PN

Patricia Nicole Rodriguez

Answers (7)

PN

Answered

Explain why indirect ownership interests are not relevant to determining control in a tiered corporate group.

On May 02, 2024

Indirect ownership interests in a tiered group:

- Control in a tiered corporate group is determined using direct ownership interests.

- In a tiered group the indirect ownership interests rarely sum to a controlling interest.However,they are important in determining the NCI.

- Control in a tiered corporate group is determined using direct ownership interests.

- In a tiered group the indirect ownership interests rarely sum to a controlling interest.However,they are important in determining the NCI.

PN

Answered

The shareholders of the parent entity in a group are entitled to:

A) total profits of all group members.

B) parent entity interest in consolidated group profit.

C) non-controlling interest in consolidated group profit.

D) none of the above.

A) total profits of all group members.

B) parent entity interest in consolidated group profit.

C) non-controlling interest in consolidated group profit.

D) none of the above.

On May 02, 2024

B

PN

Answered

Where the full goodwill on acquisition is recognised in the consolidated financial statements,any impairment loss will be allocated between parent interest and NCI on the same basis as profit or loss.

On May 02, 2024

True

PN

Answered

Tax effect adjustments only apply to consolidation adjusting entries that affect the carrying amount of parent subsidiaries.

On May 02, 2024

False

PN

Answered

Which of the following accounts cannot be altered by a consolidation adjusting entry?

A) Income tax expense

B) Income tax payable

C) Deferred tax asset

D) Deferred tax asset.

A) Income tax expense

B) Income tax payable

C) Deferred tax asset

D) Deferred tax asset.

On May 02, 2024

B

PN

Answered

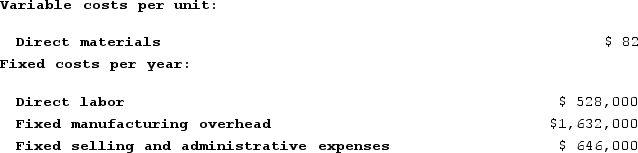

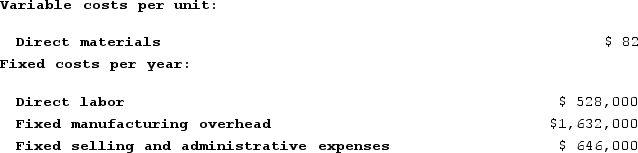

Union Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 24,000 units and sold 17,000 units. The company's only product is sold for $232 per unit.Assume that the company uses an absorption costing system that assigns $22 of direct labor cost and $68 of fixed manufacturing overhead to each unit that is produced. The net operating income under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 24,000 units and sold 17,000 units. The company's only product is sold for $232 per unit.Assume that the company uses an absorption costing system that assigns $22 of direct labor cost and $68 of fixed manufacturing overhead to each unit that is produced. The net operating income under this costing system is:

A) $(102,000)

B) $374,000

C) $(830,000)

D) $(256,000)

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 24,000 units and sold 17,000 units. The company's only product is sold for $232 per unit.Assume that the company uses an absorption costing system that assigns $22 of direct labor cost and $68 of fixed manufacturing overhead to each unit that is produced. The net operating income under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 24,000 units and sold 17,000 units. The company's only product is sold for $232 per unit.Assume that the company uses an absorption costing system that assigns $22 of direct labor cost and $68 of fixed manufacturing overhead to each unit that is produced. The net operating income under this costing system is:A) $(102,000)

B) $374,000

C) $(830,000)

D) $(256,000)

On May 01, 2024

B

PN

Answered

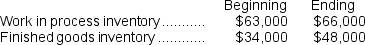

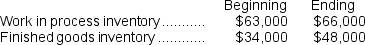

Tenneson Corporation's cost of goods manufactured for the just completed month was $151,000 and its inventories were as follows:  How much was the cost of goods available for sale on the Schedule of Cost of Goods Sold?

How much was the cost of goods available for sale on the Schedule of Cost of Goods Sold?

A) $137,000

B) $185,000

C) $151,000

D) $136,000

How much was the cost of goods available for sale on the Schedule of Cost of Goods Sold?

How much was the cost of goods available for sale on the Schedule of Cost of Goods Sold?A) $137,000

B) $185,000

C) $151,000

D) $136,000

On Apr 29, 2024

B