SG

Sarah Gegen

Answers (7)

SG

Answered

Describe the vicious circle of poverty.

On Jul 30, 2024

The vicious circle of poverty is a problem common in some developing countries in which their low per-capita incomes are an obstacle to realizing the levels of savings and investment needed to achieve rates of growth of output that exceed their rates of population growth. This means that DVCs stay poor because they are poor. A poor family has little ability or incentive to save and their low incomes mean low levels of product demand. Further, there are low levels of investment in physical and human capital that leads to low labor productivity. Because output per person is low, real income per person is low, and as a consequence, per capita income is low.

SG

Answered

A mix of cultural tightness and looseness in a cross-cultural team may result in ___.

A) synchronized performance

B) consistent productivity

C) soft or unstated conflict

D) mitigation of conflict

E) uniform and high inclination to volunteer

A) synchronized performance

B) consistent productivity

C) soft or unstated conflict

D) mitigation of conflict

E) uniform and high inclination to volunteer

On Jul 03, 2024

C

SG

Answered

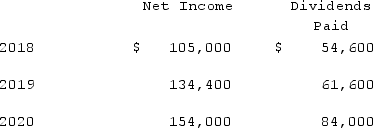

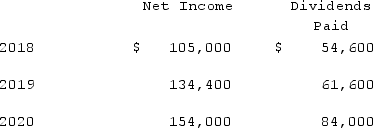

On January 1, 2018, Vacker Co. acquired 70% of Carper Inc. by paying $650,000. This included a $20,000 control premium. Carper reported common stock on that date of $420,000 with retained earnings of $252,000. A building was undervalued in the company's financial records by $28,000. This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized and amortized over 20 years.Carper earned income and paid cash dividends as follows:  On December 31, 2020, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.Required:If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?

On December 31, 2020, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.Required:If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?

On December 31, 2020, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.Required:If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?

On December 31, 2020, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.Required:If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?On Jun 29, 2024

From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. ![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_141a_948d_41896429bcf6_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_3b2b_948d_2df0a84705c0_TB7395_00.jpg) Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ]

Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] ![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_3b2c_948d_3feb78cb8aab_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_3b2d_948d_f5571a352e64_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_623e_948d_fb07108b9ccd_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_623f_948d_63d897402fe1_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_8950_948d_17242c3a4a0c_TB7395_00.jpg) Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880

Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_141a_948d_41896429bcf6_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_3b2b_948d_2df0a84705c0_TB7395_00.jpg) Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ]

Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] ![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_3b2c_948d_3feb78cb8aab_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_3b2d_948d_f5571a352e64_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_623e_948d_fb07108b9ccd_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_623f_948d_63d897402fe1_TB7395_00.jpg)

![From the acquisition value, $28,000 was allocated based on the fair value of the building. With a ten-year remaining life, amortization will be $2,800 per year of which $1,960 is attributed to the controlling interest.Copyright amortization would have been $4,000 per year of which $2,800 is attributed to the controlling interest. Goodwill: Vacker paid $650,000 which includes $20,000 premium. Thus, $630,000 represents 70% of the shares without the premium. $630,000 ÷ 70% = $900,000 value of the company without the premium. 30% × $900,000 = $270,000. The total fair value of the company is thus $650,000 that Vacker paid + $270,000 value of the noncontrolling interest shares = $920,000. The fair value of the net assets acquired is $780,000 (= $672,000 + $28,000 + $80,000) . Goodwill attributable to Vacker is $104,000 (= $650,000 − [70% × $780,000]) and the goodwill attributable to the noncontrolling interest is $36,000 (= $270,000 − [30% × $780,000]) .Total differential attributable to Vacker $170,080 [$104,000 + ((22,400 + $72,000) × 70%) ] and differential attributable to the noncontrolling interest is $64,320 [$36,000 + ((22,400 + $72,000) × 30%) ] Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880](https://d2lvgg3v3hfg70.cloudfront.net/TB7395/11eadd5a_ce16_8950_948d_17242c3a4a0c_TB7395_00.jpg) Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880

Beginning NCI = $270,000 + $29,460 (income) − $16,380 (dividends) + $38,280 (income) − $18,480 (dividends) = $302,880SG

Answered

A party with the power to avoid a contract will not lose that power by delaying the avoidance.

