OM

Olivia Merritt

Answers (6)

OM

Answered

The market demand and supply functions for VCR movie rentals are:  and

and  Calculate the equilibrium quantity and price and point elasticity of demand in equilibrium. Next, calculate producer surplus. Suppose that VCR movie rentals are taxed at $0.25 per unit. Calculate the revenues generated by the tax. Calculate the loss in producer surplus. What percentage of the burden of the tax falls on producers?

Calculate the equilibrium quantity and price and point elasticity of demand in equilibrium. Next, calculate producer surplus. Suppose that VCR movie rentals are taxed at $0.25 per unit. Calculate the revenues generated by the tax. Calculate the loss in producer surplus. What percentage of the burden of the tax falls on producers?

and

and  Calculate the equilibrium quantity and price and point elasticity of demand in equilibrium. Next, calculate producer surplus. Suppose that VCR movie rentals are taxed at $0.25 per unit. Calculate the revenues generated by the tax. Calculate the loss in producer surplus. What percentage of the burden of the tax falls on producers?

Calculate the equilibrium quantity and price and point elasticity of demand in equilibrium. Next, calculate producer surplus. Suppose that VCR movie rentals are taxed at $0.25 per unit. Calculate the revenues generated by the tax. Calculate the loss in producer surplus. What percentage of the burden of the tax falls on producers?On Jul 29, 2024

First we must determine the market equilibrium quantity and price. To do this, we set quantity demanded equal to quantity supplied and solve for equilibrium price.QD = 10 - 0.04P = QS = 3.8P + 4

Then P = 1.56, and at this price we have Q = 9.94.

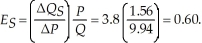

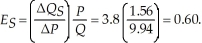

The point elasticity of supply is The producer surplus is

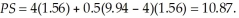

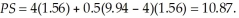

The producer surplus is  If the market is taxed $0.25 per unit, the equilibrium price consumers pay is:

If the market is taxed $0.25 per unit, the equilibrium price consumers pay is:

QD = 10 - 0.04 Pb = Qs = 3.8(Pb - 0.25) + 4

Then Pb = 1.81. The quantity exchanged is 9.93. The new level of producer surplus is:

PS' = 4(1.5599) + 0.5(9.93 - 4)(1.5599) = 10.86.

The loss in producer surplus associated with the tax is $0.01. The tax generates tax revenues of $2.48. Thus, producers bear less than 1% of the burden of the tax.

Then P = 1.56, and at this price we have Q = 9.94.

The point elasticity of supply is

The producer surplus is

The producer surplus is  If the market is taxed $0.25 per unit, the equilibrium price consumers pay is:

If the market is taxed $0.25 per unit, the equilibrium price consumers pay is:QD = 10 - 0.04 Pb = Qs = 3.8(Pb - 0.25) + 4

Then Pb = 1.81. The quantity exchanged is 9.93. The new level of producer surplus is:

PS' = 4(1.5599) + 0.5(9.93 - 4)(1.5599) = 10.86.

The loss in producer surplus associated with the tax is $0.01. The tax generates tax revenues of $2.48. Thus, producers bear less than 1% of the burden of the tax.

OM

Answered

The Food and Drug Administration (FDA) is investigating reports that Caplets Corporation is putting potentially harmful additives in Doze, a new pain-relief medication. The FDA's demands for particular documents from Caplets

A) must be specific and adequately describe the material being sought.

B) must not be specific or an incriminating item might be overlooked.

C) must be general so as to force an uncooperative party's compliance.

D) may, but need not, be specific because this is only an investigation.

A) must be specific and adequately describe the material being sought.

B) must not be specific or an incriminating item might be overlooked.

C) must be general so as to force an uncooperative party's compliance.

D) may, but need not, be specific because this is only an investigation.

On Jul 28, 2024

A

OM

Answered

Which statement is NOT true?

A) The essential skills and behaviors for effective leadership are identical across situations.

B) Some types of leadership positions may provide a slight advantage either to men or to women.

C) Any gender advantage in a particular position is likely to be a small one.

D) Gender should not be an important qualification for the position.

A) The essential skills and behaviors for effective leadership are identical across situations.

B) Some types of leadership positions may provide a slight advantage either to men or to women.

C) Any gender advantage in a particular position is likely to be a small one.

D) Gender should not be an important qualification for the position.

On Jun 29, 2024

A

OM

Answered

Which of the following statements is true of team leaders?

A) A team leader can emerge during the teamwork process.

B) A team leader must be formally designated by the team members.

C) A team leader is responsible for doing all the work.

D) A team leader has the best ideas in the team.

E) A team leader must be the one who can do the best work.

A) A team leader can emerge during the teamwork process.

B) A team leader must be formally designated by the team members.

C) A team leader is responsible for doing all the work.

D) A team leader has the best ideas in the team.

E) A team leader must be the one who can do the best work.

On Jun 27, 2024

A

OM

Answered

Liabilities:

A) are future economic benefits.

B) are debts and obligations.

C) possess service potential.

D) are things of value owned by a business.

A) are future economic benefits.

B) are debts and obligations.

C) possess service potential.

D) are things of value owned by a business.

On May 30, 2024

B

OM

Answered

The group thinks that Dawn is influential even though Dawn has no formal position of authority.Dawn can be described as ______.

A) an emergent leader

B) a legitimate leader

C) an assigned leader

D) a coercive leader

A) an emergent leader

B) a legitimate leader

C) an assigned leader

D) a coercive leader

On May 28, 2024

A