MU

Mounika Uppala

Answers (4)

MU

Answered

Within a perceptual map, a(n) ________ represents where a particular market segment's desired product would lie.

A) point of parity

B) strategic target

C) Tapestry cluster

D) ideal point

E) benefit centroid

A) point of parity

B) strategic target

C) Tapestry cluster

D) ideal point

E) benefit centroid

On Jun 01, 2024

D

MU

Answered

Management Reports are:

A) used by management and do not have to follow specified rules (i.e.GAAP or Internal Revenue Code) .The reports are prepared as needed to provide management with information to make informed business decisions.

B) used by management and follow a specified set of rules (i.e.GAAP or Internal Revenue Code) .The reports are prepared to ensure management can provide outside users with information to make informed decisions regarding their company.

C) used by management and do not follow specified rules (i.e.GAAP or Internal Revenue Code) .The reports are prepared either monthly,quarterly or yearly to ensure management is reviewing financial data on a timely basis.

D) used by management and follow a specified set of rules (i.e.GAAP or Internal Revenue Code) .The reports are prepared either monthly,quarterly or yearly to ensure management is reviewing financial data on a timely basis.

A) used by management and do not have to follow specified rules (i.e.GAAP or Internal Revenue Code) .The reports are prepared as needed to provide management with information to make informed business decisions.

B) used by management and follow a specified set of rules (i.e.GAAP or Internal Revenue Code) .The reports are prepared to ensure management can provide outside users with information to make informed decisions regarding their company.

C) used by management and do not follow specified rules (i.e.GAAP or Internal Revenue Code) .The reports are prepared either monthly,quarterly or yearly to ensure management is reviewing financial data on a timely basis.

D) used by management and follow a specified set of rules (i.e.GAAP or Internal Revenue Code) .The reports are prepared either monthly,quarterly or yearly to ensure management is reviewing financial data on a timely basis.

On Jun 01, 2024

A

MU

Answered

The act of assigning a meaning to sounds based on your own values and beliefs is called decoding.

On May 03, 2024

True

MU

Answered

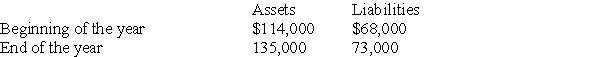

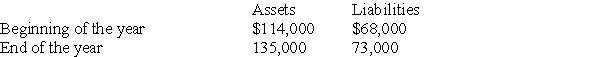

Victor Services had the following assets and liabilities at the beginning and end of the current year:

If $12,000 of common stock was issued during the year,but no dividends were paid during the year,what was the amount of net income earned by Victor Services?

If $12,000 of common stock was issued during the year,but no dividends were paid during the year,what was the amount of net income earned by Victor Services?

If $12,000 of common stock was issued during the year,but no dividends were paid during the year,what was the amount of net income earned by Victor Services?

If $12,000 of common stock was issued during the year,but no dividends were paid during the year,what was the amount of net income earned by Victor Services?On May 02, 2024

Beginning equity = $114,000 - $68,000 = $46,000

Ending equity = $135,000 - $73,000 = $62,000

Increase in equity including stock issuance = $62,000 - $46,000 = $16,000

Net income = $16,000 - $12,000 = $4,000

Ending equity = $135,000 - $73,000 = $62,000

Increase in equity including stock issuance = $62,000 - $46,000 = $16,000

Net income = $16,000 - $12,000 = $4,000