On Jun 03, 2024

False

SG

Answered

On behalf of your civic organization, you are inviting a motivational speaker to your semiannual meeting. In your request you guarantee the speaker an enthusiastic audience and a positive impact on the community, both of which emphasize

A) praise for the reader.

B) indirect benefits to the reader.

C) the indirect strategy.

D) the direct strategy.

A) praise for the reader.

B) indirect benefits to the reader.

C) the indirect strategy.

D) the direct strategy.

On May 30, 2024

B

SG

Answered

ABC Inc. has a single wholly-owned American subsidiary called US1 based in Los Angeles, California, which was acquired January 1, 2020. US1 submitted its financial statements for 2020 to ABC. Selected exchange rates in effect throughout 2020 are shown below: January 1,2020: US $1= CDN $0.815 December 31,2020: US $1= CDN $0.8175 Average for 2020: US $1= CDN $0.825 Date of Purchase of Inventory on Hand: US $1= CDN $0.83 Date Dividends were declared: US $1= CDN $0.8125\begin{array}{|l|l|r|}\hline \text { January } 1,2020: & \text { US } \$ 1= & \text { CDN } \$ 0.815 \\\hline \text { December } 31,2020: & \text { US } \$ 1= & \text { CDN } \$ 0.8175 \\\hline \text { Average for } 2020: & \text { US } \$ 1= & \text { CDN } \$ 0.825 \\\hline \text { Date of Purchase of Inventory on Hand: } & \text { US } \$ 1= & \text { CDN } \$ 0.83 \\\hline \text { Date Dividends were declared: } & \text { US } \$ 1= & \text { CDN } \$ 0.8125\\\hline\end{array} January 1,2020: December 31,2020: Average for 2020: Date of Purchase of Inventory on Hand: Date Dividends were declared: US $1= US $1= US $1= US $1= US $1= CDN $0.815 CDN $0.8175 CDN $0.825 CDN $0.83 CDN $0.8125 US1 financial results for 2020 were as follows:

US1 Financial Statements

At December 31, 2020

(in U.S. dollars)

Income Statement: Sales $5,000,000 Cost of Sales $3,500,000 Depreciation Expense $150,000 Bond Interest Expense $100,000 Other Expense $750,000 Net Income $500,000 Statement of Retained Earnings: January 1, 2020: $400,000 Net Income $500,000 Dividends $100,000) December 31,2020:$800,000 Balance Sheet Cash $1,200,000 Accounts Receivable $1,900,000 Inventory $700,000($500,000 January 1, 2020) Plant and Equipment (net) $400,000 Current Liabilities $4,200,000 Bonds Payable $2,000,000 Common Shares $1,000,000 Retained Earnings $800,000$4,200,000\begin{array}{|l|r|}\hline \text { Income Statement: } & \\\hline \text { Sales } & \$ 5,000,000 \\\hline \text { Cost of Sales } & \$ 3,500,000 \\\hline \text { Depreciation Expense } & \$ 150,000 \\\hline \text { Bond Interest Expense } & \$ 100,000 \\\hline \text { Other Expense } & \$ 750,000 \\\hline \text { Net Income } & \$ 500,000 \\\hline \text { Statement of Retained Earnings: } & \\\hline \text { January 1, 2020: } & \$ 400,000 \\\hline \text { Net Income } &\$ 500,000 \\\hline \text { Dividends } & \$ 100,000) \\\hline \text { December } 31,2020: & \$ 800,000 \\\hline \text { Balance Sheet } & \\\hline \text { Cash } &\$ 1,200,000 \\\hline \text { Accounts Receivable } & \$ 1,900,000 \\\hline \text { Inventory } & \$ 700,000(\$ 500,000 \text { January 1, 2020) } \\\hline \text { Plant and Equipment (net) } & \$ 400,000 \\\hline \text { Current Liabilities } & \$ 4,200,000 \\\hline \text { Bonds Payable } & \$ 2,000,000 \\\hline \text { Common Shares } & \$ 1,000,000 \\\hline \text { Retained Earnings } & \$ 800,000 \\\hline & \$ 4,200,000 \\\hline\end{array} Income Statement: Sales Cost of Sales Depreciation Expense Bond Interest Expense Other Expense Net Income Statement of Retained Earnings: January 1, 2020: Net Income Dividends December 31,2020: Balance Sheet Cash Accounts Receivable Inventory Plant and Equipment (net) Current Liabilities Bonds Payable Common Shares Retained Earnings $5,000,000$3,500,000$150,000$100,000$750,000$500,000$400,000$500,000$100,000) $800,000$1,200,000$1,900,000$700,000($500,000 January 1, 2020) $400,000$4,200,000$2,000,000$1,000,000$800,000$4,200,000 Sales, purchases, bond interest, and other expenses occurred evenly throughout the year.

