MS

Mohamed Saleh

Answers (8)

MS

Answered

The formula for the materials price variance is

A) (AQ × SP) - (SQ × SP) .

B) (AQ × AP) - (AQ × SP) .

C) (AQ × AP) - (SQ × SP) .

D) (AQ × SP) - (SQ × AP) .

A) (AQ × SP) - (SQ × SP) .

B) (AQ × AP) - (AQ × SP) .

C) (AQ × AP) - (SQ × SP) .

D) (AQ × SP) - (SQ × AP) .

On Jul 21, 2024

B

MS

Answered

The rational choice paradigm states that effective decision makers begin at any step in the model.

On Jul 14, 2024

False

MS

Answered

An increase in the price of steel will result in

A) a decrease in the prices of automobiles.

B) an increase in the cost of labor to produce automobiles.

C) an increase in the equilibrium quantity of automobiles.

D) a decrease in the supply of automobiles.

A) a decrease in the prices of automobiles.

B) an increase in the cost of labor to produce automobiles.

C) an increase in the equilibrium quantity of automobiles.

D) a decrease in the supply of automobiles.

On Jun 21, 2024

D

MS

Answered

What type of analysis presupposes that a linear relationship exists between sales and the number of employees?

A) ratio

B) multivariate

C) trend

D) regression

A) ratio

B) multivariate

C) trend

D) regression

On Jun 14, 2024

D

MS

Answered

Classifying costs by behavior involves:

A) Identifying fixed cost and variable cost.

B) Identifying cost of goods sold and operating costs.

C) Identifying all costs.

D) Identifying costs in a physical manner.

E) Identifying both quantitative and qualitative cost factors.

A) Identifying fixed cost and variable cost.

B) Identifying cost of goods sold and operating costs.

C) Identifying all costs.

D) Identifying costs in a physical manner.

E) Identifying both quantitative and qualitative cost factors.

On Jun 12, 2024

A

MS

Answered

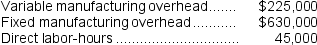

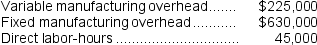

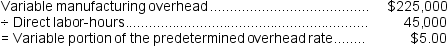

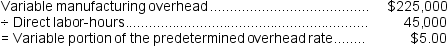

Gottshall Inc.makes a range of products.The company's predetermined overhead rate is $19 per direct labor-hour, which was calculated using the following budgeted data:  Component P0 is used in one of the company's products.The unit cost of the component according to the company's cost accounting system is determined as follows:

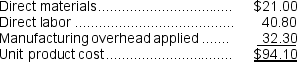

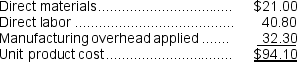

Component P0 is used in one of the company's products.The unit cost of the component according to the company's cost accounting system is determined as follows:  An outside supplier has offered to supply component P0 for $78 each.The outside supplier is known for quality and reliability.Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by this decision.Gottshall chronically has idle capacity.

An outside supplier has offered to supply component P0 for $78 each.The outside supplier is known for quality and reliability.Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by this decision.Gottshall chronically has idle capacity.

Required:

Is the offer from the outside supplier financially attractive? Why?

Component P0 is used in one of the company's products.The unit cost of the component according to the company's cost accounting system is determined as follows:

Component P0 is used in one of the company's products.The unit cost of the component according to the company's cost accounting system is determined as follows:  An outside supplier has offered to supply component P0 for $78 each.The outside supplier is known for quality and reliability.Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by this decision.Gottshall chronically has idle capacity.

An outside supplier has offered to supply component P0 for $78 each.The outside supplier is known for quality and reliability.Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by this decision.Gottshall chronically has idle capacity.Required:

Is the offer from the outside supplier financially attractive? Why?

On May 16, 2024

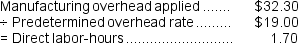

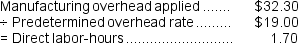

Direct materials, direct labor, and variable manufacturing overhead are relevant in this decision.Fixed manufacturing overhead is not relevant because it would not be affected by the decision.The variable portion of the manufacturing overhead rate is computed as follows:  The direct-labor hours per unit for the special order can be determined as follows:

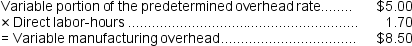

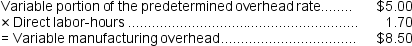

The direct-labor hours per unit for the special order can be determined as follows:  Consequently, the variable manufacturing overhead for the special order would be:

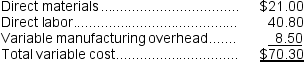

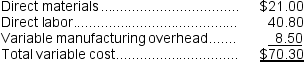

Consequently, the variable manufacturing overhead for the special order would be:  Putting this all together:

Putting this all together:  Because the outside supplier has offered to sell the component for $78.00 each, but it only costs the company $70.30 to make the component internally, this is not a financially attractive offer.

Because the outside supplier has offered to sell the component for $78.00 each, but it only costs the company $70.30 to make the component internally, this is not a financially attractive offer.

The direct-labor hours per unit for the special order can be determined as follows:

The direct-labor hours per unit for the special order can be determined as follows:  Consequently, the variable manufacturing overhead for the special order would be:

Consequently, the variable manufacturing overhead for the special order would be:  Putting this all together:

Putting this all together:  Because the outside supplier has offered to sell the component for $78.00 each, but it only costs the company $70.30 to make the component internally, this is not a financially attractive offer.

Because the outside supplier has offered to sell the component for $78.00 each, but it only costs the company $70.30 to make the component internally, this is not a financially attractive offer.MS

Answered

What is NOT a main step in conducting a proper compensation survey?

A) identifying jobs to be surveyed

B) identifying employees to be surveyed

C) determining the information needed

D) determining how you will collect the data

A) identifying jobs to be surveyed

B) identifying employees to be surveyed

C) determining the information needed

D) determining how you will collect the data

On May 13, 2024

B

MS

Answered

Neal is on a business trip to Brazil. His company is considering this market and it is his job to get a grasp on the symbols and ceremonies common to Brazil. What aspect of Brazil's culture is Neal assessing?

A) underlying values

B) visible artifacts

C) assumptions

D) opinions and beliefs

E) purchasing parity

A) underlying values

B) visible artifacts

C) assumptions

D) opinions and beliefs

E) purchasing parity

On May 12, 2024

B