SL

Shelley Lutov

Answers (3)

SL

Answered

Stockholders' equity is

A) added to assets and the two are equal to liabilities

B) added to liabilities and the two are equal to assets

C) subtracted from liabilities and the net amount is equal to assets

D) equal to the total of assets and liabilities

A) added to assets and the two are equal to liabilities

B) added to liabilities and the two are equal to assets

C) subtracted from liabilities and the net amount is equal to assets

D) equal to the total of assets and liabilities

On May 13, 2024

B

SL

Answered

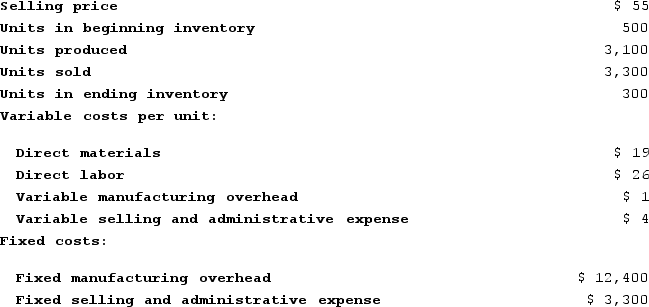

Pacheo Corporation, which has only one product, has provided the following data concerning its most recent month of operations:

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.Required:a. What is the unit product cost for the month under variable costing?b. Prepare a contribution format income statement for the month using variable costing.c. Without preparing an income statement, determine the absorption costing net operating income for the month.

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.Required:a. What is the unit product cost for the month under variable costing?b. Prepare a contribution format income statement for the month using variable costing.c. Without preparing an income statement, determine the absorption costing net operating income for the month.

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.Required:a. What is the unit product cost for the month under variable costing?b. Prepare a contribution format income statement for the month using variable costing.c. Without preparing an income statement, determine the absorption costing net operating income for the month.

The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month.Required:a. What is the unit product cost for the month under variable costing?b. Prepare a contribution format income statement for the month using variable costing.c. Without preparing an income statement, determine the absorption costing net operating income for the month.On May 13, 2024

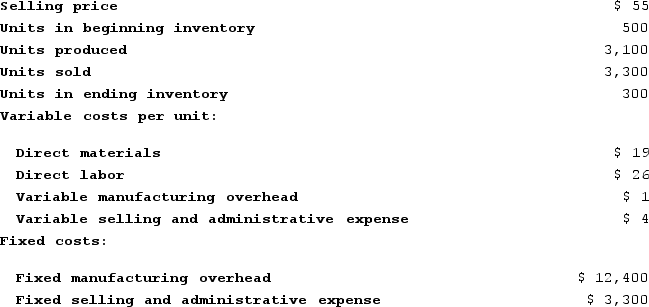

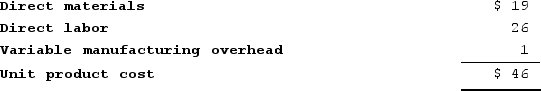

a.Variable costing unit product cost

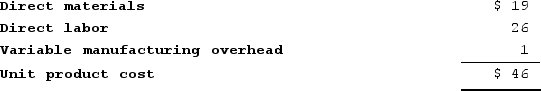

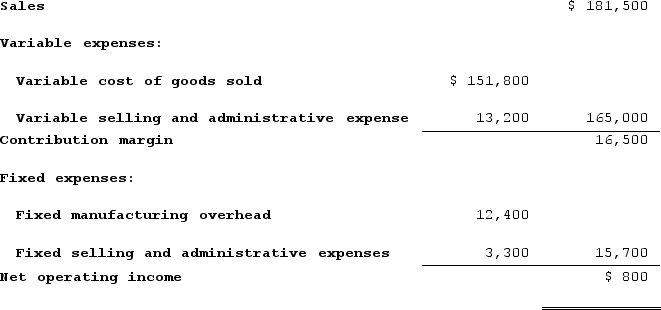

b.Variable costing income statement

b.Variable costing income statement

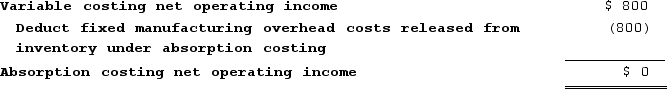

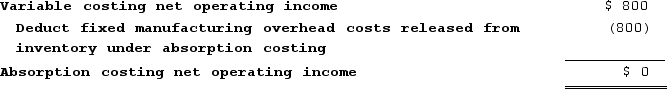

c.Computation of absorption costing net operating income:Fixed manufacturing overhead per unit = Fixed manufacturing overhead ÷ Units produced = $12,400 ÷ 3,100 units = $4 per unitManufacturing overhead deferred in (released from) inventory = Fixed manufacturing overhead in ending inventory − Fixed manufacturing overhead in beginning inventory = ($4 per unit × 300 units) − ($4 per unit × 500 units) = −$800

c.Computation of absorption costing net operating income:Fixed manufacturing overhead per unit = Fixed manufacturing overhead ÷ Units produced = $12,400 ÷ 3,100 units = $4 per unitManufacturing overhead deferred in (released from) inventory = Fixed manufacturing overhead in ending inventory − Fixed manufacturing overhead in beginning inventory = ($4 per unit × 300 units) − ($4 per unit × 500 units) = −$800

b.Variable costing income statement

b.Variable costing income statement c.Computation of absorption costing net operating income:Fixed manufacturing overhead per unit = Fixed manufacturing overhead ÷ Units produced = $12,400 ÷ 3,100 units = $4 per unitManufacturing overhead deferred in (released from) inventory = Fixed manufacturing overhead in ending inventory − Fixed manufacturing overhead in beginning inventory = ($4 per unit × 300 units) − ($4 per unit × 500 units) = −$800

c.Computation of absorption costing net operating income:Fixed manufacturing overhead per unit = Fixed manufacturing overhead ÷ Units produced = $12,400 ÷ 3,100 units = $4 per unitManufacturing overhead deferred in (released from) inventory = Fixed manufacturing overhead in ending inventory − Fixed manufacturing overhead in beginning inventory = ($4 per unit × 300 units) − ($4 per unit × 500 units) = −$800

SL

Answered

Which of the following are basic phases of the management process?

A) supervising and directing

B) decision making and supervising

C) organizing and directing

D) planning and controlling

A) supervising and directing

B) decision making and supervising

C) organizing and directing

D) planning and controlling

On May 09, 2024

D