MF

Makaila Foster 'student'

Answers (6)

MF

Answered

A family that earns $20,000 a year pays $400 a year in city wage taxes. A family that earns $40,000 a year pays $1,400 a year in city wage taxes. The city wage tax is a ________ tax.

A) progressive

B) regressive

C) proportional

D) benefits-received

A) progressive

B) regressive

C) proportional

D) benefits-received

On Jul 14, 2024

A

MF

Answered

Which one of the following items would be charged to the cost of land rather than the cost of the building?

A) Demolition of an existing structure.

B) Capitalization of interest.

C) Architectural fees.

D) Cost of the foundation.

A) Demolition of an existing structure.

B) Capitalization of interest.

C) Architectural fees.

D) Cost of the foundation.

On Jun 29, 2024

A

MF

Answered

Teenagers have more frequent unemployment spells and spend more time searching for jobs. Other thing the same, this means that teenagers have a

A) higher unemployment rate.If a larger portion of the adult population were teenagers, the natural rate of unemployment would be higher.

B) higher unemployment rate.The portion of the adult population that is teenagers does not affect the natural rate of unemployment.

C) lower unemployment rate.If a larger portion of the adult population were teenagers, the natural rate of unemployment would be lower.

D) lower unemployment rate.The portion of the adult population that is teenagers does not affect the natural rate of unemployment.

A) higher unemployment rate.If a larger portion of the adult population were teenagers, the natural rate of unemployment would be higher.

B) higher unemployment rate.The portion of the adult population that is teenagers does not affect the natural rate of unemployment.

C) lower unemployment rate.If a larger portion of the adult population were teenagers, the natural rate of unemployment would be lower.

D) lower unemployment rate.The portion of the adult population that is teenagers does not affect the natural rate of unemployment.

On Jun 13, 2024

A

MF

Answered

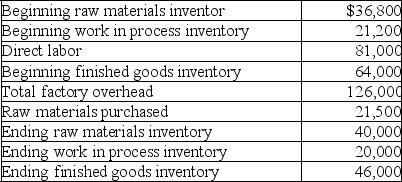

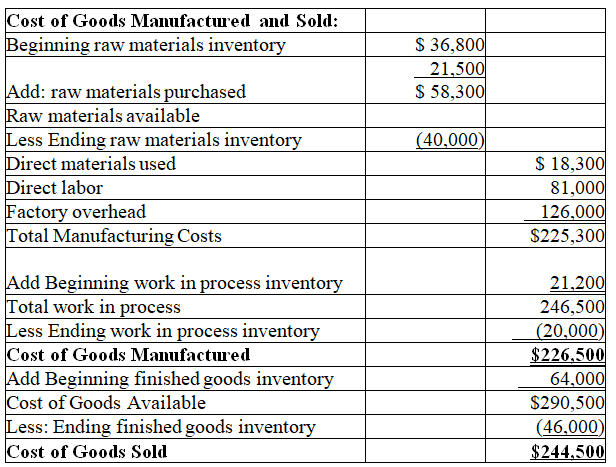

Information for Maxim Manufacturing is presented below.Compute both the cost of goods manufactured and the cost of goods sold for Maxim Manufacturing.

On May 30, 2024

MF

Answered

Disclosures about inventory should include each of the following except the

A) basis of accounting.

B) costing method.

C) quantity of inventory.

D) major inventory classifications.

A) basis of accounting.

B) costing method.

C) quantity of inventory.

D) major inventory classifications.

On May 04, 2024

C

MF

Answered

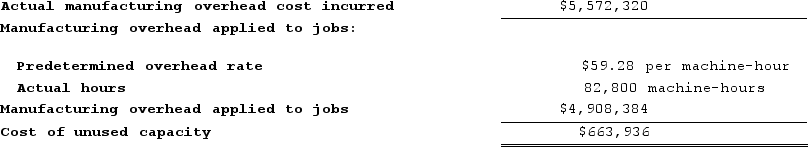

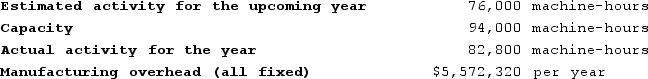

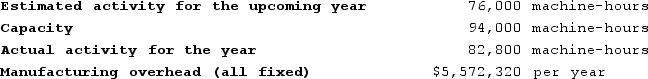

The management of Buelow Corporation would like to investigate the possibility of basing its predetermined overhead rate on activity at capacity rather than on the estimated amount of activity for the year. The company's controller has provided an example to illustrate how this new system would work.

