MA

Muhamad Azamuddin

Answers (6)

MA

Answered

Tammy loves donuts. The table shown reflects the value Tammy places on each donut she eats:

Value of first donut $0.60 Value of second donut $0.50 Value of third donut $0.40 Value of fourth donut $0.30 Value of fifth donut $0.20 Value of sixth donut $0.10\begin{array} { | l | l | } \hline \text { Value of first donut } & \$ 0.60 \\\hline \text { Value of second donut } & \$ 0.50 \\\hline \text { Value of third donut } & \$ 0.40 \\\hline \text { Value of fourth donut } & \$ 0.30 \\\hline \text { Value of fifth donut } & \$ 0.20 \\\hline \text { Value of sixth donut } & \$ 0.10 \\\hline\end{array} Value of first donut Value of second donut Value of third donut Value of fourth donut Value of fifth donut Value of sixth donut $0.60$0.50$0.40$0.30$0.20$0.10

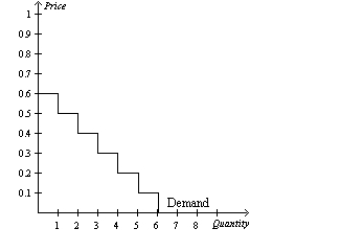

a.Use this information to construct Tammy's demand curve for donuts.

b.If the price of donuts is $0.20, how many donuts will Tammy buy?

c.Show Tammy's consumer surplus on your graph.How much consumer surplus would she have at a price of $0.20?

d.If the price of donuts rose to $0.40, how many donuts would she purchase now? What would happen to Tammy's consumer surplus? Show this change on your graph.

Value of first donut $0.60 Value of second donut $0.50 Value of third donut $0.40 Value of fourth donut $0.30 Value of fifth donut $0.20 Value of sixth donut $0.10\begin{array} { | l | l | } \hline \text { Value of first donut } & \$ 0.60 \\\hline \text { Value of second donut } & \$ 0.50 \\\hline \text { Value of third donut } & \$ 0.40 \\\hline \text { Value of fourth donut } & \$ 0.30 \\\hline \text { Value of fifth donut } & \$ 0.20 \\\hline \text { Value of sixth donut } & \$ 0.10 \\\hline\end{array} Value of first donut Value of second donut Value of third donut Value of fourth donut Value of fifth donut Value of sixth donut $0.60$0.50$0.40$0.30$0.20$0.10

a.Use this information to construct Tammy's demand curve for donuts.

b.If the price of donuts is $0.20, how many donuts will Tammy buy?

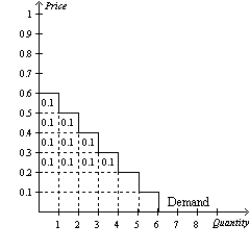

c.Show Tammy's consumer surplus on your graph.How much consumer surplus would she have at a price of $0.20?

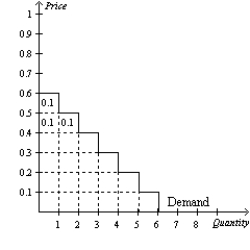

d.If the price of donuts rose to $0.40, how many donuts would she purchase now? What would happen to Tammy's consumer surplus? Show this change on your graph.

On Jul 21, 2024

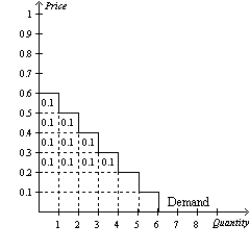

a.

b. At a price of $0.20\$ 0.20$0.20 , Tammy would buy 5 donuts.

c. The figure below shows Tammy's consumer surplus. At a price of $0.20\$ 0.20$0.20 , Tammy's consumer surplus would be $1.00\$ 1.00$1.00 . d. If the price of donuts rose to $0.40\$ 0.40$0.40 , Tammy's consumer surplus would fall to $0.30\$ 0.30$0.30 and she would purchase only 3 donuts.

d. If the price of donuts rose to $0.40\$ 0.40$0.40 , Tammy's consumer surplus would fall to $0.30\$ 0.30$0.30 and she would purchase only 3 donuts.

b. At a price of $0.20\$ 0.20$0.20 , Tammy would buy 5 donuts.

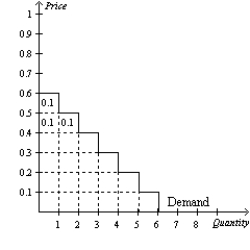

c. The figure below shows Tammy's consumer surplus. At a price of $0.20\$ 0.20$0.20 , Tammy's consumer surplus would be $1.00\$ 1.00$1.00 .

d. If the price of donuts rose to $0.40\$ 0.40$0.40 , Tammy's consumer surplus would fall to $0.30\$ 0.30$0.30 and she would purchase only 3 donuts.

d. If the price of donuts rose to $0.40\$ 0.40$0.40 , Tammy's consumer surplus would fall to $0.30\$ 0.30$0.30 and she would purchase only 3 donuts.

