SN

Siti Nur Syatira Azwa Binti Ammeran

Answers (4)

SN

Answered

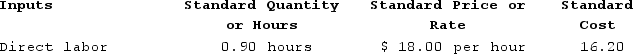

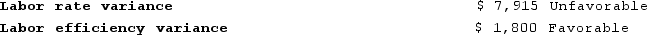

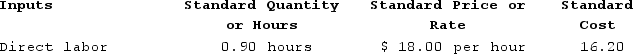

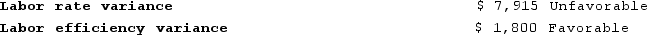

Decena Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. Information concerning the direct labor standards for the company's only product is as follows:  During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 15,830 hours at an average cost of $18.50 per hour. The company calculated the following direct labor variances for the year:

During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 15,830 hours at an average cost of $18.50 per hour. The company calculated the following direct labor variances for the year:

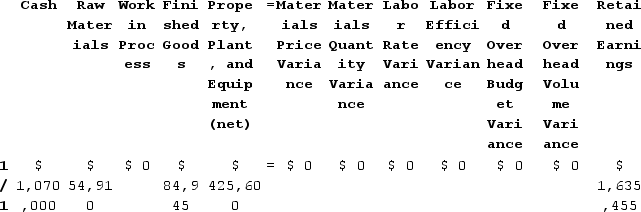

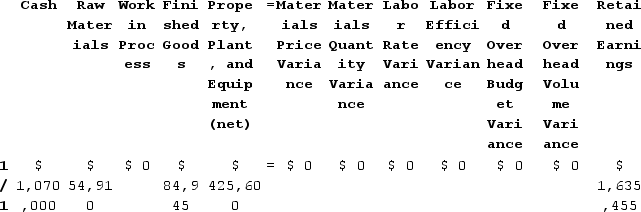

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

When recording the direct labor costs, the Work in Process inventory account will increase (decrease) by:

When recording the direct labor costs, the Work in Process inventory account will increase (decrease) by:

A) ($292,855)

B) $286,740

C) $292,855

D) ($286,740)

During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 15,830 hours at an average cost of $18.50 per hour. The company calculated the following direct labor variances for the year:

During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 15,830 hours at an average cost of $18.50 per hour. The company calculated the following direct labor variances for the year: Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation. When recording the direct labor costs, the Work in Process inventory account will increase (decrease) by:

When recording the direct labor costs, the Work in Process inventory account will increase (decrease) by:A) ($292,855)

B) $286,740

C) $292,855

D) ($286,740)

On May 13, 2024

B

SN

Answered

A budget is necessary only for those with a substantial income.

On May 13, 2024

False

SN

Answered

Cumulative quantity discounts are price reductions received for buying a certain amount of a product over a stated period of time.

On May 11, 2024

True

SN

Answered

Which of the following organizations most likely trades in knowledge?

A) A consulting firm that sells its expertise in dealing with management problems

B) An automobile manufacturing company that produces custom-made cars

C) A food manufacturing firm that manufactures health products

D) A bookstore that gives free bookmarks with every purchase

A) A consulting firm that sells its expertise in dealing with management problems

B) An automobile manufacturing company that produces custom-made cars

C) A food manufacturing firm that manufactures health products

D) A bookstore that gives free bookmarks with every purchase

On May 10, 2024

A