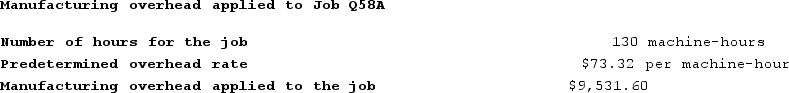

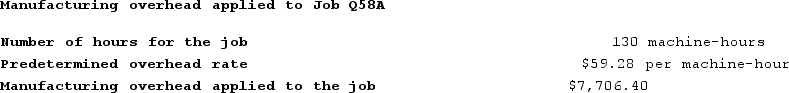

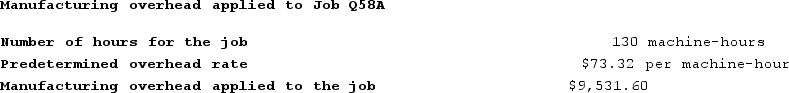

Job Q58A, which required 130 machine-hours, is one of the jobs worked on during the year.Required:a. Determine the predetermined overhead rate if the predetermined overhead rate is based on the estimated activity for the upcoming year.b. Determine how much overhead would be applied to Job Q58A if the predetermined overhead rate is based on estimated activity for the upcoming year.c. Determine the predetermined overhead rate if the predetermined overhead rate is based on the activity at capacity.d. Determine how much overhead would be applied to Job Q58A if the predetermined overhead rate is based on activity at capacity.e. Determine the cost of unused capacity for the year if the predetermined overhead rate is based on activity at capacity. Garrison 16e Rechecks 2019-01-30

Job Q58A, which required 130 machine-hours, is one of the jobs worked on during the year.Required:a. Determine the predetermined overhead rate if the predetermined overhead rate is based on the estimated activity for the upcoming year.b. Determine how much overhead would be applied to Job Q58A if the predetermined overhead rate is based on estimated activity for the upcoming year.c. Determine the predetermined overhead rate if the predetermined overhead rate is based on the activity at capacity.d. Determine how much overhead would be applied to Job Q58A if the predetermined overhead rate is based on activity at capacity.e. Determine the cost of unused capacity for the year if the predetermined overhead rate is based on activity at capacity. Garrison 16e Rechecks 2019-01-30

Job Q58A, which required 130 machine-hours, is one of the jobs worked on during the year.Required:a. Determine the predetermined overhead rate if the predetermined overhead rate is based on the estimated activity for the upcoming year.b. Determine how much overhead would be applied to Job Q58A if the predetermined overhead rate is based on estimated activity for the upcoming year.c. Determine the predetermined overhead rate if the predetermined overhead rate is based on the activity at capacity.d. Determine how much overhead would be applied to Job Q58A if the predetermined overhead rate is based on activity at capacity.e. Determine the cost of unused capacity for the year if the predetermined overhead rate is based on activity at capacity. Garrison 16e Rechecks 2019-01-30

Job Q58A, which required 130 machine-hours, is one of the jobs worked on during the year.Required:a. Determine the predetermined overhead rate if the predetermined overhead rate is based on the estimated activity for the upcoming year.b. Determine how much overhead would be applied to Job Q58A if the predetermined overhead rate is based on estimated activity for the upcoming year.c. Determine the predetermined overhead rate if the predetermined overhead rate is based on the activity at capacity.d. Determine how much overhead would be applied to Job Q58A if the predetermined overhead rate is based on activity at capacity.e. Determine the cost of unused capacity for the year if the predetermined overhead rate is based on activity at capacity. Garrison 16e Rechecks 2019-01-30On Apr 30, 2024

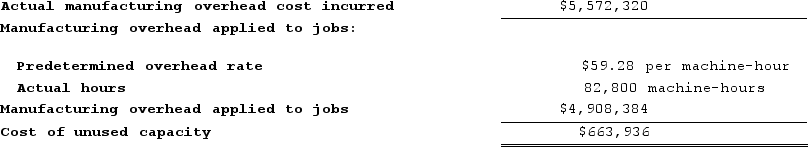

a.Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $5,572,320 ÷ 76,000 machine-hours = $73.32 per machine-hourb.

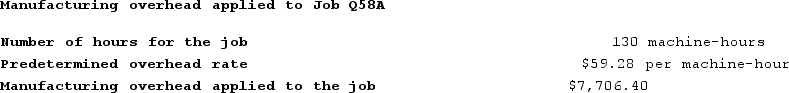

c.Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $5,572,320 ÷ 94,000 machine-hours = $59.28 per machine-hourd.

c.Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $5,572,320 ÷ 94,000 machine-hours = $59.28 per machine-hourd.

e.

e.

c.Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $5,572,320 ÷ 94,000 machine-hours = $59.28 per machine-hourd.

c.Predetermined overhead rate = Estimated total manufacturing overhead cost ÷ Estimated total amount of the allocation base = $5,572,320 ÷ 94,000 machine-hours = $59.28 per machine-hourd. e.

e.