JW

Julia Witek

Answers (5)

JW

Answered

Flash Inc., a maker of athletic shoes, registers and uses "flash" as its domain name. Later, Got Shoes Company begins to use "flast" (an intentional misspelling of "flash") as its domain name. Got Shoes is most likely

A) diminishing the quality of Flash's mark.

B) making a fair use of Flash's mark.

C) licensing the use of Flash's mark to itself.

D) engaging in lawful competitive conduct.

A) diminishing the quality of Flash's mark.

B) making a fair use of Flash's mark.

C) licensing the use of Flash's mark to itself.

D) engaging in lawful competitive conduct.

On Jun 08, 2024

A

JW

Answered

Which of the following is true of the labor force participation rate?

A) When workers become unemployed,the labor force participation rate declines.

B) When the unemployed become discouraged workers,the labor force participation rate declines.

C) When workers do not fully use their skills,the labor force participation rate decreases.

D) Since the 1950s,the labor force participation rate of women has decreased in the United States.

E) The trend toward earlier retirement has increased the labor force participation rate in the United States.

A) When workers become unemployed,the labor force participation rate declines.

B) When the unemployed become discouraged workers,the labor force participation rate declines.

C) When workers do not fully use their skills,the labor force participation rate decreases.

D) Since the 1950s,the labor force participation rate of women has decreased in the United States.

E) The trend toward earlier retirement has increased the labor force participation rate in the United States.

On Jun 08, 2024

B

JW

Answered

When resources are high, increased ________ are associated with a lower probability of death.

On Jun 04, 2024

job demands

JW

Answered

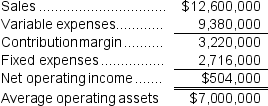

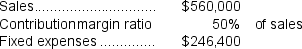

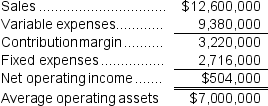

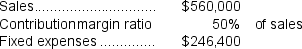

Craycraft Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $800,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $800,000 investment opportunity with the following characteristics:  Required:

Required:

1.What was last year's margin? (Round to the nearest 0.1%.)

2.What was last year's turnover? (Round to the nearest 0.01.)

3.What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall margin this year? (Round to the nearest 0.1%.)

5.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall turnover this year? (Round to the nearest 0.01.)

6.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall ROI will this year? (Round to the nearest 0.1%.)

At the beginning of this year, the company has a $800,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $800,000 investment opportunity with the following characteristics:  Required:

Required:1.What was last year's margin? (Round to the nearest 0.1%.)

2.What was last year's turnover? (Round to the nearest 0.01.)

3.What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall margin this year? (Round to the nearest 0.1%.)

5.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall turnover this year? (Round to the nearest 0.01.)

6.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall ROI will this year? (Round to the nearest 0.1%.)

On May 08, 2024

1.Last year's Margin = Net operating income ÷ Sales = $504,000 ÷ $12,600,000 = 4.0%

2.Last year's Turnover = Sales ÷ Average operating assets = $12,600,000 ÷ $7,000,000 = 1.80

3.Last year's ROI = Net operating income ÷ Average operating assets = $504,000 ÷ $7,000,000 = 7.2% or ROI = Margin × Turnover = 4.0% × 1.80 = 7.2%

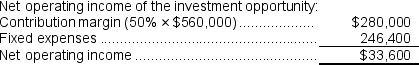

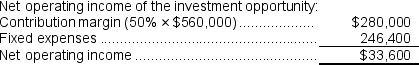

4.If the company pursues the investment opportunity and otherwise performs the same as last year, the margin will be: Net operating income = $504,000 + $33,600 = $537,600

Net operating income = $504,000 + $33,600 = $537,600

Sales = $12,600,000 + $560,000 = $13,160,000

Margin = Net operating income ÷ Sales = $537,600 ÷ $13,160,000 = 4.1%

5.If the company pursues the investment opportunity and otherwise performs the same as last year, the turnover will be:

Sales = $12,600,000 + $560,000 = $13,160,000

Average operating assets = $7,000,000 + $800,000 = $7,800,000

Turnover = Sales ÷ Average operating assets = $13,160,000 ÷ $7,800,000 = 1.69

6.If the company pursues the investment opportunity and otherwise performs the same as last year, the ROI will be:

ROI = Net operating income ÷ Average operating assets = $537,600 ÷ $7,800,000 = 6.9%

or ROI = Margin × Turnover = 4.1% × 1.69 = 6.9%

2.Last year's Turnover = Sales ÷ Average operating assets = $12,600,000 ÷ $7,000,000 = 1.80

3.Last year's ROI = Net operating income ÷ Average operating assets = $504,000 ÷ $7,000,000 = 7.2% or ROI = Margin × Turnover = 4.0% × 1.80 = 7.2%

4.If the company pursues the investment opportunity and otherwise performs the same as last year, the margin will be:

Net operating income = $504,000 + $33,600 = $537,600

Net operating income = $504,000 + $33,600 = $537,600Sales = $12,600,000 + $560,000 = $13,160,000

Margin = Net operating income ÷ Sales = $537,600 ÷ $13,160,000 = 4.1%

5.If the company pursues the investment opportunity and otherwise performs the same as last year, the turnover will be:

Sales = $12,600,000 + $560,000 = $13,160,000

Average operating assets = $7,000,000 + $800,000 = $7,800,000

Turnover = Sales ÷ Average operating assets = $13,160,000 ÷ $7,800,000 = 1.69

6.If the company pursues the investment opportunity and otherwise performs the same as last year, the ROI will be:

ROI = Net operating income ÷ Average operating assets = $537,600 ÷ $7,800,000 = 6.9%

or ROI = Margin × Turnover = 4.1% × 1.69 = 6.9%

JW

Answered

Under the mailbox rule,the acceptance of an offer is effective at the time the acceptance is dispatched unless:

A) both the offeror and offeree are merchants.

B) the offer proposes a sale of real estate.

C) the acceptance is not in the authorized mode of communication.

D) the acceptance is lost or never reaches the offeror.

A) both the offeror and offeree are merchants.

B) the offer proposes a sale of real estate.

C) the acceptance is not in the authorized mode of communication.

D) the acceptance is lost or never reaches the offeror.

On May 05, 2024

C