MA

Answered

Coffee Beans Inc. offers to buy Brewing Company's roasting services for a certain price. Brewing responds that the price is too low and thereby rejects the offer. The offer is

A) terminated.

B) valid for a reasonable time.

C) valid for the period of time prescribed by a state statute.

D) valid until Coffee Beans revokes the offer.

A) terminated.

B) valid for a reasonable time.

C) valid for the period of time prescribed by a state statute.

D) valid until Coffee Beans revokes the offer.

On Jul 20, 2024

A

MA

Answered

Required:

Prepare dated journal entries for Ocean Enterprises for 2020 to account for its investment in Zebrafish and any related income therefrom.

At January 1, 2019-purchase of 15%$150,000 LO19 revaluation 15,000‾ Balance-Dec. 31,2019(15%)$165,000 Additional purchase (10%)-January 1, 2020 110,00‾ Balance (25%) $275,000 July 1, 2020-Sale of 12,500shares 137,500‾ Balance (12.5%)137,5002020 revaluation (12,500×$12.50)−137,50018,750 Investment account balance-Dec. 31,2020$156,250\begin{array}{|l|r|}\hline \text { At January 1, 2019-purchase of } 15 \% & \$ 150,000 \\\hline \text { LO19 revaluation } & \underline{15,000} \\\hline \text { Balance-Dec. } 31,2019(15 \%) & \$ 165,000 \\\hline \text { Additional purchase (10\%)-January 1, 2020 } & \underline{110,00} \\\hline \text { Balance (25\%) } & \$ 275,000 \\\hline \text { July 1, 2020-Sale of 12,500shares } & \underline{137,500} \\\hline \text { Balance }(12.5 \%) & 137,500 \\\hline 2020 \text { revaluation }(12,500 \times \$ 12.50)-137,500 & 18,750 \\\hline \text { Investment account balance-Dec. } 31,2020 & \$ 156,250 \\\hline\end{array} At January 1, 2019-purchase of 15% LO19 revaluation Balance-Dec. 31,2019(15%) Additional purchase (10%)-January 1, 2020 Balance (25%) July 1, 2020-Sale of 12,500shares Balance (12.5%)2020 revaluation (12,500×$12.50)−137,500 Investment account balance-Dec. 31,2020$150,00015,000$165,000110,00$275,000137,500137,50018,750$156,250

Prepare dated journal entries for Ocean Enterprises for 2020 to account for its investment in Zebrafish and any related income therefrom.

At January 1, 2019-purchase of 15%$150,000 LO19 revaluation 15,000‾ Balance-Dec. 31,2019(15%)$165,000 Additional purchase (10%)-January 1, 2020 110,00‾ Balance (25%) $275,000 July 1, 2020-Sale of 12,500shares 137,500‾ Balance (12.5%)137,5002020 revaluation (12,500×$12.50)−137,50018,750 Investment account balance-Dec. 31,2020$156,250\begin{array}{|l|r|}\hline \text { At January 1, 2019-purchase of } 15 \% & \$ 150,000 \\\hline \text { LO19 revaluation } & \underline{15,000} \\\hline \text { Balance-Dec. } 31,2019(15 \%) & \$ 165,000 \\\hline \text { Additional purchase (10\%)-January 1, 2020 } & \underline{110,00} \\\hline \text { Balance (25\%) } & \$ 275,000 \\\hline \text { July 1, 2020-Sale of 12,500shares } & \underline{137,500} \\\hline \text { Balance }(12.5 \%) & 137,500 \\\hline 2020 \text { revaluation }(12,500 \times \$ 12.50)-137,500 & 18,750 \\\hline \text { Investment account balance-Dec. } 31,2020 & \$ 156,250 \\\hline\end{array} At January 1, 2019-purchase of 15% LO19 revaluation Balance-Dec. 31,2019(15%) Additional purchase (10%)-January 1, 2020 Balance (25%) July 1, 2020-Sale of 12,500shares Balance (12.5%)2020 revaluation (12,500×$12.50)−137,500 Investment account balance-Dec. 31,2020$150,00015,000$165,000110,00$275,000137,500137,50018,750$156,250

