

B) An example of an externality is a situation where a bank opens a new office, and that new office causes deposits in the bank's other offices to decline.

C) The NPV method automatically deals correctly with externalities, even if the externalities are not specifically identified, but the IRR method does not. This is another reason to favour the NPV.

D) Both the NPV and IRR methods deal correctly with externalities, even if the externalities are not specifically identified. However, the payback method does not.

A) An externality is a situation where a project would have an adverse effect on some other part of the firm's overall operations. If the project would have a favourable effect on other operations, then this is not an externality.

B) An example of an externality is a situation where a bank opens a new office, and that new office causes deposits in the bank's other offices to decline.

C) The NPV method automatically deals correctly with externalities, even if the externalities are not specifically identified, but the IRR method does not. This is another reason to favour the NPV.

D) Both the NPV and IRR methods deal correctly with externalities, even if the externalities are not specifically identified. However, the payback method does not.

On Apr 28, 2024

B