KJ

Krishna Jayaswal

Answers (10)

KJ

Answered

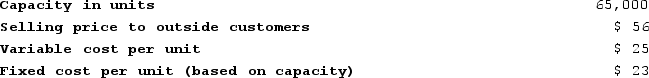

Leneau Products, Incorporated, has a Connector Division that manufactures and sells a number of products, including a standard connector that could be used by another division in the company, the Transmission Division, in one of its products. Data concerning that connector appear below:  The Transmission Division is currently purchasing 12,000 of these connectors per year from an overseas supplier at a cost of $52 per connector. Assume that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that $5 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. Does there exist a transfer price that would make both the Valve and Pump Division financially better off than if the Pump Division were to continue buying its valves from the outside supplier?

The Transmission Division is currently purchasing 12,000 of these connectors per year from an overseas supplier at a cost of $52 per connector. Assume that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that $5 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. Does there exist a transfer price that would make both the Valve and Pump Division financially better off than if the Pump Division were to continue buying its valves from the outside supplier?

A) Yes, the minimum transfer price that the selling division should be willing to accept is less than the maximum transfer price that the buying division would accept. Both divisions would be financially better off if the transfers were to take place.

B) Yes, both divisions are always better off regardless of whether the selling division has enough idle capacity to handle all of the buying division's needs.

C) No, the selling division's price to outside customers is higher than the price that the buying division has to pay its outside supplier.

D) The answer cannot be determined from the information that has been provided.

The Transmission Division is currently purchasing 12,000 of these connectors per year from an overseas supplier at a cost of $52 per connector. Assume that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that $5 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. Does there exist a transfer price that would make both the Valve and Pump Division financially better off than if the Pump Division were to continue buying its valves from the outside supplier?

The Transmission Division is currently purchasing 12,000 of these connectors per year from an overseas supplier at a cost of $52 per connector. Assume that the Valve Division is selling all of the valves it can produce to outside customers. Also assume that $5 in variable expenses can be avoided on transfers within the company due to reduced shipping and selling costs. Does there exist a transfer price that would make both the Valve and Pump Division financially better off than if the Pump Division were to continue buying its valves from the outside supplier?A) Yes, the minimum transfer price that the selling division should be willing to accept is less than the maximum transfer price that the buying division would accept. Both divisions would be financially better off if the transfers were to take place.

B) Yes, both divisions are always better off regardless of whether the selling division has enough idle capacity to handle all of the buying division's needs.

C) No, the selling division's price to outside customers is higher than the price that the buying division has to pay its outside supplier.

D) The answer cannot be determined from the information that has been provided.

On Jul 31, 2024

A

KJ

Answered

Which of the following statements is false regarding the extent of real property ownership rights?

A) A landowner's rights to property extend to airspace.

B) A landowner has water rights consisting of the legal use of water flowing across or underneath the property so long as landowners downstream are not deprived of water.

C) A landowner has mineral rights.

D) A landowner is prohibited from cutting branches of a neighbor's tree hanging over into the landowner's premises.

E) Interests in land range from temporary to permanent to future.

A) A landowner's rights to property extend to airspace.

B) A landowner has water rights consisting of the legal use of water flowing across or underneath the property so long as landowners downstream are not deprived of water.

C) A landowner has mineral rights.

D) A landowner is prohibited from cutting branches of a neighbor's tree hanging over into the landowner's premises.

E) Interests in land range from temporary to permanent to future.

On Jul 02, 2024

D

KJ

Answered

________ refers to checking whether a document is free from typographical errors.

A) Revising

B) Brainstorming

C) Freewriting

D) Proofreading

E) Clustering

A) Revising

B) Brainstorming

C) Freewriting

D) Proofreading

E) Clustering

On Jul 01, 2024

D

KJ

Answered

Royalties can NOT be earned from which of the following:

A) oil wells.

B) patents.

C) coal mines.

D) stocks.

A) oil wells.

B) patents.

C) coal mines.

D) stocks.

On Jun 02, 2024

D

KJ

Answered

If the Fed followed a rule for monetary policy, the time inconsistency problem would be eliminated.

On Jun 01, 2024

True

KJ

Answered

What are the four major nonverbal communication channels?

On May 03, 2024

The four major nonverbal communication channels are physical space between buyer and seller, appearance, handshake, and body movements.

KJ

Answered

A salesperson should ask a prospect to buy a product only when the prospect reaches the ________ stage of the mental buying process.

A) knowledge

B) attitude

C) conviction

D) belief

E) desire

A) knowledge

B) attitude

C) conviction

D) belief

E) desire

On May 02, 2024

C

KJ

Answered

Imposition of an output tax on all firms in a competitive industry will result in:

A) a downward shift in each firm's marginal cost curve.

B) a downward shift in each firm's average cost curve.

C) a leftward shift in the market supply curve.

D) the entry of new firms into the industry.

E) higher profits for the industry as price rises.

A) a downward shift in each firm's marginal cost curve.

B) a downward shift in each firm's average cost curve.

C) a leftward shift in the market supply curve.

D) the entry of new firms into the industry.

E) higher profits for the industry as price rises.

On Apr 30, 2024

C

KJ

Answered

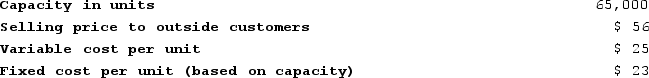

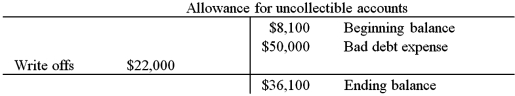

At the close of its third year of operations,on December 31,2014,the Runner Company had receivables of $350,000,which were net of the related allowance for doubtful accounts.During 2014,the company had charges to bad debt expense of $50,000 and wrote off,as uncollectible,accounts receivable of $22,000.Runner had a balance in its allowance for uncollectible accounts at December 31,2013 of $8,100.

Required:

What should the company report on its balance sheet at December 31,2014,as accounts receivable before the allowance for uncollectible accounts?

Required:

What should the company report on its balance sheet at December 31,2014,as accounts receivable before the allowance for uncollectible accounts?

On Apr 29, 2024

KJ

Answered

The price-earnings ratio reveals information about the stock market's expectations for a company's future earnings growth.

On Apr 28, 2024

True