On Jun 21, 2024

Tanuary 1, 2020 Investment in Zebrafish $110,000 Cash $110,000 (To record second purchase of shares in Zebrafish) June 30,2020 Cash $15,000 Dividend income $15,000 (To record receipt of dividend at June 30,2020) July 1,2020 Cash $150,000 Investment in Zebrafish $137,500 Gain on sale of shares (FVTPL) 12,500 To record sale of 12,500 shares for $12 per share) Dec 31,2020 Cash $4,500 Dividend income $4,500 (To record receipt of Dec 31, 2020 dividend) Investment in Zebrafish $18,750 Investment revaluation gain $18,750 (To revalue shares to $12.50 per share) \begin{array}{|l|l|l|l|}\hline \begin{array}{l}\text { Tanuary 1, } \\2020\end{array} & \text { Investment in Zebrafish } & \$ 110,000 & \\\hline & \text { Cash } & & \$ 110,000 \\\hline& \text { (To record second purchase of shares in Zebrafish) } & & \\\hline \text { June 30,2020 } & \text { Cash } & \$ 15,000 & \\\hline & \text { Dividend income } & & \$ 15,000 \\\hline & \text { (To record receipt of dividend at June 30,2020) } & & \\\hline \text { July } 1,2020 & \text { Cash } & \$ 150,000 & \\\hline & \text { Investment in Zebrafish } & & \$ 137,500 \\\hline & \text { Gain on sale of shares (FVTPL) } & & 12,500 \\\hline & \text { To record sale of } 12,500 \text { shares for } \$ 12 \text { per share) } & & \\\hline \text { Dec } 31,2020 & \text { Cash } & \$ 4,500 & \\\hline & \text { Dividend income } & & \$ 4,500 \\\hline & \text { (To record receipt of Dec 31, 2020 dividend) } & \\\hline & \text { Investment in Zebrafish } & \$ 18,750 \\\hline &\text { Investment revaluation gain } & & \$ 18,750 \\\hline &\text { (To revalue shares to } \$ 12.50 \text { per share) } & &\\\hline\end{array} Tanuary 1, 2020 June 30,2020 July 1,2020 Dec 31,2020 Investment in Zebrafish Cash (To record second purchase of shares in Zebrafish) Cash Dividend income (To record receipt of dividend at June 30,2020) Cash Investment in Zebrafish Gain on sale of shares (FVTPL) To record sale of 12,500 shares for $12 per share) Cash Dividend income (To record receipt of Dec 31, 2020 dividend) Investment in Zebrafish Investment revaluation gain (To revalue shares to $12.50 per share) $110,000$15,000$150,000$4,500$18,750$110,000$15,000$137,50012,500$4,500$18,750

MA

Answered

Hubbard Company purchased a truck on January 1,2018,at a cost of $34,000.The company estimated that the truck would have a useful life of 4 years and a residual value of $4,000.

A.Calculate depreciation expense under straight line and double declining balance for 2018-2021.

B.Which of the two methods would result in lower net income in 2018 and 2021?

A.Calculate depreciation expense under straight line and double declining balance for 2018-2021.

B.Which of the two methods would result in lower net income in 2018 and 2021?

On Jun 20, 2024

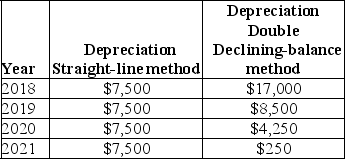

A.

Straight-line: ($34,000 - 4,000)÷ 4 years = $7,500.

Straight-line: ($34,000 - 4,000)÷ 4 years = $7,500.

Declining-balance:

2018 2/4 = $17,000.

2019 ($34,000 - $17,000)× 2/4 = $8,500.

2020 ($34,000 - $25,500)× 2/4 = $4,250.

2021 Book value $4,250 - $4,000 residual value = $250.

B.Lower net income: 2018,double declining-balance;2021,straight-line.

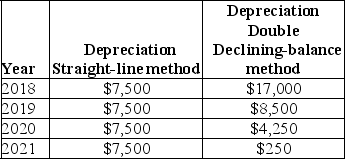

Straight-line: ($34,000 - 4,000)÷ 4 years = $7,500.

Straight-line: ($34,000 - 4,000)÷ 4 years = $7,500.Declining-balance:

2018 2/4 = $17,000.

2019 ($34,000 - $17,000)× 2/4 = $8,500.

2020 ($34,000 - $25,500)× 2/4 = $4,250.

2021 Book value $4,250 - $4,000 residual value = $250.

B.Lower net income: 2018,double declining-balance;2021,straight-line.

MA

Answered

On some websites, customers have the opportunity to download a sample or chapter of an e-book prior to purchasing it. Which objective of the 4E framework does this fulfill?

A) engagement

B) energy

C) excitement

D) experience

E) education

A) engagement

B) energy

C) excitement

D) experience

E) education

On May 22, 2024

D

MA

Answered

A party who is primarily liable for an instrument must pay without resorting to any other party.

On May 21, 2024

True