US1 is considered to be a foreign subsidiary that has a different functional currency than ABC Inc.'s functional currency.

Which of the following rates would be used to translate US1's income statement items?

A) US$1 = CDN$0.815

B) US$1 = CDN$0.8175

C) US$1 = CDN$0.825

D) US$1 = CDN$0.83

US1 Financial Statements

At December 31, 2020

(in U.S. dollars)

Income Statement: Sales $5,000,000 Cost of Sales $3,500,000 Depreciation Expense $150,000 Bond Interest Expense $100,000 Other Expense $750,000 Net Income $500,000 Statement of Retained Earnings: January 1, 2020: $400,000 Net Income $500,000 Dividends $100,000) December 31,2020:$800,000 Balance Sheet Cash $1,200,000 Accounts Receivable $1,900,000 Inventory $700,000($500,000 January 1, 2020) Plant and Equipment (net) $400,000 Current Liabilities $4,200,000 Bonds Payable $2,000,000 Common Shares $1,000,000 Retained Earnings $800,000$4,200,000\begin{array}{|l|r|}\hline \text { Income Statement: } & \\\hline \text { Sales } & \$ 5,000,000 \\\hline \text { Cost of Sales } & \$ 3,500,000 \\\hline \text { Depreciation Expense } & \$ 150,000 \\\hline \text { Bond Interest Expense } & \$ 100,000 \\\hline \text { Other Expense } & \$ 750,000 \\\hline \text { Net Income } & \$ 500,000 \\\hline \text { Statement of Retained Earnings: } & \\\hline \text { January 1, 2020: } & \$ 400,000 \\\hline \text { Net Income } &\$ 500,000 \\\hline \text { Dividends } & \$ 100,000) \\\hline \text { December } 31,2020: & \$ 800,000 \\\hline \text { Balance Sheet } & \\\hline \text { Cash } &\$ 1,200,000 \\\hline \text { Accounts Receivable } & \$ 1,900,000 \\\hline \text { Inventory } & \$ 700,000(\$ 500,000 \text { January 1, 2020) } \\\hline \text { Plant and Equipment (net) } & \$ 400,000 \\\hline \text { Current Liabilities } & \$ 4,200,000 \\\hline \text { Bonds Payable } & \$ 2,000,000 \\\hline \text { Common Shares } & \$ 1,000,000 \\\hline \text { Retained Earnings } & \$ 800,000 \\\hline & \$ 4,200,000 \\\hline\end{array} Income Statement: Sales Cost of Sales Depreciation Expense Bond Interest Expense Other Expense Net Income Statement of Retained Earnings: January 1, 2020: Net Income Dividends December 31,2020: Balance Sheet Cash Accounts Receivable Inventory Plant and Equipment (net) Current Liabilities Bonds Payable Common Shares Retained Earnings $5,000,000$3,500,000$150,000$100,000$750,000$500,000$400,000$500,000$100,000) $800,000$1,200,000$1,900,000$700,000($500,000 January 1, 2020) $400,000$4,200,000$2,000,000$1,000,000$800,000$4,200,000 Sales, purchases, bond interest, and other expenses occurred evenly throughout the year.

US1 is considered to be a foreign subsidiary that has a different functional currency than ABC Inc.'s functional currency.

Which of the following rates would be used to translate US1's income statement items?

A) US$1 = CDN$0.815

B) US$1 = CDN$0.8175

C) US$1 = CDN$0.825

D) US$1 = CDN$0.83

On May 03, 2024

C

SG

Answered

Procedural justice involves the degree to which policies and rules are fairly applied to all individuals.

On Apr 30, 2024

True