RL

Rebeca Lemus

Answers (4)

RL

Answered

When operating,the loss minimization point is

A) when at the minimum point on the average total cost curve.

B) when at the minimum point on the average variable cost curve.

C) where marginal cost equals marginal revenue.

D) when total revenue is maximized.

A) when at the minimum point on the average total cost curve.

B) when at the minimum point on the average variable cost curve.

C) where marginal cost equals marginal revenue.

D) when total revenue is maximized.

On Jun 21, 2024

C

RL

Answered

Your CEO is concerned that employees are not saving enough for their retirement.At the same,the CEO wants to have some of the company's profits shared with all employees.To address these issues,your CEO asks you,a human resource compensation specialist,to recommend the most appropriate profit-sharing plan to address this retirement issue.Which profit-sharing plan would you recommend?

A) deferred

B) combination

C) current distribution

D) cash plan

A) deferred

B) combination

C) current distribution

D) cash plan

On Jun 19, 2024

A

RL

Answered

The category of assignment intended to retain the culture,structure,and decision processes of the home-country firm is referred to as strategic control.

On May 22, 2024

True

RL

Answered

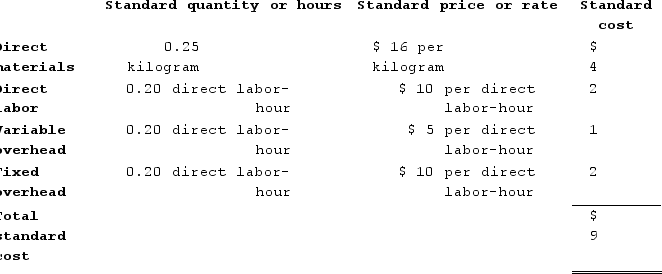

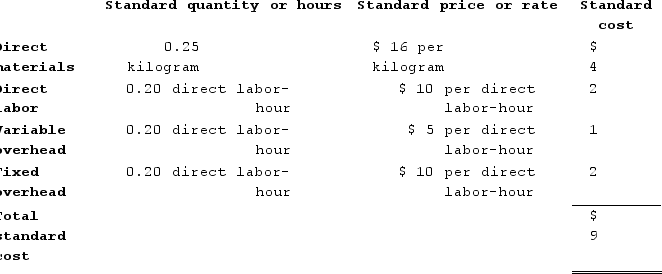

Eastern Company uses a standard cost system in which manufacturing overhead is applied to units of product on the basis of standard direct labor-hours. The denominator activity level is 60,000 direct labor-hours, or 300,000 units. A standard cost card for the company's product follows:

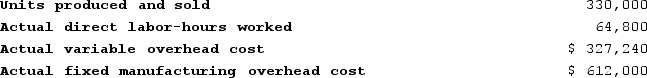

Actual data for the year follow:

Actual data for the year follow:

Required:

Required:

a.Compute the variable overhead rate and efficiency variances.

b. Compute the fixed manufacturing overhead budget and volume variances.

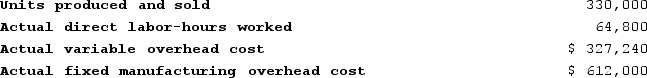

Actual data for the year follow:

Actual data for the year follow: Required:

Required:a.Compute the variable overhead rate and efficiency variances.

b. Compute the fixed manufacturing overhead budget and volume variances.

On May 20, 2024

a. Variable overhead variances:

Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= $327,240 − (64,800 direct labor-hours × $5.00 per direct labor-hour)

= $327,240 − $324,000

= $3,240 Unfavorable

Variable overhead efficiency variance = (Actual hours − Standard hours) × Standard rate

= (64,800 direct labor-hours − 66,000 direct labor-hours*) × $5.00 per direct labor-hour

= (−1,200 direct labor-hours) × $5.00 per direct labor-hour

= $6,000 Favorable

* 330,000 units × 0.20 direct labor-hour per unit = 66,000 direct labor-hours

b. Fixed overhead variances:

Budget variance = Actual fixed manufacturing overhead − Budgeted fixed manufacturing overhead

= $612,000 − $600,000

= $12,000 Unfavorable

Volume variance = Fixed component of the predetermined overhead rate × (Denominator hours − Standard hours allowed for the actual output)

= $10.00 per direct labor-hour × (60,000 direct labor-hours − 66,000 direct labor-hours)

= $10.00 per direct labor-hour × (−6,000 direct labor-hours)

= $60,000 Favorable

Variable overhead rate variance = (Actual hours × Actual rate) − (Actual hours × Standard rate)

= $327,240 − (64,800 direct labor-hours × $5.00 per direct labor-hour)

= $327,240 − $324,000

= $3,240 Unfavorable

Variable overhead efficiency variance = (Actual hours − Standard hours) × Standard rate

= (64,800 direct labor-hours − 66,000 direct labor-hours*) × $5.00 per direct labor-hour

= (−1,200 direct labor-hours) × $5.00 per direct labor-hour

= $6,000 Favorable

* 330,000 units × 0.20 direct labor-hour per unit = 66,000 direct labor-hours

b. Fixed overhead variances:

Budget variance = Actual fixed manufacturing overhead − Budgeted fixed manufacturing overhead

= $612,000 − $600,000

= $12,000 Unfavorable

Volume variance = Fixed component of the predetermined overhead rate × (Denominator hours − Standard hours allowed for the actual output)

= $10.00 per direct labor-hour × (60,000 direct labor-hours − 66,000 direct labor-hours)

= $10.00 per direct labor-hour × (−6,000 direct labor-hours)

= $60,000 Favorable