LN

Leslie Nungaray

Answers (7)

LN

Answered

Which of the following is the first stage of the interview process and is designed to eliminate those who are not a good fit for the position?

A) Offer

B) Screening

C) Final

D) Selection

E) Open-ended

A) Offer

B) Screening

C) Final

D) Selection

E) Open-ended

On Aug 04, 2024

B

LN

Answered

A profit and loss ratio must be based on capital contributions.

On Jul 08, 2024

False

LN

Answered

If The Kingdom and Alexandria are acting independently,how many units should they order?

A) 284

B) 314

C) 367

D) 380

A) 284

B) 314

C) 367

D) 380

On Jul 05, 2024

B

LN

Answered

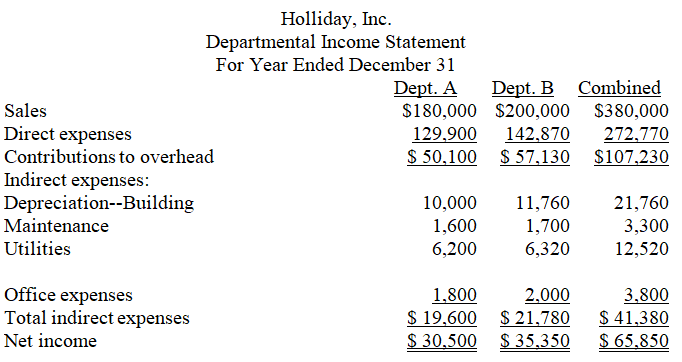

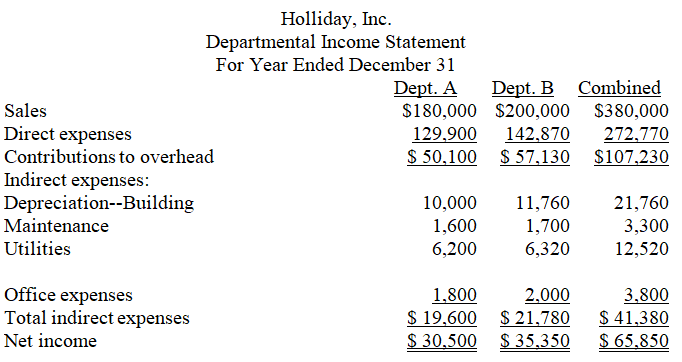

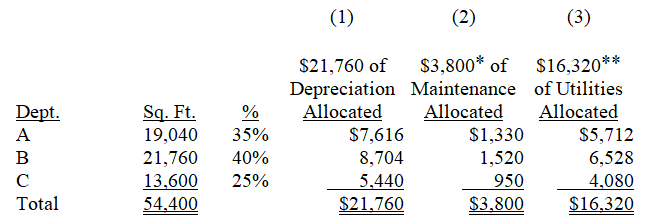

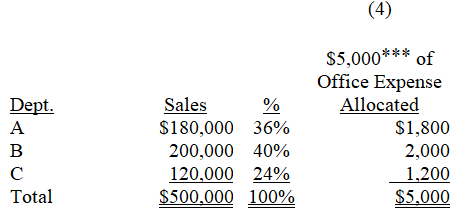

Holliday,Inc.,operates a retail store with two departments,A and B.Its departmental income statement for the current year follows:

Holliday allocates building depreciation,maintenance,and utilities on the basis of square footage.Office expenses are allocated on the basis of sales.

Holliday allocates building depreciation,maintenance,and utilities on the basis of square footage.Office expenses are allocated on the basis of sales.

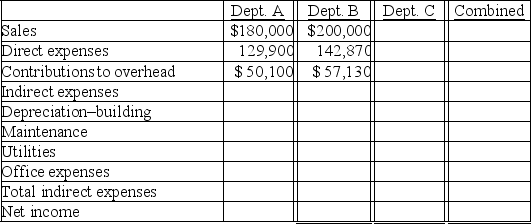

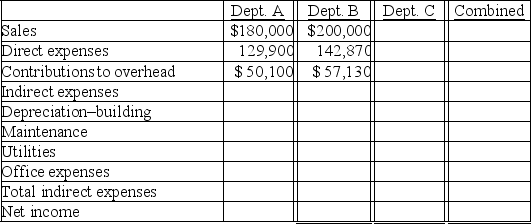

Management is considering an expansion to a three-department operation.The proposed Department C would generate $120,000 in additional sales and have a 17.5% contribution to overhead.The company owns its building.Opening Department C would redistribute the square footage to each department as follows: A,19,040; B,21,760 sq.ft.; C,13,600.Increases in indirect expenses would include: maintenance,$500; utilities,$3,800; and office expenses,$1,200.

Complete the following departmental income statements,showing projected results of operations for the three sales departments.(Round amounts to the nearest whole dollar.)

Holliday allocates building depreciation,maintenance,and utilities on the basis of square footage.Office expenses are allocated on the basis of sales.

Holliday allocates building depreciation,maintenance,and utilities on the basis of square footage.Office expenses are allocated on the basis of sales.Management is considering an expansion to a three-department operation.The proposed Department C would generate $120,000 in additional sales and have a 17.5% contribution to overhead.The company owns its building.Opening Department C would redistribute the square footage to each department as follows: A,19,040; B,21,760 sq.ft.; C,13,600.Increases in indirect expenses would include: maintenance,$500; utilities,$3,800; and office expenses,$1,200.

Complete the following departmental income statements,showing projected results of operations for the three sales departments.(Round amounts to the nearest whole dollar.)

On Jun 08, 2024

* $3,300 + $500 = $3,800; ** $12,520 + $3,800 = $16,320; *** $3,800 + $1,200 = $5,000

LN

Answered

Three widely used methods of comparing investment alternatives are payback period,net present value,and rate of return on average investment.

On Jun 05, 2024

True

LN

Answered

The most appropriate discount rate to use when applying a FCFF valuation model is the

A) required rate of return on equity.

B) WACC.

C) risk-free rate.

D) required rate of return on equity or risk-free rate, depending on the debt level of the firm.

E) None of the options are correct.

A) required rate of return on equity.

B) WACC.

C) risk-free rate.

D) required rate of return on equity or risk-free rate, depending on the debt level of the firm.

E) None of the options are correct.

On May 09, 2024

B

LN

Answered

If one worker can pick $30 worth of grapes and two workers together can pick $50 worth of grapes,the:

A) marginal revenue product of each worker is $25.

B) marginal revenue product of the first worker is $20.

C) marginal revenue product of the second worker is $20.

D) data given do not permit the determination of the marginal revenue product of either worker.

A) marginal revenue product of each worker is $25.

B) marginal revenue product of the first worker is $20.

C) marginal revenue product of the second worker is $20.

D) data given do not permit the determination of the marginal revenue product of either worker.

On May 06, 2024

C