PG

Peter Gichuru

Answers (6)

PG

Answered

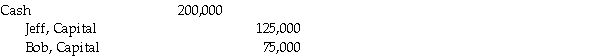

Jeff and Bob agreed on October 1, 201x to enter into a partnership. Jeff contributes $125,000 and Bob contributes $75,000. Journalize their initial investments.

On Jul 24, 2024

PG

Answered

The phrase gains from trade refers to the:

A) profits obtained from sales of a good or service.

B) increase in total output that is realized when individuals specialize in particular tasks and trade with each other.

C) gains that one obtains by taking advantage of an uninformed buyer and selling at a higher than average price.

D) gains that one obtains by taking advantage of a temporary discount,or sale price.

A) profits obtained from sales of a good or service.

B) increase in total output that is realized when individuals specialize in particular tasks and trade with each other.

C) gains that one obtains by taking advantage of an uninformed buyer and selling at a higher than average price.

D) gains that one obtains by taking advantage of a temporary discount,or sale price.

On Jul 22, 2024

B

PG

Answered

Terry pre-orders a DVD of this year's hit show: Cold Canadian Winter Hobbies online. He received a confirmation number. The $40 will be paid when it is delivered to his home. Is this an enforceable agreement pursuant to the Sale of Goods Act?

A) Yes, this contract does not have to be in writing.

B) Yes, this contract must be in writing and the electronic record constitutes writing.

C) No, the contract is still executory and therefore must be in writing.

D) No, Terry did not receive the goods, pay a deposit or give something of earnest to bind the contract. Therefore, it must be in writing.

E) No, the Sale of Goods Act does not apply to e-commerce.

A) Yes, this contract does not have to be in writing.

B) Yes, this contract must be in writing and the electronic record constitutes writing.

C) No, the contract is still executory and therefore must be in writing.

D) No, Terry did not receive the goods, pay a deposit or give something of earnest to bind the contract. Therefore, it must be in writing.

E) No, the Sale of Goods Act does not apply to e-commerce.

On Jun 24, 2024

B

PG

Answered

______ is defined as the framework of work roles and functions that help shape and support employee behavior.

A) Organizational structure

B) Organizational change

C) Organizational strategy

D) Organizational culture

A) Organizational structure

B) Organizational change

C) Organizational strategy

D) Organizational culture

On Jun 22, 2024

A

PG

Answered

Tangible factors

A) include the price or terms of agreement.

B) are psychological motivations that influence the negotiations.

C) include the need to look good in negotiations.

D) cannot be measured in quantifiable terms.

E) None of the above statements describe tangible factors.

A) include the price or terms of agreement.

B) are psychological motivations that influence the negotiations.

C) include the need to look good in negotiations.

D) cannot be measured in quantifiable terms.

E) None of the above statements describe tangible factors.

On May 24, 2024

A

PG

Answered

Income statements prepared internally for management often show cost of goods sold at standard cost and variances are

A) separately disclosed.

B) deducted as other expenses and revenues.

C) added to cost of goods sold.

D) closed directly to retained earnings.

A) separately disclosed.

B) deducted as other expenses and revenues.

C) added to cost of goods sold.

D) closed directly to retained earnings.

On May 23, 2024

A